Transrail Lighting Ltd (BSE: 544317 / NSE: TRANSRAILL) reported higher revenue and profitability in the quarter ended December 31, 2025, driven by robust execution in its Transmission & Distribution (T&D) segment, rising order inflows and a larger unexecuted order book.

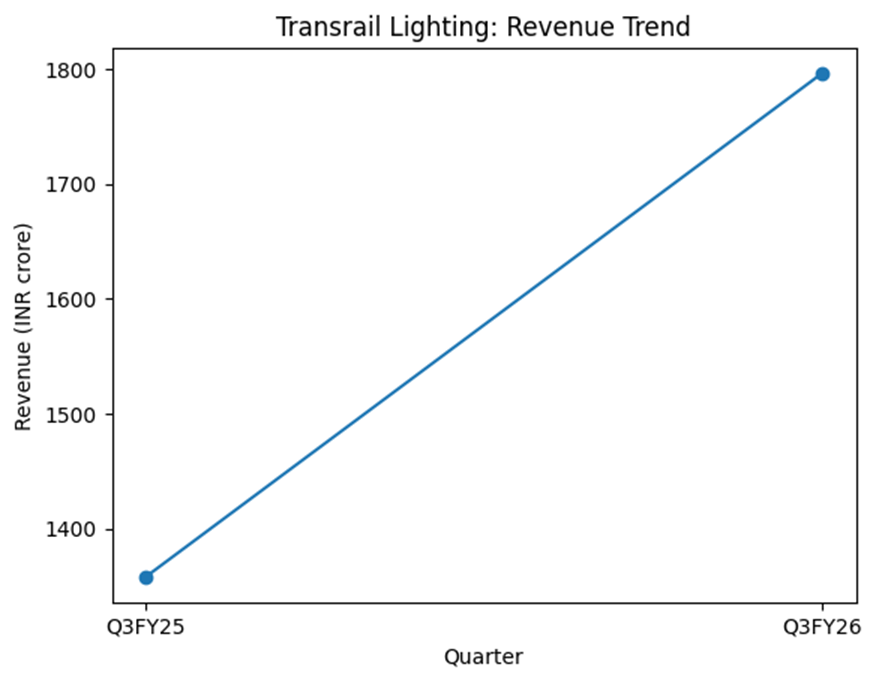

The company posted revenue from operations of ₹1,796 crore in Q3 FY26, up 32% year-on-year. Operating profit after tax (before exceptional items) rose 36% to ₹127 crore, while EBITDA increased 27% to ₹228 crore, with EBITDA margin at 12.7%.

Business overview

Transrail Lighting is an integrated EPC company focused primarily on power transmission and distribution, with manufacturing capabilities in lattice towers, conductors and monopoles. Its portfolio also spans substations, civil construction, railways, poles and lighting, and international solar EPC projects.

The company operates four integrated manufacturing facilities and has executed projects across 63 countries, with a strong presence in India, Africa, the GCC, Southeast Asia and select markets in Europe and the Americas.

Financial performance — Q3 FY26

Revenue from operations in Q3 FY26 rose to ₹1,796 crore from ₹1,358 crore in Q3 FY25. EBITDA increased to ₹228 crore from ₹180 crore, while operating profit before tax rose 34% to ₹169 crore.

After accounting for tax, operating profit after tax stood at ₹127 crore, compared with ₹93 crore a year earlier. Profit after tax including an exceptional item related to the statutory impact of new labour codes was ₹110 crore.

Nine-month performance (9M FY26)

For the nine months ended December 31, 2025, revenue from operations grew 49% year-on-year to ₹5,017 crore. EBITDA rose 40% to ₹614 crore, while operating profit after tax increased 62% to ₹324 crore.

Profit after tax including the labour code impact was ₹307 crore, compared with ₹200 crore in 9M FY25.

Order inflows and backlog

During 9M FY26, Transrail reported fresh order inflows of ₹5,135 crore, with 55% from domestic markets and 45% from international markets.

As of December 31, 2025, the unexecuted order book stood at ₹14,733 crore, up 28% year-on-year. Including L1 positions, the total order book was ₹18,216 crore, providing visibility on future revenue.

Operating and strategic developments

Execution momentum in the T&D segment remained strong in Q3 FY26, with new contracts secured in India and the GCC region.

The company continued brownfield expansion of its tower and conductor manufacturing capacities, with phase-wise capacity additions targeted through FY27. It also progressed its SAP RISE upgrade from SAP HANA to improve process integration and operational visibility.

Cash and balance sheet position

Cash and cash equivalents stood at ₹380 crore as of December 31, 2025, up from ₹87 crore at the end of September 2025, supported by improved cash inflows and working capital management.

Risks and constraints

Performance remains exposed to execution timelines, raw material costs, project site challenges, regulatory changes, working capital requirements and the pace of government and private sector T&D project awards.

Management commentary

The company stated that growth was driven by executional discipline, a strong T&D pipeline, and margin focus, supported by a robust order book and operational capabilities.