Uflex Ltd is a leading Indian multinational company which is engaged in the manufacturing and sale of flexible packaging products & offers a complete flexible packaging solution to its customers across the globe. The company is a leading global manufacturer of packaging films and one of India’s largest flexible packaging firms. Nestle, Mondelez International, Amul, CocaCola, PepsiCo, ITC, Adani Wilmar, Britannia, P&G, etc. Its top customer accounts for 8% of revenues and its top 5 customers account for 20% of revenues. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

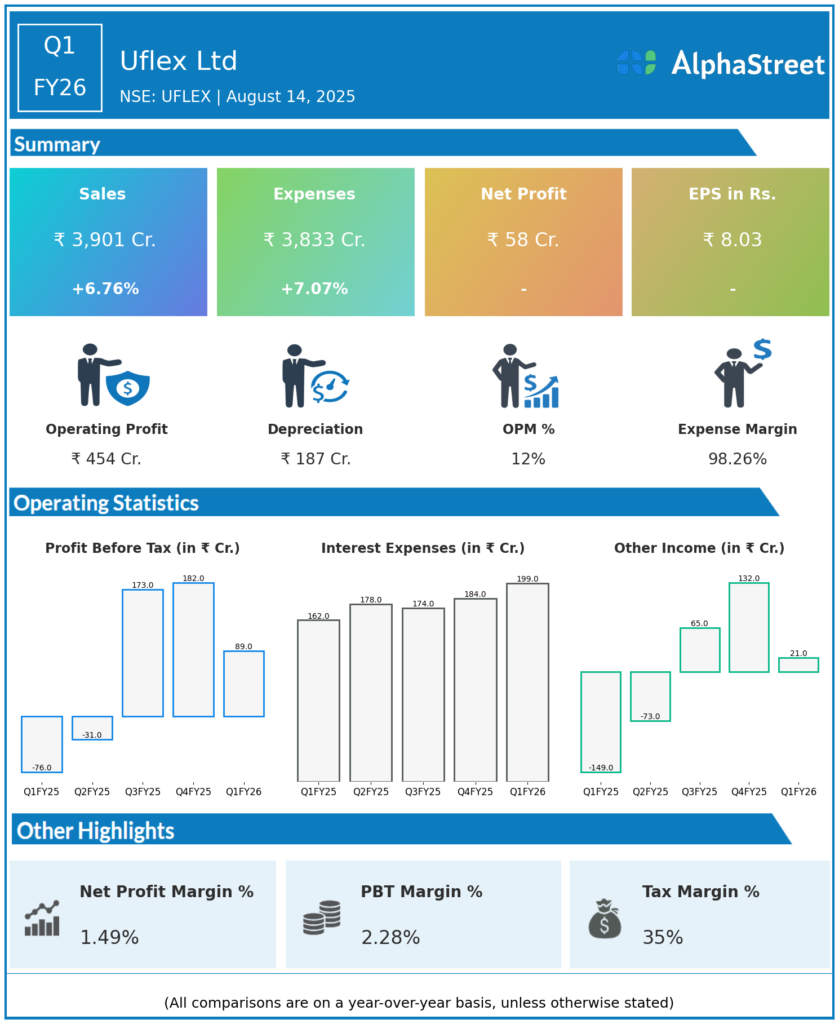

Revenue: ₹3,900.6 crore, up 6.76% year-over-year (YoY) from ₹3,653.75 crore; also up 2.26% quarter-on-quarter (QoQ).

-

Net Profit (PAT): ₹58.02 crore, a reversal from the loss of ₹98.45 crore in Q1 FY25 and a considerable improvement over previous quarters.

-

EBIT: ₹86.17 crore, EBIT margin at 2.34% (vs negative margin YoY).

-

Sales Volume: 7.9% YoY increase, reflecting improved operational efficiency.

-

Flexible Packaging Activities Revenue: ₹3,572.1 crore, up 11.82% YoY.

-

EPS: ₹8.03, rebounded to positive, reflecting profitability improvement.

Management Commentary & Strategic Highlights

-

Management reiterated that volume growth in India remains healthy (up 5% sequentially), while overseas operations were flat, but margins improved notably in offshore business (13.4% margin this quarter vs 7.2% Q1 FY25).

-

Capacity Utilization: Newly commissioned plants running at 65% utilization; management expects to reach 90% this year, with profitability already at 65% run-rate.

-

Sustainability & Regulation: Regulatory push towards recycled content in packaging films could become a substantial business lever; management is bullish about capturing new demand from sustainability mandates.

-

Debt Update: Working capital debt increased due to higher output and sales, while long-term capex-related debt decreased slightly in the quarter.

Q4 FY25 Earnings Results

-

Revenue: ₹3,873.79 crore, lower than Q1 on a sequential basis.

-

Net Profit (PAT): ₹168.57 crore, showing stronger profitability as a seasonal base.

-

EBIT and Margins: 9.46% EBIT margin in Q4 FY25, much higher than Q1 FY26 (seasonal effect).

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.