Titagarh Rail Systems Ltd (Formerly Titagarh Wagons Limited), incorporated in 1997, is mainly engaged in the manufacturing and selling of Freight Wagons, Passenger Coaches, Metro Trains, Train Electricals, Steel Castings, Specialised Equipments & Bridges, Ships, etc. The company caters to both domestic and export markets. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

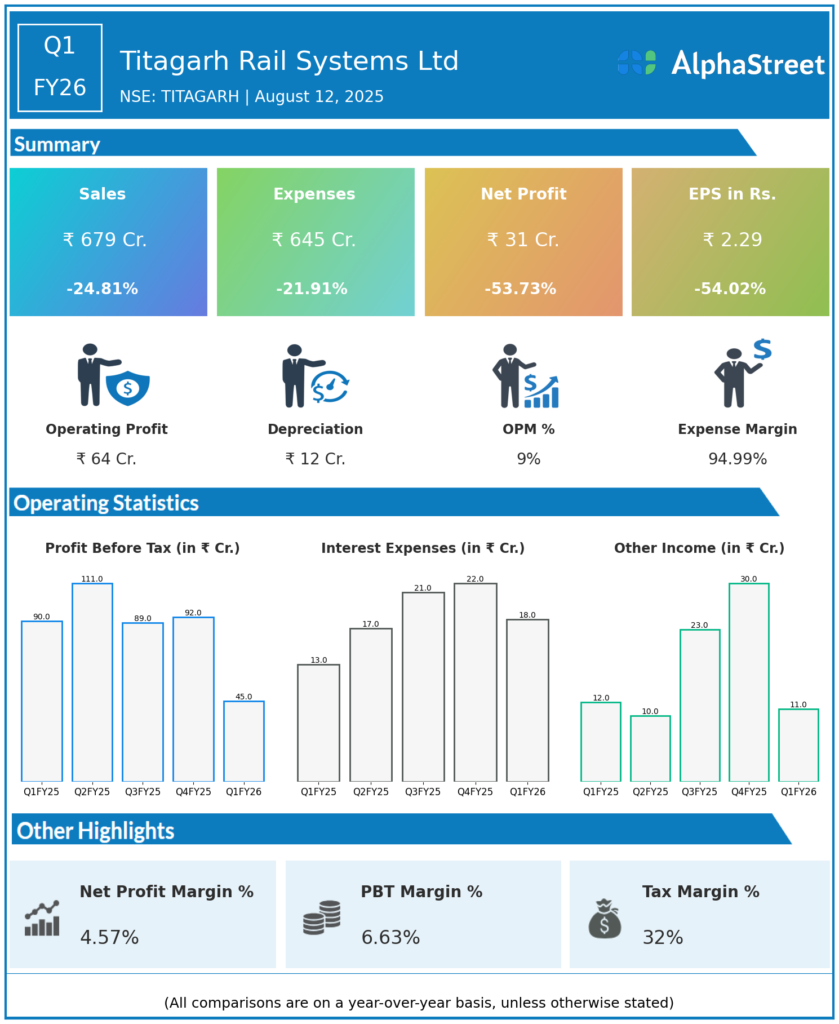

Revenue from Operations: ₹679.3 crore, down 24.8% year-over-year (YoY) from ₹903.05 crore in Q1 FY25.

-

Net Profit (PAT): ₹30.86 crore, sharply down 54% YoY (Q1 FY25: ₹67.01 crore).

-

EBITDA: ₹75.10 crore, down 26% YoY (Q1 FY25: ₹101.83 crore); EBITDA margin at 11.1% vs 11.3% YoY.

-

Wagon Dispatches: Only 1,628 units (vs 2,073 YoY and 2,455 in previous quarter), hit by supply constraints of wheelsets from Rail Wheel Factory, Bangalore.

-

New Order Intake: Booked ₹2,469 crore (including GST), or ~₹2,092 crore excluding GST; overall order book surged to ₹26,000 crore (exc. GST), ensuring strong revenue visibility.

-

EPS: ₹2.29, net profit down sharply by 54%.

-

Management Update: The supply issue for wheelsets has now been resolved. Titagarh expects to recover lost production in balance of FY26 and match FY25 delivery levels (9,431 wagons).

Key Management Commentary & Strategic Highlights

-

Management called the Q1 dip a temporary setback, confirming wheelset supplies have normalized and production will recover in Q2FY26.

-

Despite the drop, Titagarh retained leadership, delivering the highest number of wagons to Indian Railways in Q1.

-

Focus is on:

-

Leveraging the strong ₹26,000 crore order book for growth across wagons, coaches, metro, Vande Bharat, and propulsion.

-

Business restructuring via new subsidiary creation for added flexibility.

-

Expansion plans enabled by large forward pipeline and joint venture orders.

-

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹1,005.57 crore, down 4.45% YoY.

-

Net Profit (PAT): ₹64.45 crore, down 18.6% YoY.

-

Dividend: ₹1/share recommended for FY25.

-

Order Intake: Over ₹1,200 crore (new orders).

-

Production Growth: Up 12.41% YoY during FY25; supply challenges were noted in wheelsets in Q4 as well.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.