Titan Company Ltd is among India’s most respected lifestyle companies. It has established leadership positions in the Watches, Jewellery and Eyewear categories led by its trusted brands and differentiated customer experience. It was founded in 1984 as a joint-venture between TATA Group and Tamilnadu Industrial Development Corporation (TIDCO). Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

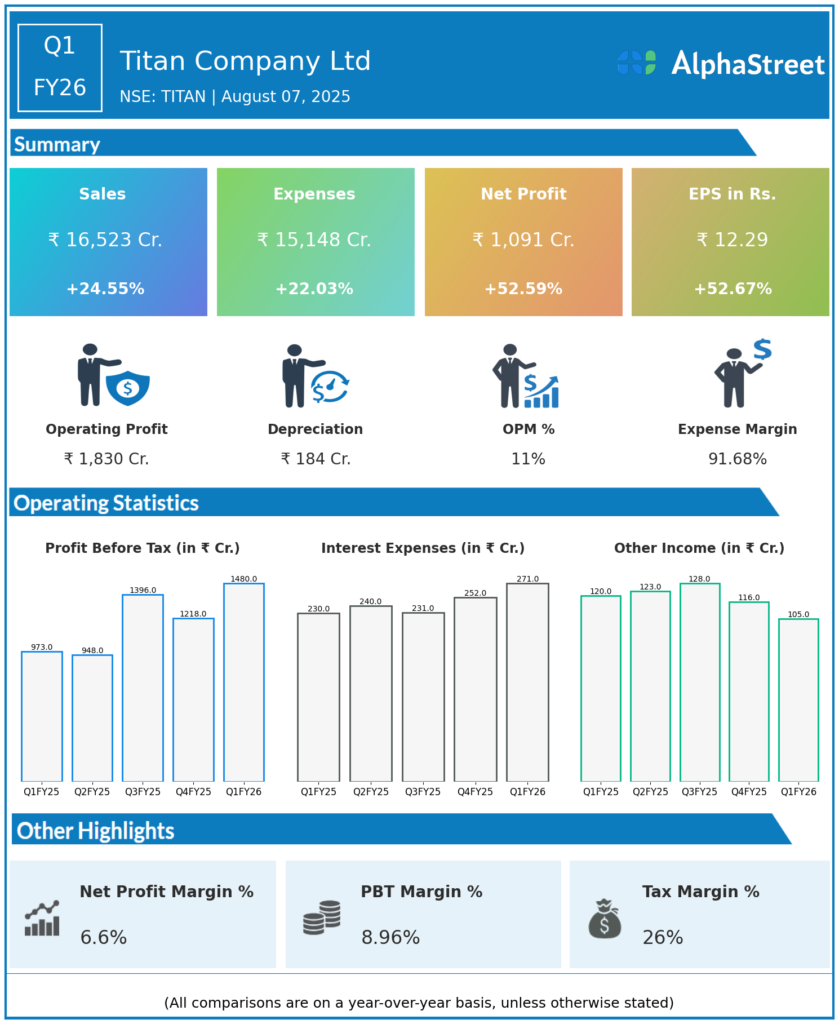

Consolidated Revenue: ₹16,523 crore, up 24.6–25% year-over-year (YoY) from ₹13,266 crore in Q1 FY25.

-

Net Profit (PAT): ₹1,091 crore, up 52.5–53% YoY from ₹715 crore, significantly beating analyst estimates.

-

EBITDA: ₹1,830 crore, up 47% YoY (Q1 FY25: ₹1,247 crore); EBITDA margin expanded to 11.1% from 9.4% last year.

-

Profitability: Margins and profit exceeded estimates; strong operating leverage evident across core businesses.

-

Stock Reaction: Shares settled at ₹3,415.70 on the NSE post-earnings announcement.

-

Market Forecast: 23 out of 34 analysts rate Titan as a ‘buy’; 12-month consensus target: ₹3,834 (implying ~12% upside).

Key Management Commentary & Strategic Highlights

-

CK Venkataraman, Managing Director: “Q1 FY26 has been an encouraging start, with 21% consolidated revenue growth demonstrating the strength of our diversified business model. Jewellery remained resilient even in a high gold price environment, and watches delivered one of its best quarters ever.”

-

Growth Drivers:

-

Jewellery: 19% YoY growth (excluding bullion/digi-gold), Tanishq’s international push and major design launches kept momentum high.

-

Watches & Wearables: Revenue jumped 24% YoY (₹1,273 crore). Premium launches (like Nebula’s JALSA tourbillon watch) and global recognition (Paris Couture Week, Cannes) reinforced Titan’s leadership in luxury and technology watches.

-

EyeCare: Up 13% YoY to ₹238 crore; EBIT margin at 8.4%.

-

Engineering & Automation: Titan Engineering & Automation Ltd. posted 56% income growth; strong aerospace sector tailwinds.

-

-

Strategic Initiatives: Significant investments in omni-channel expansion, international forays via Tanishq, and technology-led retail experience continued through Q1.

-

Order Book & Outlook: Management remains bullish on growth in the premium segment and sees market share gains sustaining through FY26, driven by new launches and deeper retail presence.

Q4 FY25 Earnings Results

- Titan Company Ltd reported Revenues for Q4FY25 of ₹14,916.00 Crores up from ₹12,494.00 Crore year on year, a rise of 19.39%.

- Total Expenses for Q4FY25 of ₹13,814.00 Crores up from ₹11,662.00 Crores year on year, a rise of 18.45%.

- Consolidated Net Profit of ₹871.00 Crores up 12.97% from ₹771.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹9.81, up 13.02% from ₹8.68 in the same quarter of the previous year.

To view the company’s previous earnings, click here