Trent Ltd is engaged in retailing of apparels, footwear, accessories, toys, games, food, grocery & non food products through various of its retail formats/ concepts. Presenting below are its Q1 FY26 earnings.

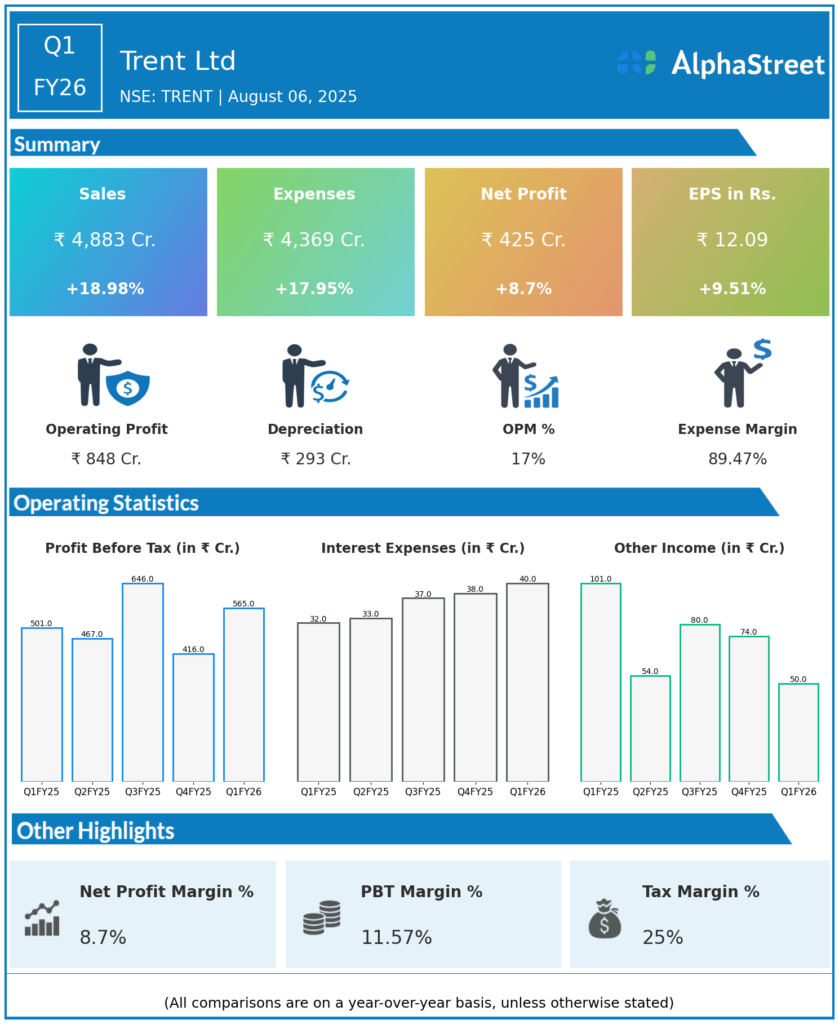

Q1 FY26 Earnings Summary

-

Consolidated Net Profit (PAT): ₹425 crore, up 9% year-over-year (YoY) from ₹391 crore in Q1 FY25.

-

Sequential PAT Growth: Profit rose 36% sequentially from ₹312 crore in Q4 FY25.

-

Consolidated Revenue: ₹4,883 crore, up 19% YoY from ₹3,992 crore in Q1 FY25 (standalone basis).

-

Consolidated Profit Before Tax (PBT): ₹565 crore, up 13% YoY.

-

Like-for-like growth in the fashion portfolio: Low single digits.

-

Store Expansion: Added 1 Westside store and 11 Zudio stores during the quarter.

-

Profit margins: The exact margin data was not reported, but a 70 basis points margin contraction is expected versus last year (analyst expectations around 14.2% EBITDA margin).

-

Standalone Results:

-

Net profit at ₹423 crore, up 23% YoY.

-

Revenue up 20% YoY to ₹4,781 crore.

-

Key Management Commentary & Strategic Highlights

-

The company reported healthy revenue growth across most micro markets despite headwinds such as early monsoon onset and geopolitical disruptions.

-

Management indicated that the historical five-year revenue CAGR for Trent has been 35%, but going forward, a sustainable revenue CAGR of about 25% is expected.

-

The strategic mix of revenue participation across business concepts remains broadly aligned with company plans.

-

Expansion plans include continued store additions and brand building.

-

Management is focused on sustaining growth momentum with improved operational efficiency amid changing consumer behavior and external challenges.

Q4 FY25 Earnings Summary

- Trent Ltd reported Revenues for Q4FY25 of ₹4,217.00 Crores up from ₹3,298.00 Crore year on year, a rise of 27.87%.

- Total Expenses for Q4FY25 of ₹3,876.00 Crores up from ₹3,074.00 Crores year on year, a rise of 26.09%.

- Consolidated Net Profit of ₹312.00 Crores down 56.18% from ₹712.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹8.95, down 54.82% from ₹19.81 in the same quarter of the previous year.

- Quarterly Trends: Q4 FY25 profit was lower than Q1 FY26, with sequential growth in Q1 indicating operational improvement.

To view the company’s previous earnings, click here