Torrent Pharmaceuticals Ltd is one of the leading Indian Pharmaceutical Company engaged in research, development, manufacturing and marketing of generic pharmaceutical formulations.

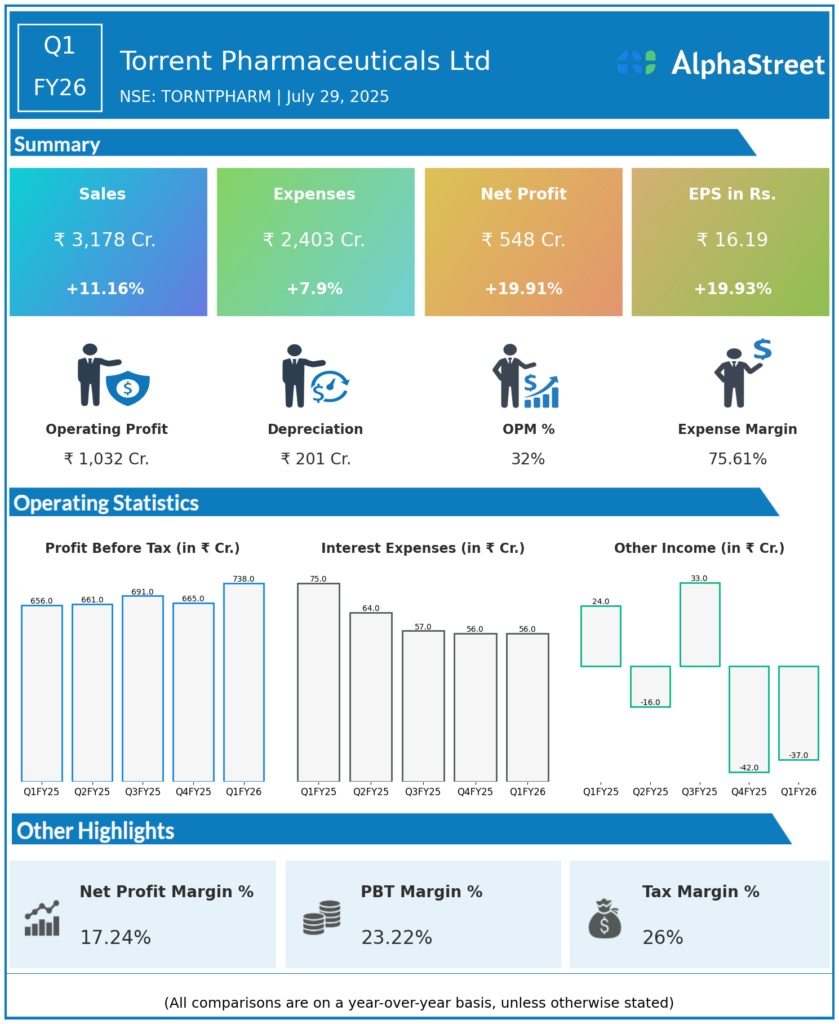

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹3,178 crore, up 11.2% YoY (Q1 FY25: ₹2,859 crore).

-

Net Profit (PAT): ₹548 crore, up 20% YoY (Q1 FY25: ₹457 crore).

-

EBITDA: ₹1,032 crore, up 14% YoY (Q1 FY25: ₹904 crore).

-

Margin: Improved to 32.5% from 31.6% YoY.

-

India Business: ₹1,811 crore, up 11% YoY, driven by outperformance in focus therapies. Chronic segment grew 13%.

-

US Business: Revenue ₹308 crore, up 19% YoY; recent launches achieved targeted market shares.

-

Germany & Brazil: Germany revenue up 9% YoY to ₹308 crore. Brazil portfolio revenue up 11% to ₹218 crore.

-

Outlook: Analysts continue to rate the stock favorably; consensus price targets with modest upside.

Key Management & Strategic Decisions

-

Leadership Transition: Appointment of Aman Mehta as MD from August 2025, ensuring generational leadership and continuity.

-

Growth Investment: Planned fundraise to support R&D, M&A, and pipeline development in India and export markets.

-

Expansion: Recent product launches in the US achieving targeted market share; focus continues on India, Brazil, Germany.

-

R&D Focus: Increasing R&D allocation to 5–6% of revenues in FY26 to support innovation and complex generics.

-

Cost & Efficiency: Continued margin improvement through operational leverage and scale.

-

Dividend Policy: Maintains high shareholder returns via dividends.

-

Strategic Acquisitions: Recent acquisition in the sector to diversify and strengthen specialty product offering.

-

Therapy Leadership: Targeting market leadership in chronic diseases (cardiac, diabetes, CNS) in India and selective global markets.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue: ₹2,959 crore, up 7.8% YoY.

-

Net Profit (PAT): ₹498 crore, up 11% YoY (Q4 FY24: ₹449 crore).

-

EBITDA: ₹964 crore, up 9% YoY; EBITDA margin expanded to 32.6% from 32.2%.

-

EPS: Approximately ₹14.

-

Gross Margin: 75.3%.

-

Profit Driver: Growth led by robust India business and margin improvement.

-

Exceptional Items: Adjusted PAT growth for Q4 FY25 is 15% when excluding exceptional charges related to the closure of DPCO litigation.

-

R&D Investment: ₹581 crore for FY25, making up 5% of revenues (+10% YoY).

-

Dividend: Recommended a final dividend of ₹6/share (face value ₹5) and distributed ₹26/share interim dividend in FY25.

-

Fundraise Plan: Board approved proposal to raise up to ₹5,000 crore via shares/convertibles (subject to shareholder approval).

-

Leadership: Aman Mehta (Whole-Time Director) named as new Managing Director, effective August 1, 2025, pending AGM approval.