Stock Data

Ticker: TIDEWATER

Exchange : NSE and BSE

Industry: Lubricants

The share price of Tide Water Oil is Rs 1,127.60 as on 26 Aug, 2022, 02:16 PM IST. The price declined by 0.13% based on previous share price of Rs. 1126.1. In last 1 Month, Tide Water Oil share price has increased by 12.90%. The share has reached a high price of Rs 2,049.80 and low price of Rs 975.05 in last 52 Weeks. The shares are trading at a very high P/E of 16.64. The P/B ratio is 2.82.The dividend yield is 4.88%. The debt/Equity ratio stood at zero.

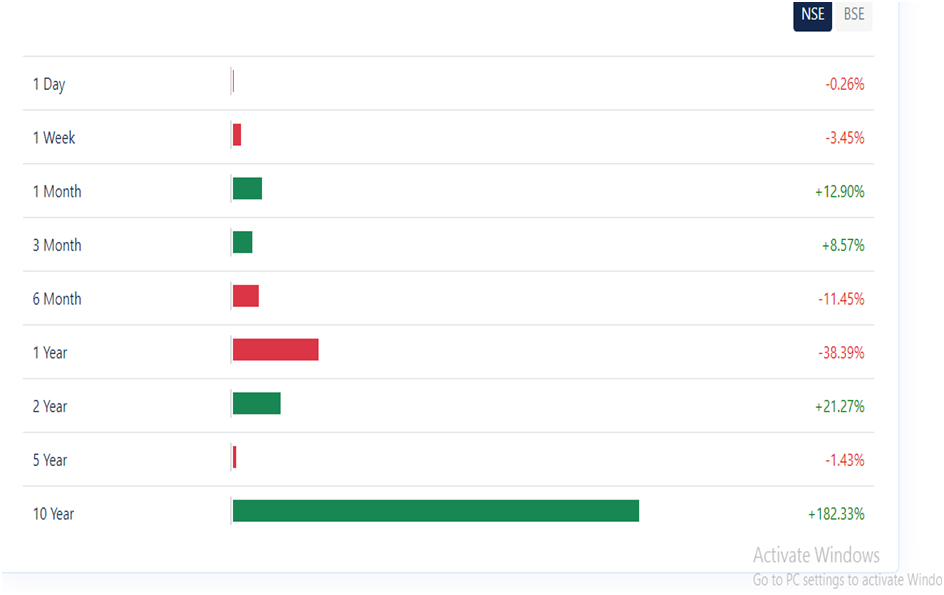

Price Analysis

In last 1 month the share price has increased by 12.90%. It has moved up by 8.57% in last 3 months. The price has declined by 11.45% in last 6 months. In last year there is a decline of 38.39%.

Performance Analysis

In last 1 year, there has been an increase in sales growth by 18.68%. The profit declined by 9.25% The ROE for last 1 year declined to 15.49% compared to 16.19% in last 3 years. The ROCE in 1 year stood at 20.02%. There is a decline in ROCE compared to 21.58% in last 3 years

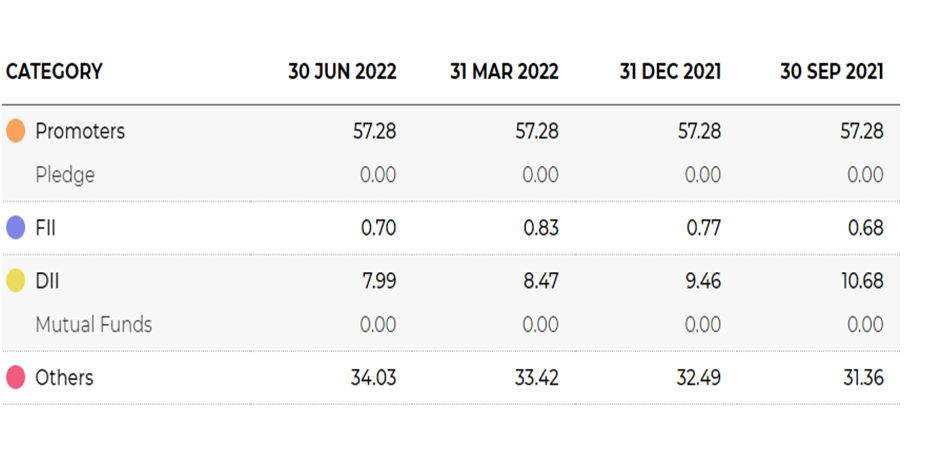

Share holding Pattern

The promoters holding remains static at 57.28%. The promoters have zero pledge. The FII holdings have increased to 0.70 as on 30th June 2022. The DII holding declined to 7.99%. The mutual fund holdings stood at zero. For others the holding is 34.03%.

