Tips Industries Limited, incorporated in 1996, is engaged in the business of Production and Distribution of motion Pictures and acquisition and exploitation of Music of Rights. The company is also a leading producer of Punjabi films in the country.

Q3 FY26 Earnings Results

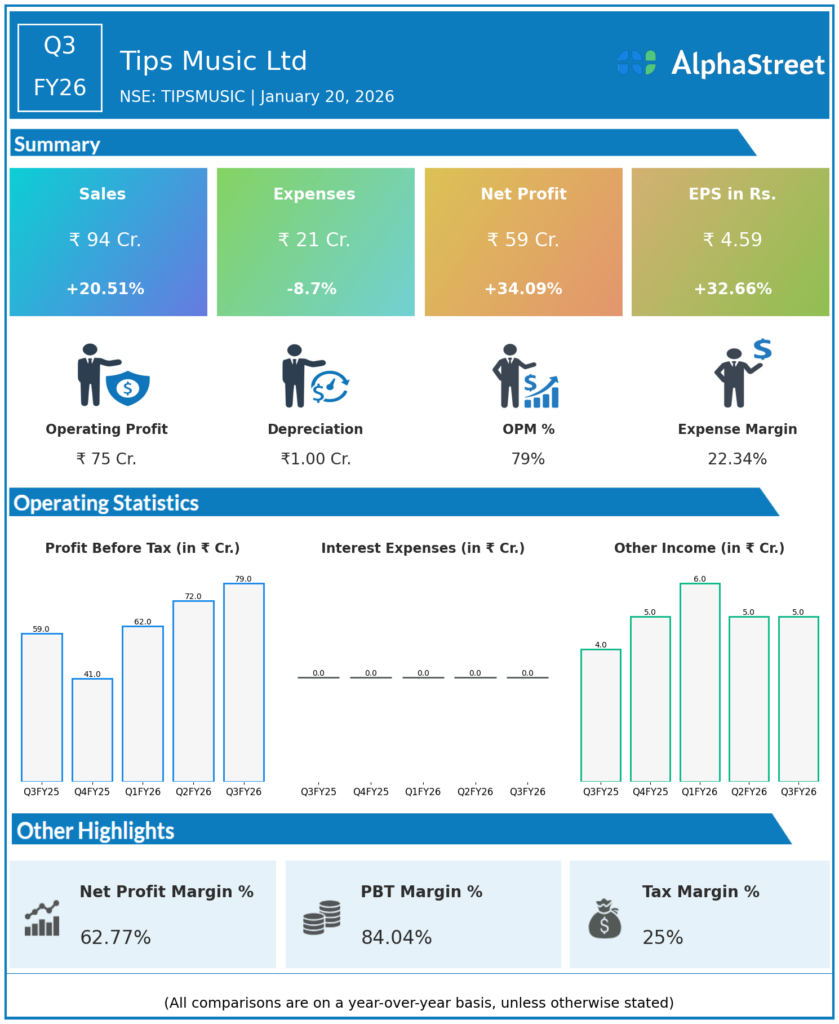

- Revenue from Operations: ₹94.3 crore, up 6.0% QoQ from ₹89.2 crore in Q2 FY26 and up 21% YoY from ₹77.7 crore in Q3 FY25.

- Operating EBITDA: ₹74.5 crore, up 10% QoQ from ₹67.8–67.9 crore and up 34% YoY from ₹55.6 crore; operating EBITDA margin 79.0% vs 76.0% in Q2 FY26 and 71.6% in Q3 FY25.

- Profit After Tax (PAT): ₹58.7 crore, up 10% QoQ from ₹53.2 crore and up 33% YoY from ₹44.2 crore; PAT margin 62.2% vs 59.6% in Q2 FY26 and 56.9% in Q3 FY25.

- Total income (all items): ₹99.09 crore vs ₹81.82 crore in Q3 FY25.

- 9M FY26 performance: Revenue ₹271.6 crore, up 17% YoY; PAT ₹157.7 crore, up 16% YoY.

- Dividend: Interim dividend of ₹5 per share declared for Q3 FY26; total dividend outgo for 9M FY26 at ₹166.18 crore, meeting the stated intent to return 100% of FY25 PAT to shareholders.

Management Commentary & Strategic Decisions – Q3 FY26

- Management commentary highlights that strong double‑digit revenue growth and further margin expansion were driven by higher digital monetisation, strong performance of the music catalogue across streaming platforms, and disciplined cost control, resulting in operating EBITDA margin of 79% and PAT growth of 33% YoY.

- Strategic focus areas reinforced in Q3:

- Continued investment in content – releasing 108 new songs in the quarter and expanding the catalogue, with emphasis on high‑quality, repeat‑consumption music assets.

- Deepening digital distribution and monetisation across YouTube, audio streaming apps and social platforms, leveraging a growing subscriber base (YouTube subs around 145.3 million).

- Maintaining a shareholder‑friendly capital‑return policy via high payout ratios while sustaining growth investments in catalogue acquisition and production.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹89.22 crore, up 11% YoY from ~₹80.35 crore in Q2 FY25; this then grew a further 6% QoQ into ₹94.3 crore in Q3 FY26.

- Operating EBITDA: ₹67.90 crore, up 14% YoY from ~₹59.5 crore; operating EBITDA margin 76% vs ~74% in Q2 FY25.

- Profit After Tax (PAT): ₹53.00 crore, up 11% YoY from ~₹47.7 crore; PAT margin just under 60%.

- H1 FY26 snapshot: Revenue ₹177.30 crore, up 15% YoY; strong profitability maintained on the back of high‑margin digital revenue and a largely fixed‑cost base.

- Songs released: 133 songs in Q2 FY26, with solid traction across YouTube and Meta platforms.

- Dividend: Second interim dividend of ₹4 per share declared in Q2 FY26, contributing to the cumulative 9M FY26 payout.

Management Commentary & Strategic Directions – Q2 FY26

- Management positioned Q2 FY26 as a solid quarter with 11% revenue and PAT growth despite broader industry volatility, driven by consistent streaming income from its catalogue and new releases.

- Strategic themes in Q2:

- Maintaining 20% full‑year revenue‑growth guidance by focusing on “quality over quantity” in content creation and selective catalogue acquisition.

- Leveraging strong digital metrics on YouTube and social platforms to deepen monetisation, while keeping operating costs lean to preserve 70%+ EBITDA margins.

- Continuing high dividend payouts alongside growth investments, signalling confidence in recurring cash‑flow strength.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.