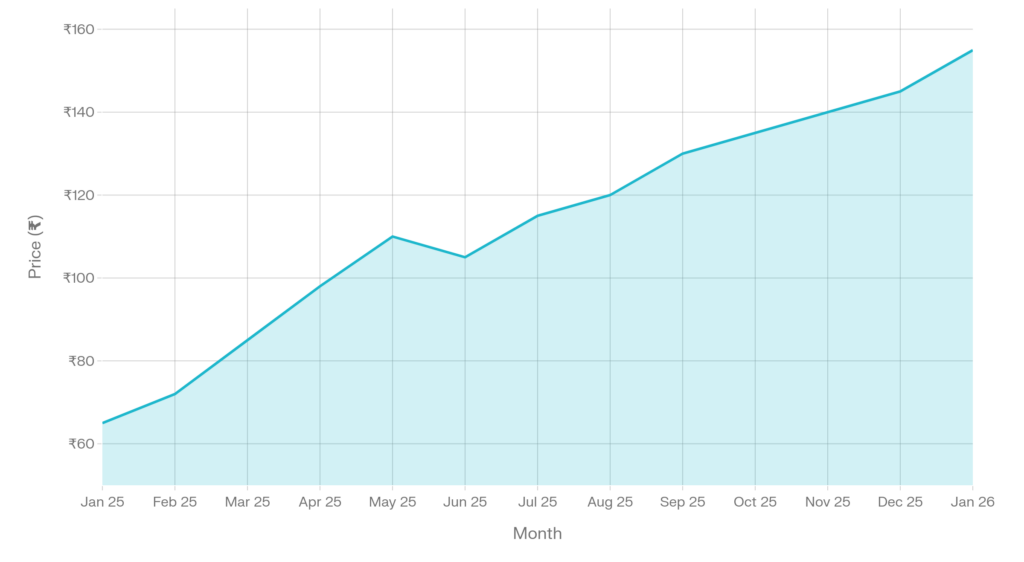

Trishakti Industries Ltd. (NSE: TRISHAKT; BSE: 531279) reported record quarterly profitability on Tuesday, with the stock trading near ₹154.95 on January 19, 2026, up approximately 138% from ₹65 twelve months prior.

Market Capitalization

Trishakti Industries’ current market capitalization is approximately ₹278.65 crore, reflecting investor re-rating following a sustained earnings acceleration narrative. The company remains classified as a micro-cap stock with a market float of around 31.51% after accounting for 68.49% promoter shareholding as of December 2025.

Latest Quarterly Results

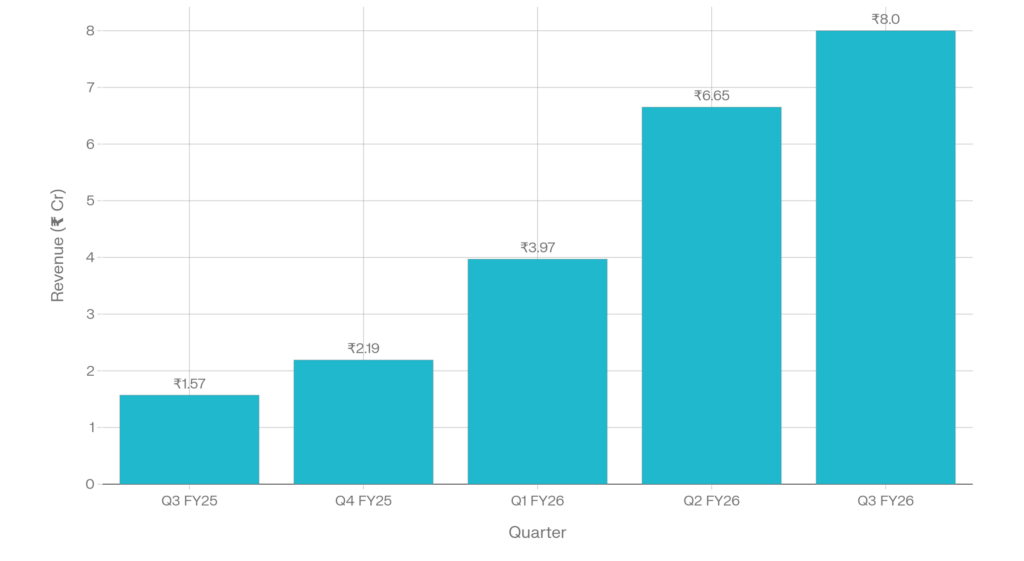

Consolidated revenue for Q3 FY26 (ended December 31, 2025) reached ₹8.00 crore, representing a 409.55% increase from ₹1.57 crore in Q3 FY25 and 20.30% sequential growth from ₹6.65 crore in Q2 FY26. The company achieved net profit after tax of ₹2.41 crore, a dramatic turnaround from ₹0.02 crore in the year-ago quarter. EBITDA rebounded to ₹5.56 crore with a margin of 70.05%, the highest in eight quarters, up from 58.97% in Q2 FY26. The profit-after-tax margin expanded to 30.13%, up substantially from 0.64% in Q3 FY25, underscoring improving operational discipline and cost management. Earnings per share increased to ₹1.47 from ₹0.01 in Q3 FY25.

Full-Year Results Context

For the nine-month period ended December 31, 2025 (9M FY26), consolidated revenue totaled ₹18.74 crore, up 17.95% from ₹15.90 crore in the comparable period of FY25. Net profit for 9M FY26 reached ₹4.89 crore, representing 116.88% growth compared to ₹2.26 crore in 9M FY25. The annualized revenue run rate based on nine-month performance stands at approximately ₹48 crore, demonstrating accelerating momentum. Management has guided toward full-year FY26 revenue of ₹200-220 million (₹20-22 crore), with multi-year targets of ₹600-650 million in FY27 and ₹900 million to ₹1,000 million in FY28.

Financial Trends

Trishakti Industries Operating Performance (Q3 FY25 – Q3 FY26)

Trishakti Industries Stock Price Movement (12 Months, January 2025 – January 2026)

Business & Operations Update

Trishakti Industries operates as a heavy equipment rental and infrastructure solutions provider, specializing in crane hire, man-lifts, and earth-moving machinery deployment across infrastructure, renewable energy, and industrial sectors. The company maintains 100% fleet utilization across 117 active machines deployed across 20+ concurrent projects.

M&A OR Strategic Movies

Trishakti Industries announced a landmark contract from Reliance Ltd. for deployment of equipment to support large-scale renewable energy projects, reinforcing the company’s positioning as an infrastructure partner to India’s clean energy transition. The company secured a record contract with PEPL (a Jindal Group subsidiary) deploying machinery worth ₹60 million, representing over 50% of the company’s projected capex allocation. Strategic partnerships with industry majors including Tata Steel Ltd. and Larsen & Toubro Ltd. anchor the company’s order book visibility.

Guidance & Outlook

Management has provided multi-year guidance targeting revenue of ₹200-220 crore in FY26, scaling to ₹600-650 crore in FY27 and ₹900-1,000 crore in FY28. The company expects to maintain EBITDA margins in the 60-65% range as it scales, with return on capital employed remaining between 22-25% on new capex deployment.

Performance Summary

Trishakti Industries delivered an operational turnaround in Q3 FY26, posting record quarterly profit of ₹2.41 crore on revenue of ₹8.00 crore. While profitability metrics have demonstrated material improvement, valuation multiples remain elevated relative to historical precedent, warranting careful monitoring of execution risks on the company’s multi-year ₹400 crore capex program.