Timken India Ltd is engaged in the manufacturing, distribution and sale of anti-friction bearings, components, accessories and mechanical power transmission products for the customer base across different sectors. It also provided maintenance contracts and refurbishment services and industrial services. It was incorporated in 1987 and is a part of the global Timken Group.

Q2 FY26 Earnings Results:

-

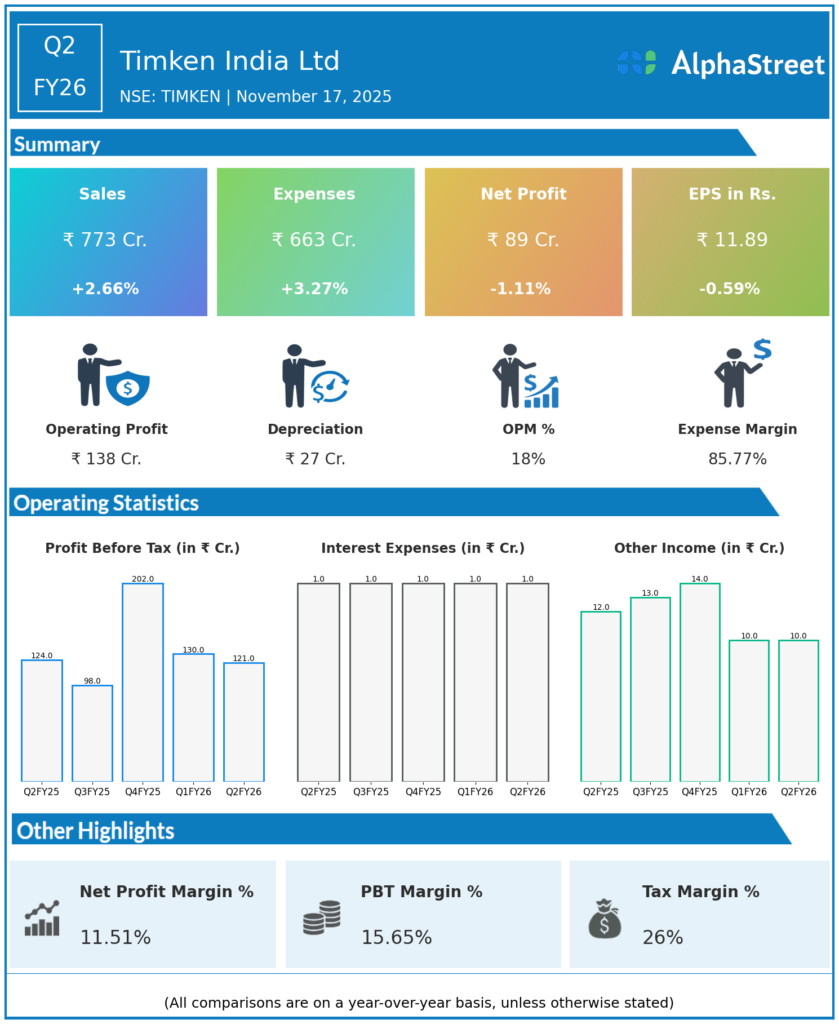

Revenue from Operations: ₹773 crore, up 2.7% YoY from ₹753 crore, but down 4.4% QoQ from ₹809 crore in Q1 FY26

-

EBITDA: ₹138 crore, up 3.8% YoY with EBITDA margin at 17.9% (up 19 bps YoY); sequential margin improvement despite top-line softening

-

Profit After Tax (PAT): ₹89.5 crore, down 0.5% YoY from ₹89.95 crore, and down 14.2% QoQ from ₹104 crore in Q1 FY26

-

PAT margin: 11.6% (down 33 bps YoY, down 1.3pp QoQ)

-

Depreciation: ₹26.6 crore, up 27.8% QoQ due to recent capex coming online

-

Employee costs: ₹43.1 crore, largely flat YoY and QoQ

-

H1 FY26: Revenue ₹1,582 crore (up 3% YoY), Net Profit ₹193.7 crore (down 3.5% YoY)

-

Rail (24%), Mobile (19%), Distribution (18%), Process (18%), Exports (20%) in Q1 FY26 revenue mix

Management Commentary & Strategic Insights

-

Margins resilient on cost control, but significant sequential margin and profit pressure from lower volumes and higher depreciation

-

Demand remains soft in automotive, railways, and general engineering; order pipeline and capex program under focus for medium-term growth

-

Management expects government infrastructure spending and PLI incentives to help over the medium term, but near-term industrial demand visibility remains constrained

-

Increased depreciation reflects ramp-up of new manufacturing capacity, anticipated to contribute to future earnings

-

FII shareholding declined with cautious market sentiment, but company maintains commitment to efficiency and strategic value addition

-

Key risks remain cyclical demand, high valuation, and muted near-term growth

Q1 FY26 Earnings Results

-

Revenue: ₹809 crore, up 3.1% YoY

-

EBITDA: ₹142 crore (margin 17.6%, slightly down from 18% YoY)

-

PAT: ₹104 crore, up 8.3% YoY from ₹96.3 crore

-

EPS: ₹13.86, up from ₹13.03 YoY

-

Bharuch plant’s CRB manufacturing commenced late June 2025

-

Exports faced headwinds due to tariffs and weak North American truck demand

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.