TVS Motor Company Ltd (TVSM) is engaged in manufacturing two-wheelers and its accessories; it currently manufactures a wide range of two-wheelers and three-wheelers.

Q2 FY26 Earnings Results

-

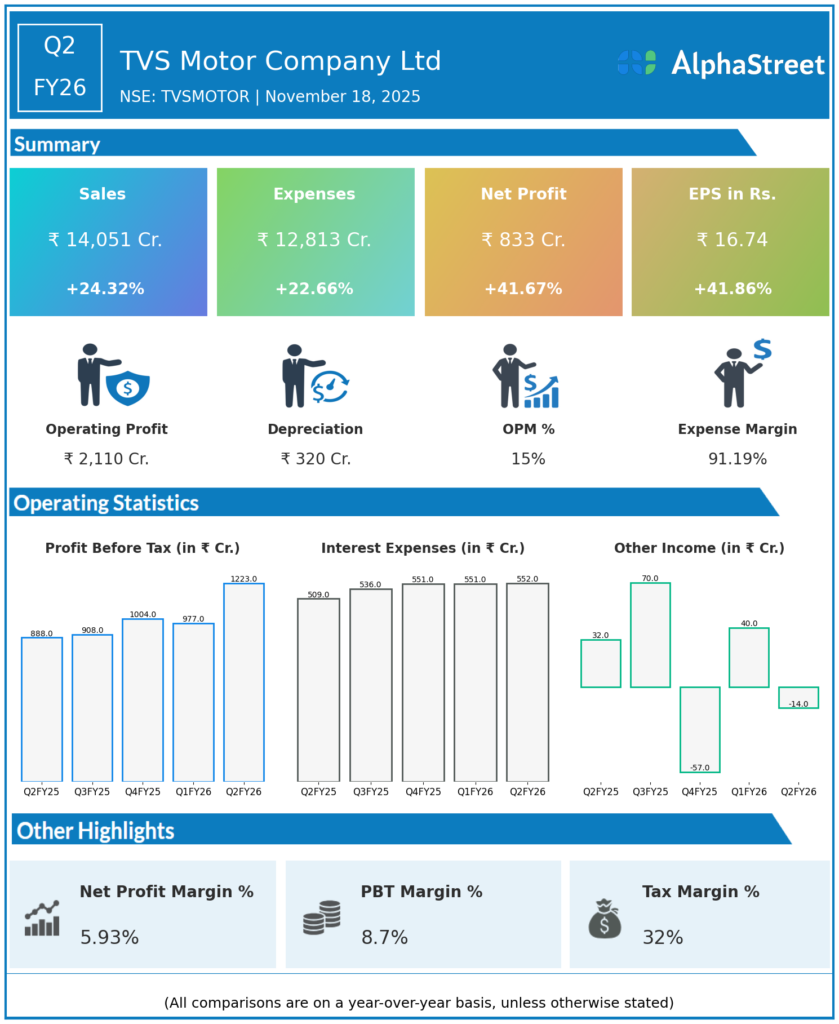

Revenue from Operations: ₹14,051 crore, up 15.08% QoQ and 24.3% YoY from ₹11,301.68 crore in Q2 FY25.

-

EBITDA: ₹1,509 crore, a 40% YoY increase with EBITDA margin expansion to 12.7% from 11.7% in Q2 FY25.

-

Profit Before Tax (PBT): ₹1,223 crore, up 39.3% YoY.

-

Profit After Tax (PAT): ₹833 crore, up 41.6% YoY and up 36.5% sequentially.

-

PAT margin: 5.93%, improved from 5.27% in Q1 FY26.

-

Earnings per Share (EPS): ₹16.74, up significantly YoY.

-

Record high quarterly sales with strong domestic and international buyer demand.

-

Electric vehicle (EV) segment reported robust growth, with 80,000 units sold including 3-wheelers with 11% market share.

-

Interest costs increased to ₹552 crore but operating interest coverage improved to 3.84 times.

-

Operating cash flow remains strong, setting a positive financial tone for the year.

Management Commentary & Strategic Decisions

-

Management highlighted a strong festive season demand driving revenue and profit growth, with operational efficiencies contributing to margin expansion.

-

Renewed focus on EV product launches and expanding global footprint, especially in premium motorcycles and three-wheelers.

-

Market share gains across multiple two-wheeler segments supported by product innovation and aggressive marketing.

-

Working capital management and capital expenditure on new facilities progressing to support future growth.

-

Cautiously optimistic outlook with intent to sustain double-digit revenue growth and improve profitability despite raw material inflation and supply chain risks.

-

Continued investments in R&D, digital sales channels, and electrification strategies to capture evolving market trends.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹12,210 crore, up 20% YoY.

-

EBITDA: ₹1,263 crore, up 32% YoY, with EBITDA margin at 12.5%.

-

Profit Before Tax (PBT): ₹1,053 crore, up 35% YoY.

-

Profit After Tax (PAT): ₹610 crore, up 35% YoY.

-

EPS: ₹12.21.

-

Highest-ever quarterly vehicle sales of 12.77 lakh units, including a 17% rise in exports.

-

Margin improvements driven by better product mix and cost efficiencies despite inflationary pressures.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.