TVS Supply Chain Solutions provides supply chain management services for international organizations, government departments, and large and medium-sized businesses.

Q2 FY26 Earnings Results

-

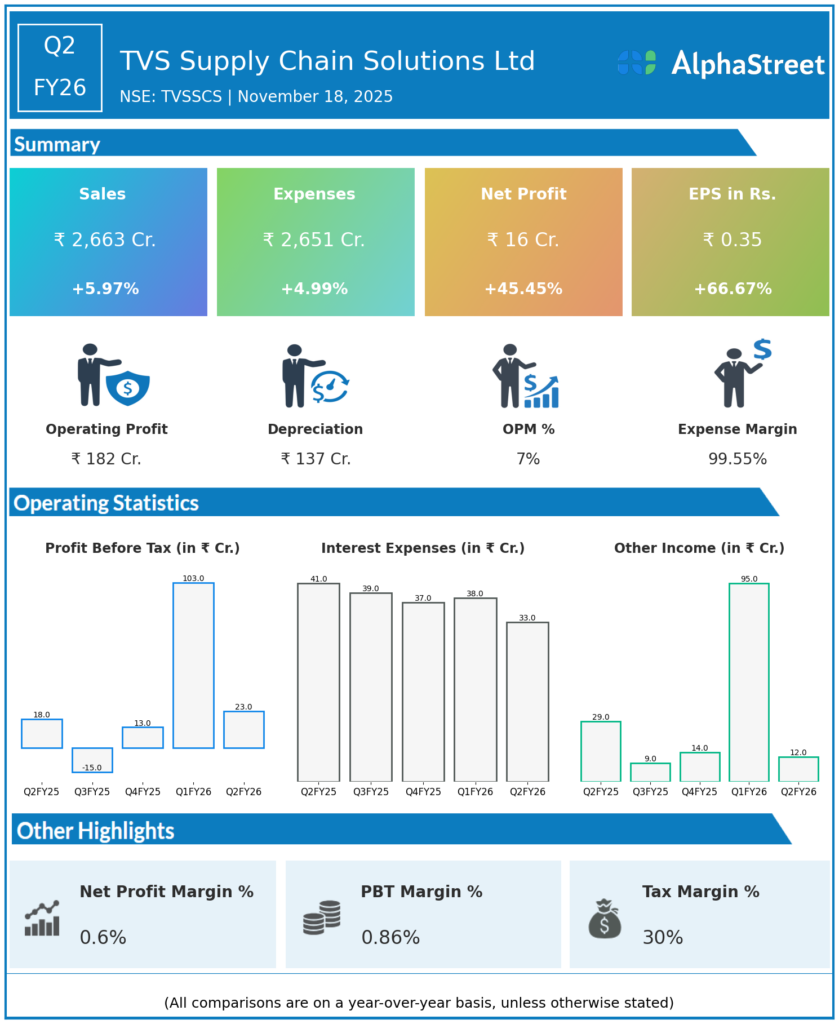

Revenue from Operations: ₹2,662.63 crore, up 6% YoY from ₹2,512.88 crore in Q2 FY25.

-

Profit Before Tax (PBT): ₹23.32 crore, up 31% YoY.

-

Profit After Tax (PAT): ₹16.31 crore, up 54% YoY from ₹10.61 crore in Q2 FY25.

-

Adjusted EBITDA: ₹177.4 crore, marginally up from ₹176.07 crore in Q2 FY25.

-

EBITDA margin: 6.66%, slightly down from 7.01% in Q2 FY25.

-

Integrated Supply Chain Solutions (ISCS) segment revenue grew 8.4% YoY to ₹1,993.01 crore, with EBITDA margin expansion to 8.7%.

-

Global Forwarding Solutions (GFS) segment revenue declined slightly by 0.7% to ₹669.62 crore; EBITDA margin contracted to 2.03% from 4.18% previous year.

-

New business secured worth ₹204 crore; strong pipeline exceeding ₹6,200 crore.

-

Cash flow from operations stood at ₹105 crore in H1 FY26.

-

Management reaffirmed its target to achieve 4% PBT margin by Q4 FY27 supported by “Project One” initiative and robust business pipeline.

Management Commentary & Strategic Decisions

-

Management highlighted consistent revenue growth driven primarily by the ISCS segment’s operational performance and better cost efficiencies.

-

Pricing pressure continues to impact the GFS segment; focus remains on improving margins in that division.

-

The company is investing in technology and efficiency improvements under Project One to sustain margin expansion.

-

Operational resilience and strong cash flows demonstrate the robustness of the business model despite macroeconomic challenges.

-

Outlook remains cautiously optimistic with emphasis on doubling return ratios over medium term and maintaining double-digit revenue growth.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹2,592.31 crore, up 2.1% YoY.

-

Profit Before Tax (PBT): ₹17.53 crore, up 37.4% YoY.

-

Profit After Tax (PAT): ₹71.16 crore (including share of profit from joint ventures, including TVS ILP).

-

Adjusted EBITDA: ₹172.01 crore, with margin of 6.64%.

-

ISCS segment led performance with revenue growth and margin expansion.

-

GFS segment remained under pressure with EBITDA margin contraction.

-

Management reported strong operational execution and disciplined cost control.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.