Titagarh Rail Systems Ltd (Formerly Titagarh Wagons Limited), incorporated in 1997, is mainly engaged in the manufacturing and selling of Freight Wagons, Passenger Coaches, Metro Trains, Train Electricals, Steel Castings, Specialised Equipments & Bridges, Ships, etc. The company caters to both domestic and export markets.

Q2 FY26 Earnings Results:

-

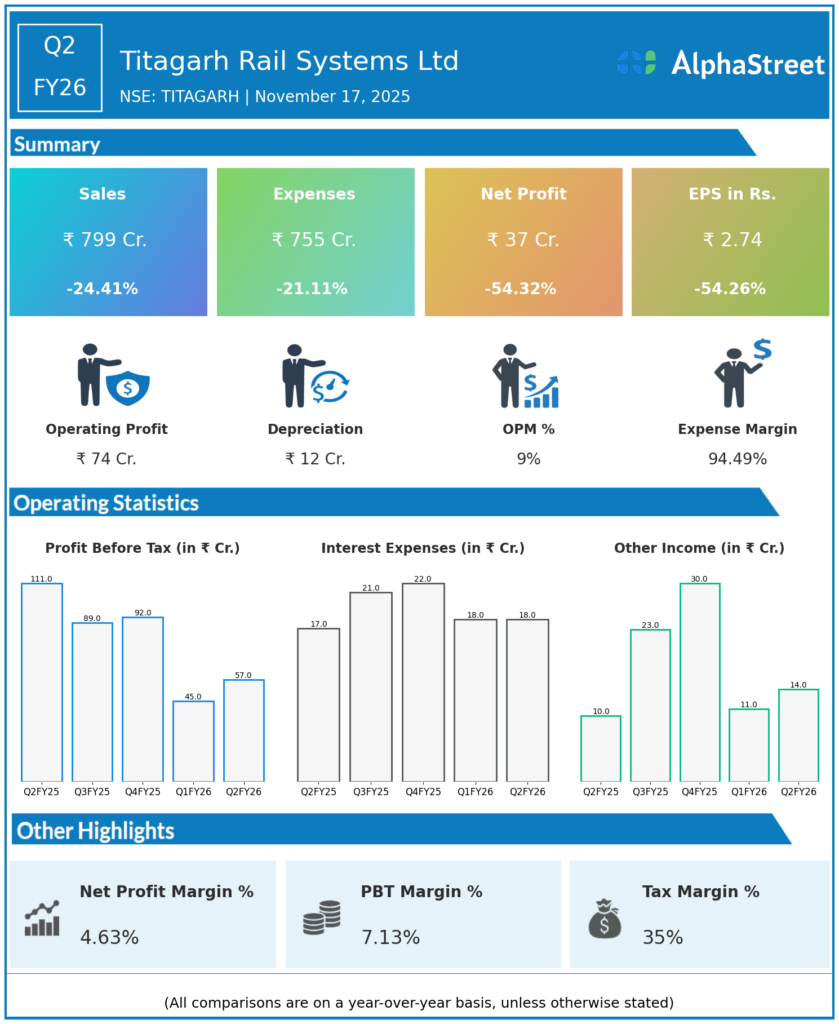

Consolidated Revenue from Operations: ₹799.03 crore, down 24.4% YoY from ₹1,056.95 crore but up 17.6% QoQ from ₹679.3 crore in Q1 FY26

-

Net Profit (PAT): ₹36.90 crore, down 54.3% YoY from ₹80.69 crore, up 19.6% QoQ from ₹30.86 crore in Q1 FY26

-

EBITDA: ₹88.71 crore, margin at 11.1% vs 11.2% YoY and ~11.1% QoQ

-

Profit Before Tax: ₹57.3 crore, down 48.3% YoY

-

EPS (for Q2): ₹3.51

-

Freight Rail Systems revenue: ₹676.82 crore (down 32.3% YoY)

-

Passenger Rail Systems revenue: ₹122.21 crore (up 114.7% YoY)

-

Cost of raw materials fell 30% YoY; employee benefit expense up 29% YoY

-

H1 FY26 consolidated net profit: ₹67.76 crore (down 54.1% YoY); H1 revenue: ₹1,478.3 crore (down 24.6% YoY)

Management Commentary & Strategic Insights

-

Board approved ₹50 crore investment in subsidiary Titagarh Naval Systems and entry into wagon leasing

-

Design & engineering unit to be restructured; uncertainty on ₹112.73 crore investment in Italian associate Firema SpA

-

Supply chain for wagon wheelsets resolved; expect to recover lost production and match FY25 delivery levels

-

Order book robust at ~₹26,000 crore (ex-GST), ensuring strong revenue visibility

-

Management remains focused on growth in passenger segment and international expansion through JVs and product innovation

-

Margins remain steady but profit pressured by lower freight business and ongoing restructuring costs

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹679.3 crore, down 24.8% YoY

-

Net Profit (PAT): ₹30.86 crore, down 54% YoY

-

EBITDA: ₹75.1 crore (margin 11.1%)

-

Wagon dispatches affected by wheelset supply constraints; now resolved

-

Strong order intake: new orders of ₹2,469 crore in Q1; expects production ramp-up in H2 FY26

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.