Tube Investments of India Limited (TII) is one of India’s leading manufacturers of a wide range of products for major industries such as Automotive, Railway, Construction, Mining, Agriculture, etc. The Company’s 3 main verticals are Engineering, Metal Formed Products and Bicycles. In line with its growth strategies, the Company has forayed into TMT bars and Truck Body Building business and is additionally exploring opportunities in optic lens and other vision systems for the Auto industry. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Results

-

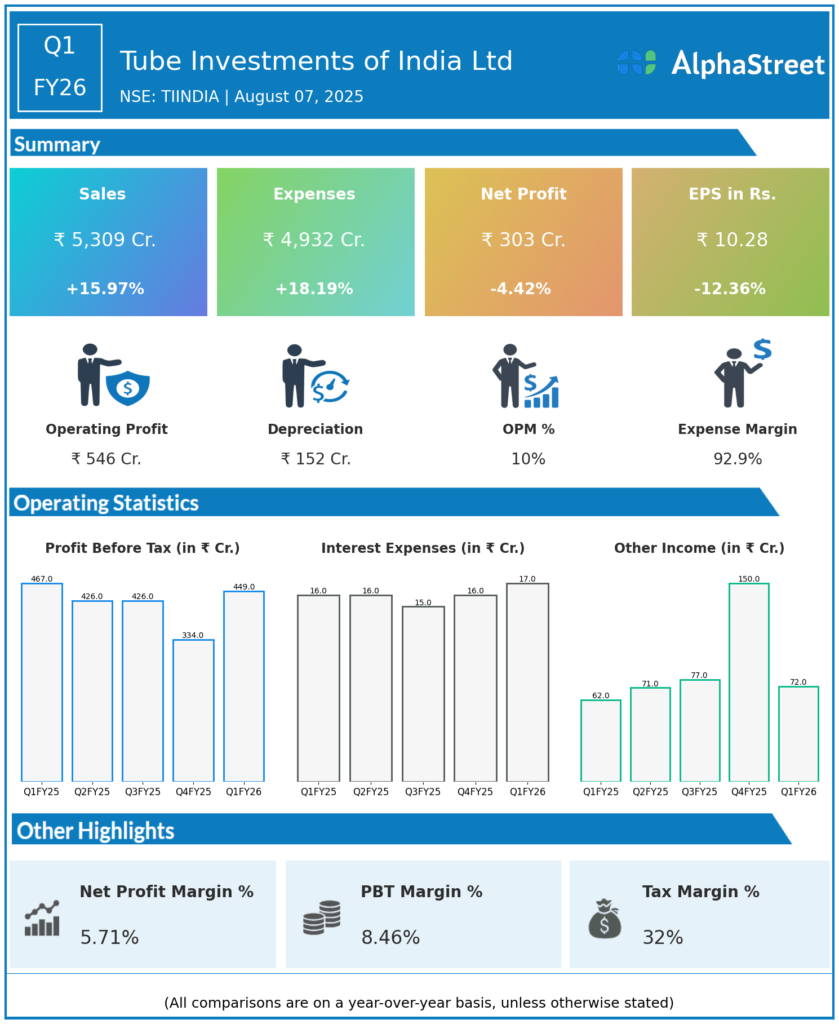

Consolidated Revenue: ₹5,309 crore, up 15.9% year-over-year (YoY) from ₹4,642.7 crore and up 17.6% quarter-over-quarter (QoQ) from ₹4,573.5 crore.

-

Profit Before Tax (PBT): ₹449.1 crore, flat YoY (₹463.9 crore in Q1 FY25), but up 13.7% QoQ (₹395 crore in Q4 FY25).

-

Profit After Tax (PAT): ₹303.2 crore, down 4.4% YoY (₹313.7 crore in Q1 FY25), up 11.8% QoQ (₹271.3 crore in Q4 FY25).

-

Earnings Per Share (EPS): ₹10.28 (vs ₹11.60 in Q1 FY25; ₹9.80 in Q4 FY25).

-

Total Expenses: ₹4,931.6 crore, up 18.0% YoY.

-

Margins: Operating margins remained steady at 12% (standalone), with consolidated margins improving to 12% from 10% last year. Net profit margin ticked up to 6% from 5% last year.

-

Business Drivers: Growth was led by robust sales performance across product lines and particularly strong subsidiary contribution (notably CG Power). Operational cost increases moderated YoY profitability, but overall financial health improved with resilient core business and strategic expansions.

Key Management Commentary & Strategic Highlights

-

Management underlined strong underlying value creation, healthy financial footing, and prudent resource management. Margin discipline, low debt levels, and improved efficiencies were highlighted.

-

The quarter saw Tube Investments strengthen its EV strategy: an additional ₹500 crore was invested into TI Clean Mobility (electric vehicle venture) via Series B fundraising, signifying a deeper push into next-gen mobility.

-

The CG Power subsidiary completed a significant ₹3,000 crore QIP, arming it with capital for growth.

-

The order book and asset base improved, setting the stage for continued double-digit growth. Management reaffirmed a double-digit growth outlook but noted export targets remain challenging due to macro factors; exports currently contribute about 13–15% of revenue.

-

The strategic focus remains: engineering, metals, mobility (cycles), and new energy via green tech and digital. Margin stability, operational excellence, and investments in advanced manufacturing and digital transformation are emphasized.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹5,150 crore, up from ₹4,490 crore YoY.

-

Consolidated PAT: ₹158 crore, down from ₹274 crore YoY (impacted by one-offs and higher costs).

-

Standalone Revenue: ₹1,957 crore (flat YoY).

-

Standalone PBT (before exceptional items & fair value gain): ₹327 crore (vs ₹318 crore YoY); PBT including fair value gains (CCPS) was ₹896 crore.

-

Standalone PAT: ₹814 crore (boosted by exceptional fair value gain on clean mobility investments).

-

Dividend: Final dividend of ₹1.50 per share for FY25, with a total payout of ₹3.50 per share.

-

Other Highlights: ROCE for FY25 was 44%. Free cash flow remained strong, and the balance sheet continued to strengthen. The board sanctioned borrowings of up to ₹300 crore for FY26.

To view the company’s previous earnings, click here