Uflex Ltd is a leading Indian multinational company which is engaged in the manufacturing and sale of flexible packaging products & offers a complete flexible packaging solution to its customers across the globe.

Q2 FY26 Earnings Results

-

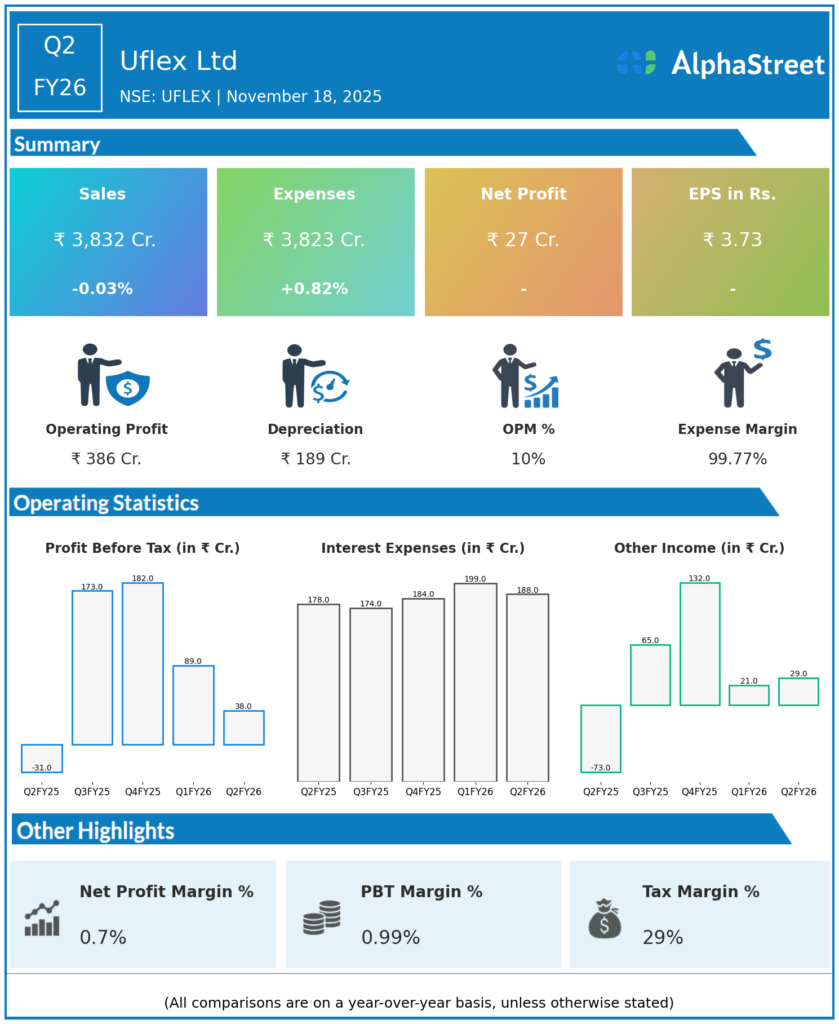

Revenue from Operations: ₹3,832 crore (₹38,610 million), flat YoY.

-

Normalized EBITDA: ₹389.5 crore (₹3,895 million), with EBITDA margin at 10.1%, down from 11.5% YoY.

-

Profit After Tax (PAT): ₹26.9 crore (₹269 million), turning positive from a loss of ₹64.6 crore in Q2 FY25.

-

Operational highlights include improved packaging films capacity utilization at 79.7% (vs 77.1% YoY), with production volumes up 3.4% YoY to 32,726 metric tons.

-

The quarter faced challenges including US tariffs on Indian imports, geopolitical tensions, the impact of GST rollout, and prolonged rainy season affecting demand and margin.

-

Expansion plans include a new packaging films production line in Karnataka to meet growing demand.

-

On a half-year basis, H1 FY26 showed PAT of ₹84.9 crore vs a loss of ₹163.1 crore last year, and normalised EBITDA margin of 11%.

Management Commentary & Strategic Decisions

-

Chairman Ashok Chaturvedi emphasized resilience amid a challenging macro-environment and confirmed strategic investments in capacity expansion.

-

Focus on operational efficiencies and product mix improvements to offset adverse market conditions.

-

The company is leveraging its broad product portfolio to navigate geopolitical and tariff challenges.

-

Strengthening ties in domestic and export markets to sustain revenue growth.

-

Commitment to enhance sustainable packaging solutions and expand market footprint through innovation and technology upgrades.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹3,922 crore (₹39,219 million), up 6.8% YoY.

-

Normalized EBITDA: ₹469.8 crore (₹4,698 million), EBITDA margin of 12%, up from 11.5% YoY.

-

Profit After Tax (PAT): ₹58 crore (₹580 million), significant profit turnaround from previous losses.

-

Capacity utilization improved substantially, supporting volume growth and better realizations.

-

Packaging films division and vPET chips were key growth drivers, reporting 8-9% YoY growth in Q1.

-

Recovery in margins helped by improved operational efficiency and better product mix.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.