Shares of Titan Company Limited (NSE: TITAN) jumped around 5% on the BSE nearing its 52-week high. The surge in price followed the company’s business update for the September quarter, expected to report later this month.

The update showcased robust financial performance across all segments in the quarter riding on retail network expansion and the positivity of the festive season.

With the addition of 105 retail stores in the September quarter, Titan Company remains optimistic for the festive season and positive consumer sentiment.

Performance in Detail

Titan Company reported 18% YoY growth in total sales driven by double-digit sales growth in mostly all segments.

On a segment basis, Jewellery, Watches & Wearables, EyeCare, and Other Businesses recorded revenue growth of 18%, 20%, 7%, and 58%, respectively, on a year-over-year basis. Additionally, Titan Engineering & Automation Limited (TEAL) and CaratLane reflected YoY revenue growth of 139% and 56%, respectively, in the second quarter.

According to the company, the Jewellery division grew on a “high base of Q2FY22 that had elements of pent-up demand and spillover purchases of a Covid disrupted Q1FY22.”

Additionally, varied choice of premium brands in watches to consumers in the company and strong sales from Titan Eye+ propelled overall sales. However, lower sales across Trade & Distribution channel on a YoY basis was on the downside.

TEAL grew stupendously on higher sales at Automation Solutions and Aerospace and Defence Division, while Caratlane reaped the benefits of the festive season.

Snapshot

Titan Company, a joint venture between the TATA Group and Tamil Nadu Industrial Development Corporation (TIDCO), stands out in 2022 despite the continual pandemic and the global hues at the beginning of the year. It experienced stupendous sales and financial growth overcoming macro-economic challenges, which continued in the September quarter as well.

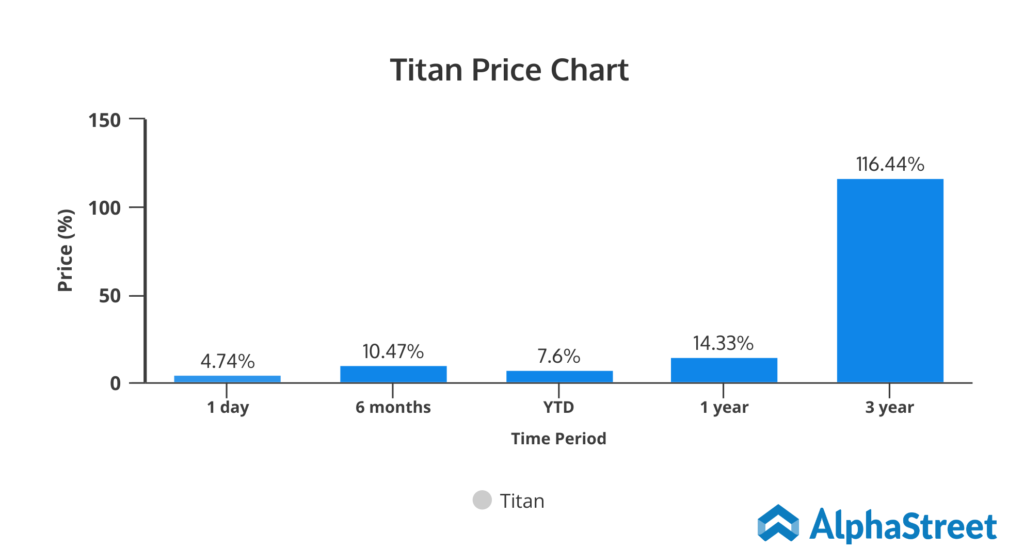

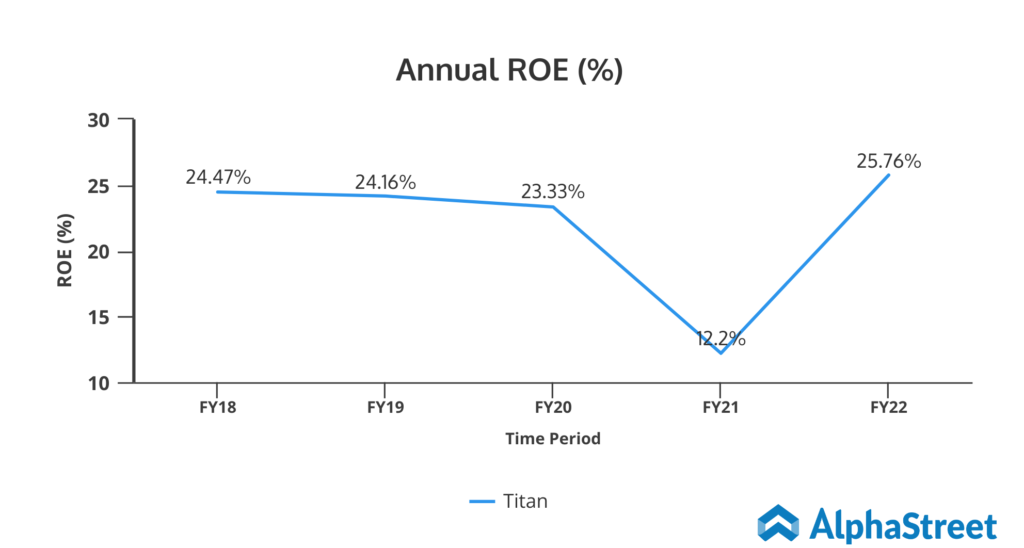

The company seems overvalued compared to its peers at current levels based on both P/E and P/B ratios. Nevertheless, this Large Cap company, with a market capitalization of Rs 239,169 crore, offers superior double-digit ROE, strong returns, and long-term growth prospects.