TTK Group was founded in 1928 founded by Mr. T.T. Krishnamachari who set up the distribution for a wide range of products ranging from Foods, Personal care products, etc. The company is India’s largest kitchenware company. TTK Prestige was Established in 1955 as a private limited company, TTK went public in 1994. It is among the leading brands in the kitchen equipment space, especially in the pressure cooker segment. In 2012 Company had an Alliances with global high-end brands for high-end cookware/Store ware/Water Filters/ Gas-tops

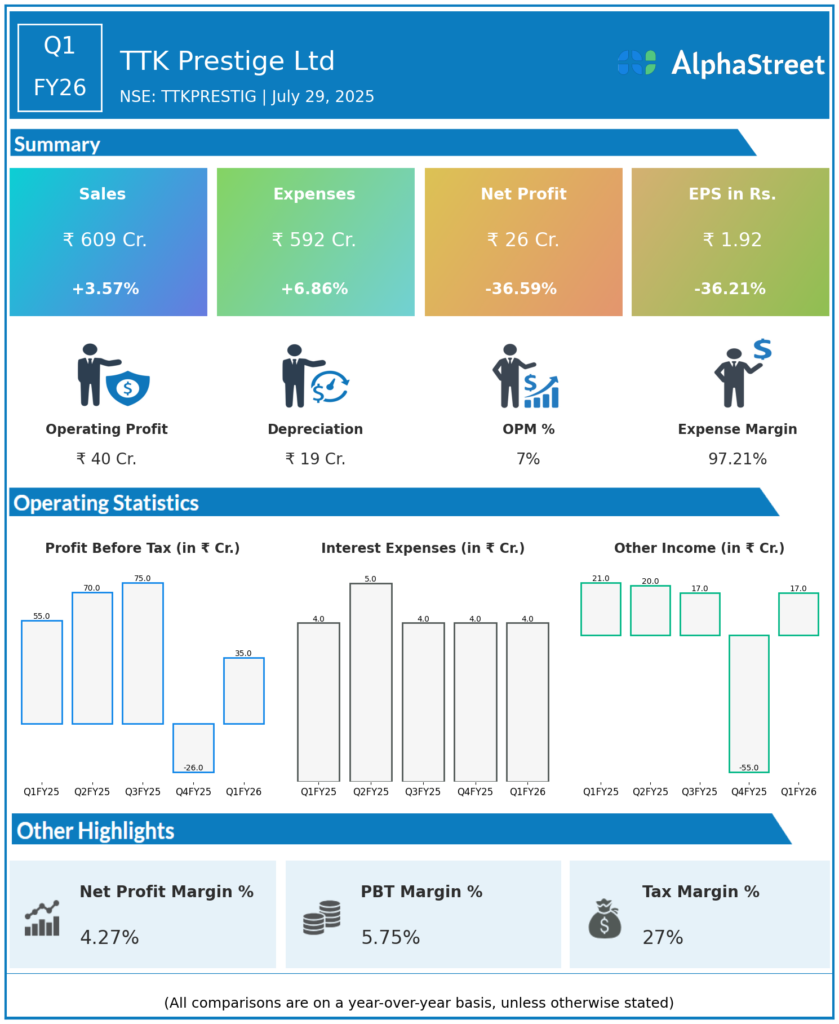

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue from Operations: ₹609 crore, up 3.6% YoY.

-

Net Profit (PAT): ₹26 crore, down 37% YoY.

-

EBITDA: ₹40.4 crore, down from ₹54.4 crore YoY.

-

Total Income: ₹592.11 crore, up 3.4% YoY.

-

Operating Margin (Pre-exceptional): 11.9%, up slightly from 11.5% YoY.

-

Export Sales: ₹15.6 crore, down from ₹17.4 crore YoY.

-

Segment Performance: General trade and e-commerce sales posted healthy growth; rural/institutional channels remained subdued. Shipments to the US delayed due to external logistical and tariff headwinds.

-

One-off Costs: Provision of ₹17.7 crore relating to cost optimization and transformation initiatives.

-

Product & Innovation: Plans to launch 76 new SKUs in Q2 FY26, reflecting a focus on innovation for future growth.

Key Management & Strategic Decisions

-

Impairment & Write-downs: Major exceptional charge in Q4 due to impairment of goodwill for the UK subsidiary, responding to continued challenges in the UK and European economies and potential US tariffs.

-

Channel Focus & Expansion: Robust growth from core channels (general trade, exclusive brand outlets, e-commerce, modern trade); continued weakness in rural and institutional segments due to macro and distribution constraints.

-

Cost Management: Intensified efforts on cost optimization, including business transformation and manufacturing efficiency programs (examples: exceptional provision in Q1 FY26 for transformation spending).

-

Product Innovation: Management is focusing on introducing new SKUs and enhancing product pipeline to drive recovery and competitiveness—they plan to launch 76 new SKUs in Q2 FY26.

-

Cash and Balance Sheet: Maintained strong cash position, supported by prudent working capital deployment and discipline even amidst dividend payouts and buybacks.

-

Dividend Policy: Continued shareholder friendly stance with a recommended ₹6/share final dividend.

-

Outlook: Management remains optimistic for H2 FY26 with strong festive pipeline, innovation, and operating cost discipline, even as rural/institutional recovery may be gradual.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue from Operations: ₹650 crore, up 4.3% year-over-year (YoY).

-

Total Income: ₹666.12 crore, up 3.9% YoY.

-

Net Profit/Loss: ₹(40.64) crore (net loss), compared to a profit of ₹58.7 crore in Q4 FY24.

-

EBITDA: ₹51.53 crore, down 33.6% YoY.

-

EBITDA Margin: 7.93%, contracting 452 basis points from 12.45% YoY.

-

Exceptional Loss: ₹71.42 crore, due to impairment of goodwill for the UK subsidiary Horwood Homewares.

-

Domestic & Export Sales: Domestic sales at ₹582.2 crore, up 3% YoY; export sales at ₹21.6 crore, up 60% YoY.

-

Dividend: Board recommended a final dividend of ₹6 per share for FY25.

-

Financial Position: Free cash over ₹825 crore, even after capex, buybacks and working capital needs.

-

Profitability Drivers: Weak demand in rural/institutional channels, strong performance in general trade, e-commerce, modern trade offset overall muted demand