Time Technoplast is a multinational conglomerate involved in the manufacturing of technology and innovation driven polymer & composite products.

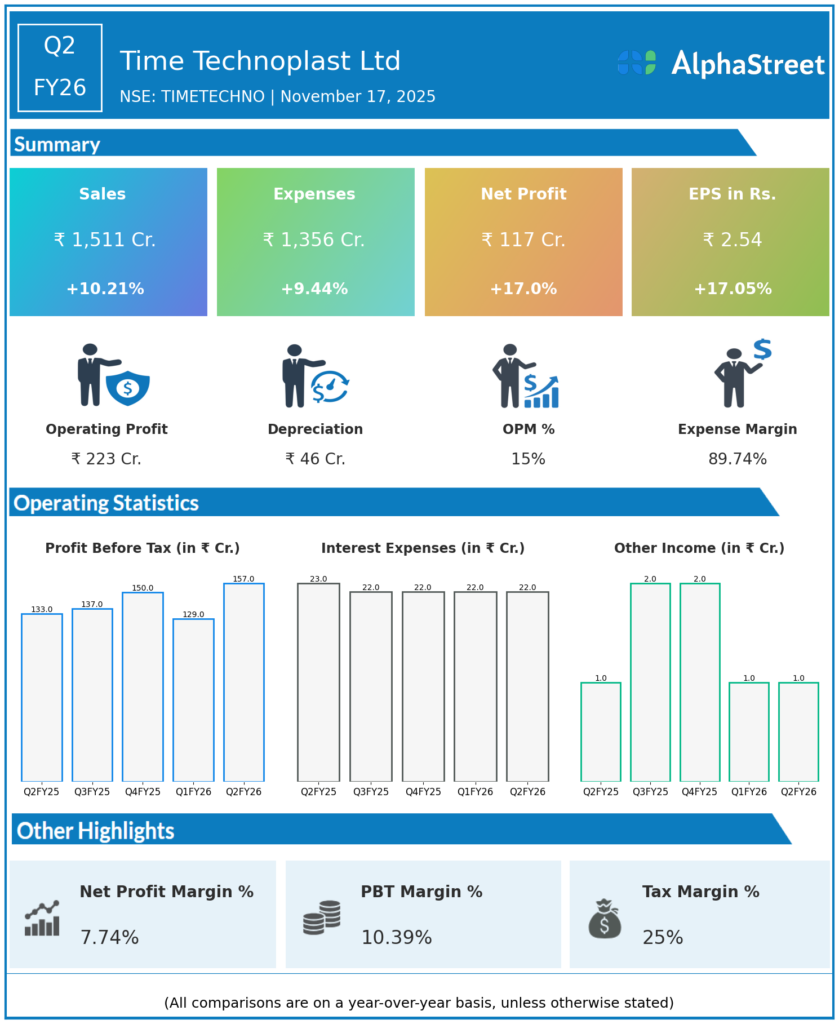

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹1,511 crore, up 10.2% YoY from ₹1,371.5 crore and up 11.7% QoQ from ₹1,353.6 crore in Q1 FY26

-

EBITDA: ₹224 crore, up 13.5% YoY, margin expanded to 14.8% from 14.4% YoY

-

Net Profit (PAT): ₹117.2 crore, up 17.5% YoY from ₹99.8 crore, and up 21.4% QoQ

-

Net profit margin: 7.75%

-

EPS (post bonus issue): ₹2.54 for Q2 FY26

-

Polymer Products segment: Revenue ₹927 crore, up 6.9% YoY, PBIT margin ~10.95%

-

Composite Products segment: Revenue ₹584 crore, up 16% YoY, PBIT margin ~12.93%

-

Balance sheet robust: Debt-to-equity ratio at 0.20

-

Total Assets: ₹4,516 crore; Total Equity: ₹3,117 crore as of Sep 30, 2025

Management Commentary & Strategic Insights

-

MD Bharat Kumar Vageria credited resilience and operational excellence for robust growth in Q2 FY26

-

Polymer and composite segments showed expansion, with strong demand in both domestic and export markets

-

Focus remains on value-added solutions, R&D investment, brand strength, and leveraging international market leadership

-

Healthy balance sheet and prudent leverage provide capacity for further expansion

-

Business outlook positive for H2 FY26, with expectations of continued momentum driven by innovation and efficiency

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹1,353.6 crore, up 10% YoY

-

PAT: ₹96.6 crore, up 20% YoY

-

EBITDA: ₹196 crore, margin improved to ~14.5%

-

EPS: ₹4.20 (pre-bonus), up 20% YoY

-

Margin and profit gains supported by product mix and operational efficiency

-

Q1 marked by steady growth in international markets and scale-up of composite product portfolio.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.