Financial Snapshots- For the quarter ending on June 2022, the total income of Rs. 442.69 crore. The net profit / (loss) of Rs.33.72 crores. It has reported EPS of Rs.19.84 for the period.

Company Description– Tide Water Oil Co. (India) Ltd., owner of brand Veedol, is a leading manufacturer and marketer of quality lubricants. It has its presence in over 65 countries around the globe. The company has its registered office in Kolkata and regional offices in New Delhi, Mumbai and Chennai. It has an extensive retail distribution network in India that consists of more than 500 direct distributors and dealers servicing over 50,000 retail outlets and workshops.

Presence– The Company has a global presence in Europe, America, MiddleEast, Africa, Asia Pacific & South Asia.

Product Portfolio– The product portfolio includes Industrial Lubricants and Automotive Lubricants and specialties.

Growth Strategies-The major factors which contribute to the growth is demand of lubricants in Commercial Vehicles (CVs), Passenger Vehicles (PVs) and two-wheeler segments. Recently it has been observed that demand increased due to increasing consumer awareness towards utilizing better-quality lubricants.

Industry Analysis– According to different statistics, thelubricants market in India is expected to grow by 809.93 thousand tons from 2021 to 2026. It is expected that the market will progress at a CAGR of 5.58%. The main factor which contributes to the growth is increasing demand. The industry is mainly hindered by fluctuations in crude oil prices. Light-duty vehicles like two-wheelers and passenger cars widely use lubricants in their automobiles.

The Lubricant industry was impacted due to COVID-19. Due to the lockdown during the pandemic period, automobile production was halted and so there was a decline in demand for lubricants in 2020. Industrial lubricants is the largest market segment in India and it holds 54 percent of the total market. Indian industrial lubricants in the automotive and oil & gas sector expects CAGR to grow 7% by 2025.

Inherent Strength– Tide Water Oil India Co Ltd products have strong brand recognition in the Oil & Gas Operations industry. The company has concentrated on product diversification for capturing the market. The company has explored itself in global markets.

Key Risks– The geo political pressure is a big risk to this sector. The company is showing a decline in Net Profit on Q-O-Q basis. The company should focus more in improving the sales growth.

Peer Comparison

| Company | MCAP Cr | P/B | P/E | EPS Rs | ROE % | ROCE % | EV/EBITDA |

| Castrol India | 11,360.07 | 6.33 | 14.04 | 8.18 | 42.58 | 56.78 | 8.5 |

| Gulf Oil Lubricant | 2,261.65 | 2.23 | 9.58 | 48.16 | 24.83 | 25.97 | 5.31 |

| Savita Oil Tech | 2,240.58 | 1.64 | 8.61 | 188.26 | 22.85 | 31.8 | 5.59 |

| Tide Water oil | 1,961.94 | 2.82 | 16.64 | 67.67 | 17.06 | 22.89 | 11.28 |

| Panama Petrochem | 1,872.28 | 2.68 | 10.45 | 29.61 | 28.01 | 38.97 | 7.02 |

| GP Petroleums | 311.00 | 1.18 | 8.85 | 6.89 | 7.84 | 8.17 | 6.67 |

On the basis of the above analysis from an investor perspective Castrol Oil holds the highest Market Cap. Though it has high trading P/E ratio of 14.04 but it gives a huge ROE of 42.58% and ROCE of 56.78%. The company also has a very good EV/EBITDA ratio of 8.5. Tide Water Oil also trade in a very high P/E ratio of 16.64 and the ROE and ROCE is 17.06 and 22.89. The EV/EBITDA is slightly higher.