Trent Ltd is engaged in retailing of apparels, footwear, accessories, toys, games, food, grocery & non food products through various of its retail formats/ concepts.

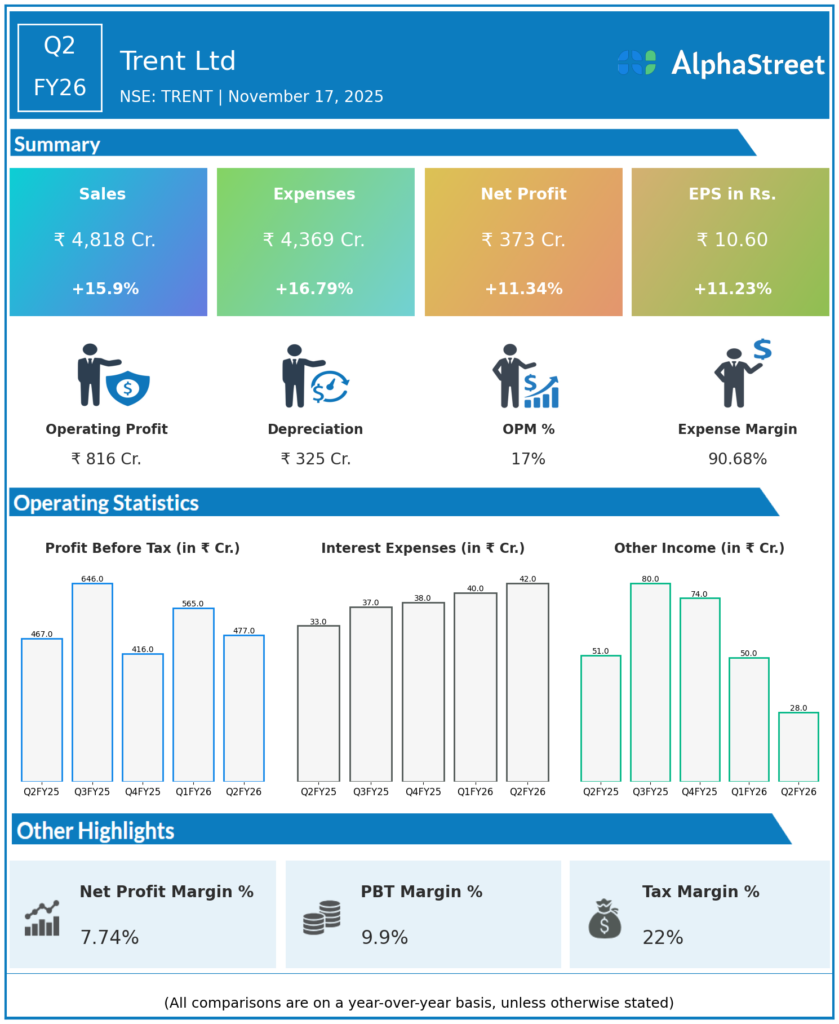

Q2 FY26 Earnings Results:

-

Consolidated Revenue from Operations: ₹4,817.68 crore, up 16% YoY from ₹4,156.67 crore, but down 1.35% QoQ from ₹4,883.48 crore in Q1 FY26

-

Net Profit (PAT): ₹373.42 crore, up 11% YoY from ₹338.75 crore, and down 12.3% QoQ

-

EBITDA: ₹803 crore, up 15% YoY; EBITDA margin stable at 16.7% (Q2 FY25: 15.5%)

-

Net profit margin: 7.75% (down 31 bps YoY and 95 bps QoQ)

-

Earnings Per Share (EPS): ₹10.60 (Q2 FY25: ₹9.53)

-

Total expenses: ₹4,367.15 crore, up 16.7% YoY (largely flat QoQ)

-

Depreciation rose 65% YoY to ₹324.93 crore (reflecting aggressive store expansion and asset base increase)

-

Interest costs: ₹41.62 crore, up 26.1% YoY

-

Dividend announced: ₹2 per share

-

Debt-to-EBITDA ratio improved to 5.34; quality of earnings remains robust

Management Commentary & Strategic Insights

-

Retail footprint expanded with 19 new Westside stores (6 closed) and 44 new Zudio stores added in Q2 FY26

-

Management cited solid performance across brands, but acknowledged moderation in growth trajectory and consumer sentiment

-

Margin pressure attributed to higher depreciation and interest costs from network expansion

-

Robust ROCE at 27.7% and ROE at 28.3% signal efficient capital deployment and improved asset utilisation

-

Ongoing focus on enhancing store density in established markets and entry into new Tier-II/III cities for future growth

-

Foreign institutional holding has declined from 26.6% to 16.8% YoY, with concerns around demand sustainability and valuation

Q1 FY26 Earnings Results

-

Revenue: ₹4,883.48 crore, up 19% YoY

-

PAT: ₹429.69 crore, up 9.5% YoY

-

EBITDA: ₹888.45 crore

-

Net profit margin: 8.8% (down 30 bps YoY)

-

Continued investment in technology and automation for operational efficiency

-

Zudio expansion was cited as a strong growth driver

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.