TTK Group was founded in 1928 founded by Mr. T.T. Krishnamachari who set up the distribution for a wide range of products ranging from Foods, Personal care products, etc. The company is India’s largest kitchenware company. TTK Prestige was Established in 1955 as a private limited company, TTK went public in 1994. It is among the leading brands in the kitchen equipment space, especially in the pressure cooker segment. In 2012 Company had an Alliances with global high-end brands for high-end cookware/Store ware/Water Filters/ Gas-tops.

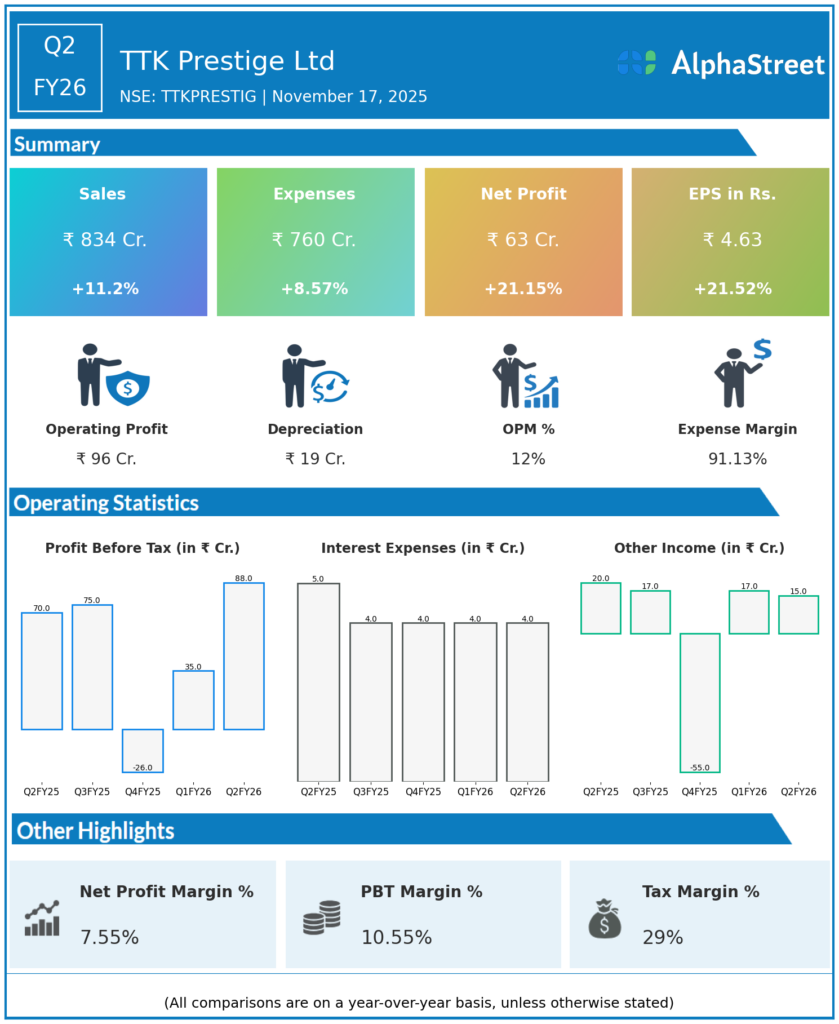

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹834 crore, up 35.5% QoQ from ₹626.68 crore in Q1 FY26, and up 11.2% YoY from ₹769.84 crore in Q2 FY25.

-

EBITDA: ₹96.5 crore, with an operating margin of 11.57%, significantly improving from 6.62% margin in Q1 FY26.

-

Profit Before Tax (PBT): ₹94.2 crore, up 22.2% YoY.

-

Profit After Tax (PAT): ₹63.20 crore, up 146.7% QoQ from ₹25.62 crore in Q1 FY26, and up 21.0% YoY from ₹52.25 crore in Q2 FY25.

-

PAT margin: 7.58%, up from 4.20% in Q1 FY26, driven by festive season demand and operational leverage.

-

EPS: ₹4.69, up 141.8% QoQ and 22.8% YoY.

-

Employee cost was ₹79.87 crore (9.58% of sales), marginally higher than Q2 FY25.

-

Export sales grew moderately, with a healthy growth in domestic sales driven by kitchen and cookware segments.

Management Commentary & Strategic Decisions

-

CEO and management emphasized the strong festive quarter, which lifted revenues and profits substantially through improved operational leverage and market demand.

-

Structural margin pressures remain due to competitive intensity, rising input costs, and increased promotional spends, though Q2 showed margin recovery versus Q1.

-

Management is focused on sustaining momentum through innovation, product portfolio enhancement, and expanding retail penetration especially in tier 2 and 3 cities.

-

Investment in digitization and e-commerce channels continues to be a priority to capture shifting consumer behaviors.

-

The company remains cautious regarding margin sustainability given external headwinds but optimistic about medium-term growth prospects driven by brand strength and new launches.

-

ROCE and ROE metrics showed some decline, indicative of operational challenges; management aims to reverse this via operational efficiencies and working capital management.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹626.68 crore, down 2.2% QoQ and flat YoY versus previous periods.

-

EBITDA: ₹40.36 crore with a margin contraction to 6.62% from 11.57% in Q2 FY26.

-

Profit Before Tax (PBT): ₹35.24 crore, down 52.7% QoQ and down 36.0% YoY.

-

Profit After Tax (PAT): ₹25.62 crore, down 55.4% QoQ and 37.2% YoY.

-

EPS: ₹1.90, down sharply from previous quarters.

-

Margin and profitability were impacted by rising costs and subdued demand outside the festive season.

-

Management flagged challenges due to competitive pricing pressures and higher overheads in Q1, with a focus on turnaround in the coming quarters

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.