Company Profile

UCO Bank (formerly United Commercial Bank) is a Government of India-owned public sector bank headquartered in Kolkata, West Bengal, India. Ashwani Kumar is the MD & CEO.

Business & Services

UCO Bank provides a wide range of banking and financial services across customer segments, including: Retail Banking, Corporate & Wholesale Banking, International Banking, and Other Services.

Recent Business Scale

As of recent annual reporting periods, global business exceeded ₹5 lakh crore (total of deposits + advances), and branches are concentrated in rural, semi-urban, and urban markets throughout India.

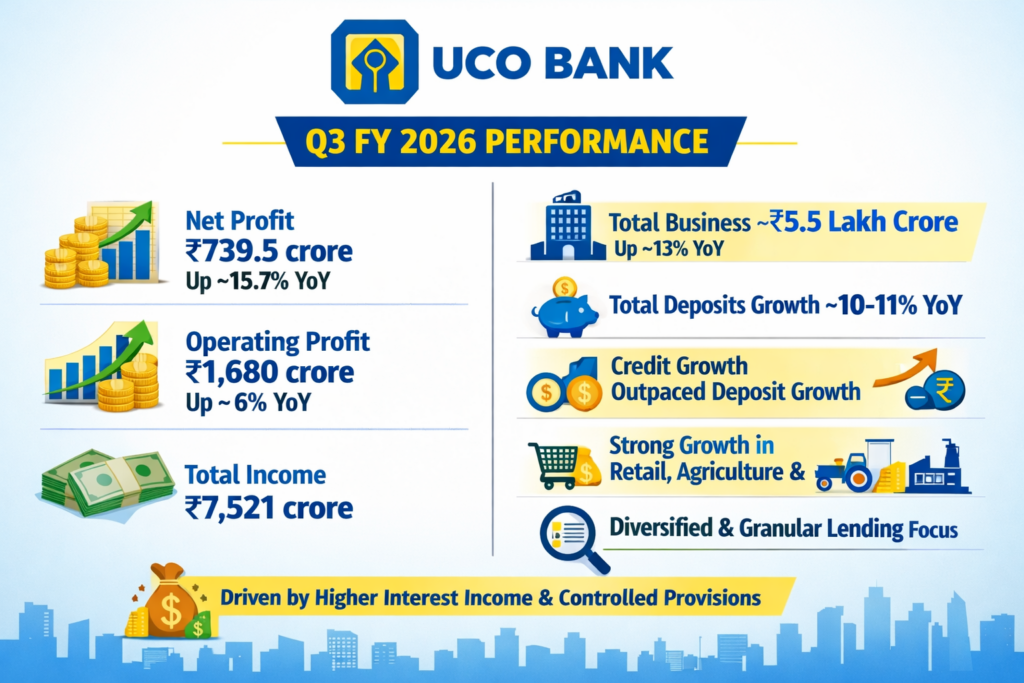

Q3 FY26 Earnings Summary

Net Profit of ₹739.5 crore, operating profit of ₹1,680 crore, and total income of ₹7,521 crore for the quarter ended Dec. 31, 2025.

Highlight: UCO Bank delivered double-digit net profit growth in Q3, supported by stronger core income and disciplined cost/provision control.

Q3 FY26 Executive Snapshot

Strong YoY profitability growth was supported by core income. Continued momentum in advances growth. Asset quality improved across GNPA and NNPA. Capital position strengthened above regulatory requirements.

Net Profit, ₹739.5 crore, up ~15.7% YoY; operating profit, ₹1,680 crore, up ~6% YoY; and total income, ₹7,521 crore. Profit growth was driven by higher interest income and controlled provisions. Total business was ~₹5.5 lakh crore, up ~13% YoY. Total deposits had growth ~10–11% YoY. Credit growth outpaced deposit growth during the quarter. Growth led by retail, agriculture, MSME segments, and continued focus on diversified and granular lending.

Management focuses to sustain profitable credit growth, improve deposit franchise and CASA share, maintain asset quality discipline, and strengthen capital and risk management framework.

Q3 FY26 Key Takeaways

Consistent earnings growth with improving balance-sheet strength. Healthy credit demand across core segments. Asset quality metrics on a sustained improving trajectory. Capital position provides headroom for medium-term growth.