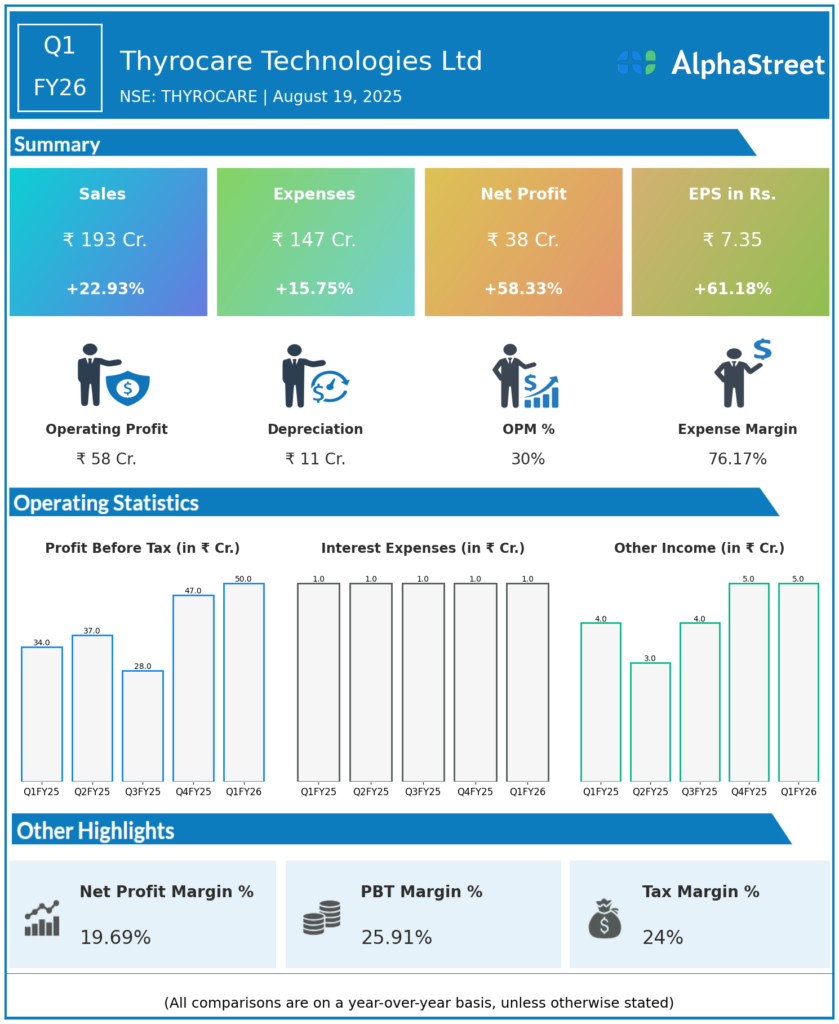

Thyrocare Technologies is engaged in the business of healthcare industry and is involved in providing quality diagnostic services at affordable costs to patients, laboratories and hospitals in India. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹193.03 crore, up 23% year-over-year (YoY) from ₹156.91 crore in Q1 FY25.

-

Pathology Segment Revenue: Grew 25% YoY, with franchise revenue up 20% and partnership revenue up 36%.

-

Radiology Segment Revenue: Increased 6% YoY.

-

Total Test Volume: 46.9 million, up 15% YoY.

-

Gross Margin: ₹137.40 crore, growing 23% YoY, maintaining a margin of 71%.

-

Normalized EBITDA (before ESOP expenses): ₹63.35 crore, up 42% YoY from ₹44.73 crore.

-

Reported EBITDA: ₹57.46 crore, up 37% YoY from ₹42.01 crore.

-

Normalized EBITDA Margin: Improved from 29% to 33%.

-

Reported EBITDA Margin: Rose from 27% to 30%.

-

Profit After Tax (PAT): ₹38.06 crore, up 58% YoY from ₹24 crore, with PAT margin rising from 15% to 20%.

-

EBITDA and PAT growth achieved despite margin pressures from acquisitions and geographic expansions.

Operational Highlights for Q1 FY26 Earnings

-

Expanded physical footprint with new diagnostic laboratories in Bhagalpur, Kashmir, and Roorkee.

-

Active franchise count grew to over 9,500 from 8,145 a year ago, with the company adding around 100 franchisees per month.

-

Achieved 100% NABL accreditation for all labs, the first national lab chain in India to do so.

-

Focus on improving quality; complaints per million reduced from 6.4 to 4, aiming for Six Sigma (less than 3.4 complaints per million).

-

Test menu expansion to around 1,000 tests, including advanced diagnostics in histopathology, HPLC, coagulation, and PCR.

-

Launched new packages like Jaanch (focused on lifestyle diseases) and Her Check.

Management Commentary

-

CEO Rahul Guha highlighted strong operational efficiency, scale-up, and partner-led growth as key drivers.

-

Emphasis on affordable, high-quality diagnostics and expanding accessibility across India.

-

Continued focus on technology, network expansion, and quality to sustain growth.

-

FY26 guidance remains for mid-teen revenue and volume growth.

FY25 Earnings Results

-

Revenue: ₹687.32 crore, up by 20 percent from the last year.

-

Gross Margin: ₹496.25 crore (72%).

-

Normalized EBITDA: ₹209.94 crore (31% margin).

-

Reported EBITDA: ₹189.21 crore (28% margin).

-

PAT: ₹91 crore (13% margin) depicting a growth of 31.8 percent over the last year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.