Stock Data

Ticker: TITAN

Exchange : NSE and BSE

Industry: Jewellery & Retail

As at 19th Aug, 2022 the price of Titan Share price is Rs 2,446.00.

The price has declined by 1.32% based on previous share price of Rs. 2492.2. In last 1 Month, Titan Company share price moved up by 9.00%.Based on the analysis the P/E ratio is expensive, it stood at 75.36. EPS of Titan Company is 33.09. Price/Sales ratio of Titan Company is 7.84 and Price to Book ratio of Titan Company is 23.28.

Investment Thesis

Financial Snapshots- The Sales grew 205% YoY. Revenue from Jewellery business grew by 207%.Revenue from Watches & Wearables increased by 158% YoY. The revenue from eye division grew 176% YoY. Trade, LFS and E-commerce channels contributed to a 271% yearly growth.

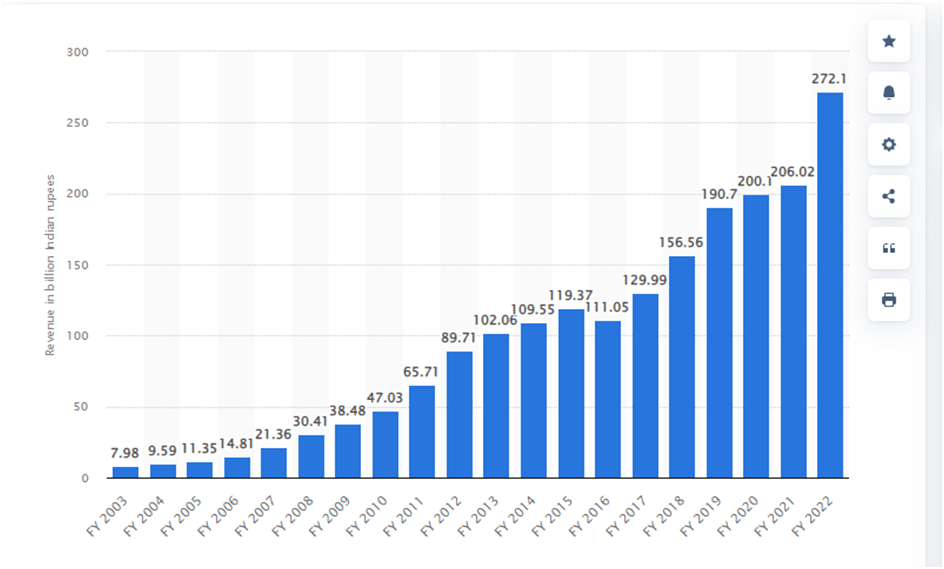

Revenue of Titan Company Limited

Shareholding –The Promoter owns 52.9%as on 30 Jun 2022. There is no change in Promoters Holding. There is zero Promoters’ pledge. The Domestic Institutional Investors holding has gone up to 11.26% as on June 2022. Foreign Institutional Investors holding have gone down to 16.77% as on June 2022. Other investor holding has gone up to 19.07%.

Business Outlook- The company is targeting to open more new stores in FY 23. The Full year EBITDA is expected to be in the range of 12-13% for Jewellery Business.

Company Description– Titan Company Limited is an Indian company. It mainly deals in luxurious products which includes jewellery, watches and eyewear. The company has its headquarters in Bangalore, Karnataka India. The company started its operation in the year 1984 with Titan watches. Later it diversified itself with jewellery, eyewear etc. It has its operations worldwide.

Business Segments– The major business segments include Jewellery, Watches & Wearables, EyeCare and Fragrances and Fashion Accessories, Indian Dress Wear. The Jewellery brand includes Tanishq, Caratline, Mia and Zoya. The Jewellery division holds6% Market Share. It has 606 Retail Stores. It has initiated 40%+ Recycled Gold usage (via exchange policies). The jewellery division has shown a notable growth of 260+% YoY. The 3-year CAGR stood at 23.4%. The wedding segment has recorded a healthy growth of 178% YoY. This division has earned EBIT of Rs 1027Crores with an EBIT margin of 13.5%.

Watches & Wearables include Titan, Fastrack, Xylus, RAGA, and Tommy Hilfiger.It has 8,500+ Multi Brand Outlets with a 272 Town Presence Pan-India. For Q1 FY 23, the total income stood at Rs 785 crores. The EBIT stood at Rs 103 crores with a margin of 13.1%.

The Eye Care segment includes Titan Eye and Fastrack. It has 317 Town Presence Pan-India with a 789 Retail Store Network. The eyecare division has earned a total income of Rs 183 crores. The company has spent Rs 12 crores for the quarter to strengthen the brand’s TV presence. The EBIT Margin stood at 19.8%.

The Fragrances and Fashion Accessories include SKINN and Fastrack. This division has 2,100+ Multi Brand Outlets. This division has earned total income of Rs 56 crores with an EBIT of RS 10 crores.

Taneira is a Tata Product. It provides the finest range of pure handcrafted weaves from across the country. It has 26 retail stores. It has its presence in 11 towns. The sales of Taneira grew by 608% YoY on a low base. Brand continued to expand its national presence.

Return on Capital Employed– The return on capital employed has seen a significant increase driven mainly by the enhancement in operational efficiency. The company has given a 23.35% ROE.

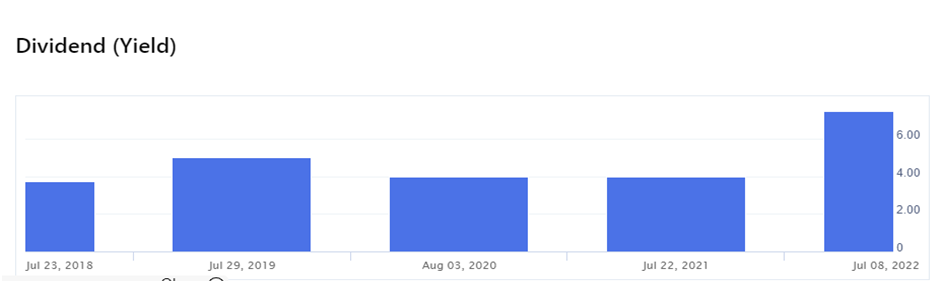

Dividend- The Company has an unstable dividend yield payout. In last 3 years the dividend yield is 0.38%, 0.24% and 0.35%. In last 3 years the company has paid dividend of Rs.7.5000 per share, Rs.4.0000 per share and Rs.4.0000 per share.

Industry Presence– Tanishq is a well known brand operated by Titan in the jewellery segment. Gold jewellery forms around 80% of the Indian jewellery market. The major concern in this industry is the price fluctuation. Titan has adopted a very good method to avoid gold price fluctuation. It purchases most of its gold on lease.

Peer Comparison

| Company Name | MCap(Cr) | TTM PE | P/B | ROE(%) | Debt/Equity |

| Titan Company | 2,21,400.55 | 75.37 | 23.74 | 23.35 | 0.06 |

| Kalyan Jeweller | 7,236.12 | 20.54 | 2.22 | 6.56 | 0.42 |

| PC Jeweller | 2,955.31 | 0.76 | -10.05 | 0.84 |

Titan Company has a market cap of Rs 2, 21,400.55. From investors perspective the company has a ROE of 23.35%. The company has a debt Equity ratio of 0.06. So it will be a good decision to invest in the stock of Titan.

Our Views– The Company is trading at a high EV/EBITDA of 49.43which needs a severe improvement. The company has a good cash flow management; CFO/PAT which stood at 1.25.The variety of product line has helped Titan to become a major player in the industry.