Sundaram Clayton Ltd was incorporated in Chennai in 1962 and is part of the TVS group, led by Mr. Venu Srinivasan. It is engaged in the business of manufacturing and distributing aluminum die castings. Sundaram Clayton manufactures non-ferrous gravity and pressure die castings.

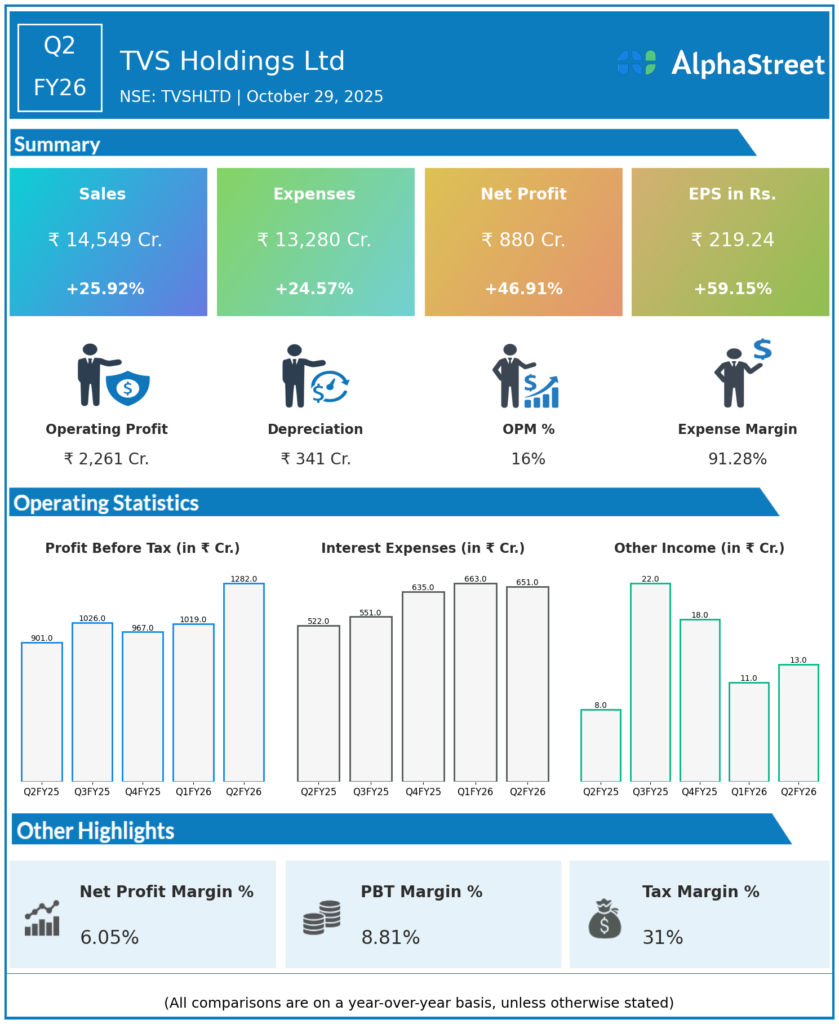

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹14,549.15 crore, up from ₹11,449.95 crore in Q2 FY25, indicating strong growth.

-

Total Income: ₹14,562.03 crore.

-

Profit Before Tax (PBT): ₹1,281.73 crore, up from ₹892.22 crore in Q2 FY25.

-

Profit After Tax (PAT): ₹880.08 crore, compared to ₹598.81 crore in Q2 FY25, reflecting significant profitability growth.

-

Earnings Per Share (Basic & Diluted): ₹218.89 per share for the quarter (non-annualized).

-

Total Comprehensive Income: ₹1,314 crore, up from ₹676.89 crore YoY.

-

Segment Revenue:

-

Automotive Vehicles & Parts: ₹12,260.99 crore.

-

Financial Services: ₹2,352.92 crore.

-

-

Segment Results (Profit before tax and interest):

-

Automotive Vehicles & Parts: ₹1,034.49 crore.

-

Financial Services: ₹433.79 crore.

-

-

Total Assets: ₹58,275.75 crore (up from ₹39,233.68 crore in Q2 FY25).

-

Net Debt to Equity Ratio: 5.32 (reflected increased leverage due to business scale).

-

Capex and Investments: Significant ongoing expenditures towards growth and technology upgrades highlighted.

Management and Corporate Details

-

Management highlighted robust demand across vehicle segments, led by two-wheeler sales surge and financing business growth.

-

Emphasis on balancing growth with asset quality, with credit costs tightly controlled in financial services segment.

-

Continued investment in EV and green technology to support long-term sustainability goals.

-

Management remains optimistic about recovery in supply chain constraints and stable raw material prices enhancing profitability ahead.

-

Strong liquidity and balance sheet position enable aggressive capex and strategic acquisitions.

Q1 FY26 Earnings Results

-

Revenue: ₹12,742 crore.

-

Adjusted EBITDA: ₹2,261 crore,

-

PAT: ₹675 crore.

-

PBT: ₹1,019 crore.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.