Triveni Turbine Ltd is primarily engaged in business of manufacture and supply of power generating equipment and solutions. It was a division of Triveni Engineering & Industries Ltd since 1970s and was demerged w.e.f from Oct 2010 into a separate entity. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

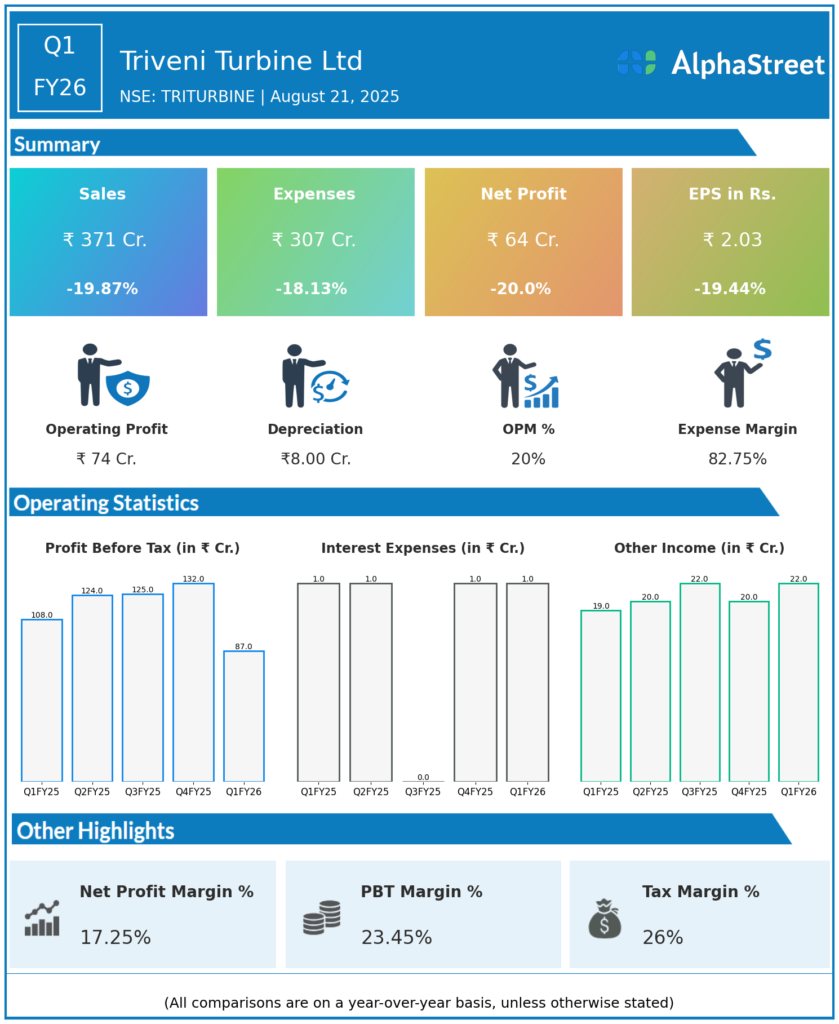

Revenue from Operations: ₹371 crores down 19.87 percent from ₹463 crores in Q1 FY25

-

EBITDA: ₹958 crores down 16.7 percent from ₹1,150 crores in Q1 FY25, depicting a margin of 25.8 percent.

-

Profit After Tax (PAT): ₹644 crores down 19.9 percent from ₹804 crores in Q1 FY25.

-

EPS: ₹2.03 vs ₹2.52 during the same quarter, last year.

Management Commentary & Strategic Decisions

-

Management focuses on growth driven by increasing demand for steam turbines and efficient energy solutions.

-

Strategic initiatives include expanding the export market footprint, particularly in emerging economies.

-

Focus on innovation, energy efficiency, and long-term partnerships with key industrial clients.

-

They continue investments in R&D and capacity expansions planned for FY26 to meet growing market demand.

-

Managing supply chain efficiencies and cost control remain key priorities amid global uncertainties.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹463 crores, up 23% YoY from ₹376 crores in Q1 FY24.

-

EBITDA: ₹115 crores, a 36.4% increase YoY.

-

EBITDA Margin: 24.8%, improved from 22.4% in Q1 FY24.

-

Profit Before Tax (PBT): ₹108 crores, up 37.2% YoY.

-

Net Profit After Tax (PAT): ₹80 crores, a 31.8% increase YoY.

-

EPS: ₹2.52, up 31.9% YoY.

-

Order Book: ₹630 crores in Q4 FY25, up 44% YoY; domestic order bookings surged 150% to ₹440 crores mainly due to an NTPC order for a Long Duration Energy Storage system.

-

Exports: Export order bookings declined 27% YoY to ₹190 crores.

-

Market: Export sales rose 27% YoY to ₹280 crores, while domestic sales grew 8% YoY to ₹260 crores.

-

Total Order Book: ₹1,909 crores as of March 31, 2025, up 23% YoY.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.