Recently we have analyzed the volume trend that investors are dumping IEX stock like there’s no tomorrow. Lets dive deeper into this story and figure out and whether that panic actually makes sense.

The Story

Let’s rewind back in time to 2008.

That’s when the Indian government opened up the power exchange market, a platform where electricity could be traded just like shares. The goal was simple, make power buying and selling more efficient.

Here’s how it works:

The electricity lighting up your home doesn’t come directly from NTPC or Tata Power. It’s supplied by a distribution company (discom) that buys electricity from power generators and sends it to your local grid.

To ensure steady supply, discoms sign long-term contracts with generators called Power Purchase Agreements (PPAs). These contracts lock in the price and quantity of electricity for years.

But there’s a catch. If electricity prices fall in the market, discoms still have to pay the higher, fixed PPA price. And if demand suddenly spikes, they might not have enough supply.

That’s why the government launched power exchanges, platforms where buyers and sellers could trade short-term electricity contracts to balance demand and supply.

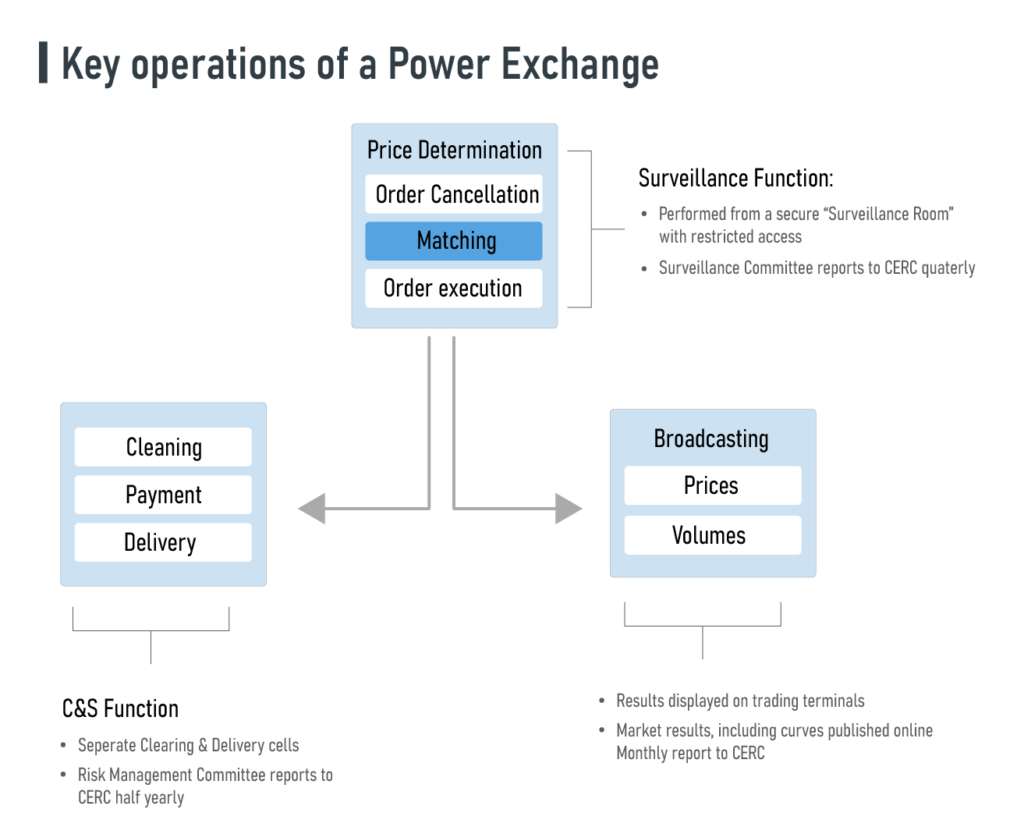

They could buy a day in advance (that’s the Day Ahead Market or DAM) or even a few hours ahead.

The Birth of IEX

Enter the Indian Energy Exchange (IEX), the first such trading platform in the country.

Thanks to its early start and strong network effects, IEX quickly became the go to marketplace for power trading. Buyers and sellers flocked to it, and as more people joined, liquidity improved attracting even more participants.

Even when rivals like PXIL (Power Exchange India Ltd) came later, they couldn’t catch up.

Why?

Because liquidity drives everything. More buyers and sellers on one platform mean better prices and better prices attract more users.

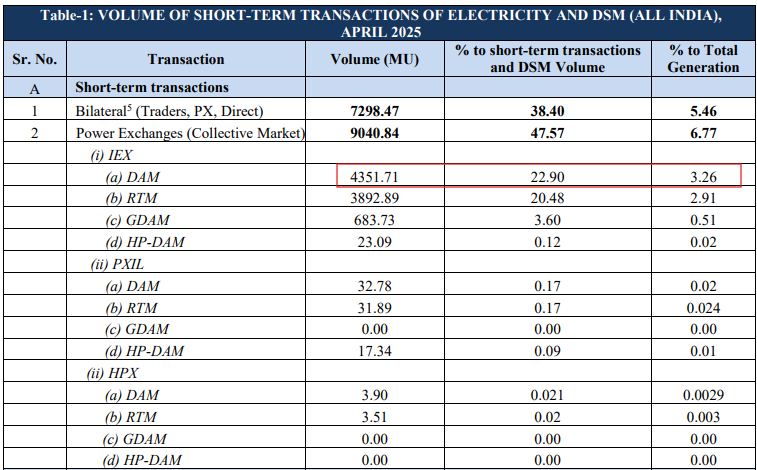

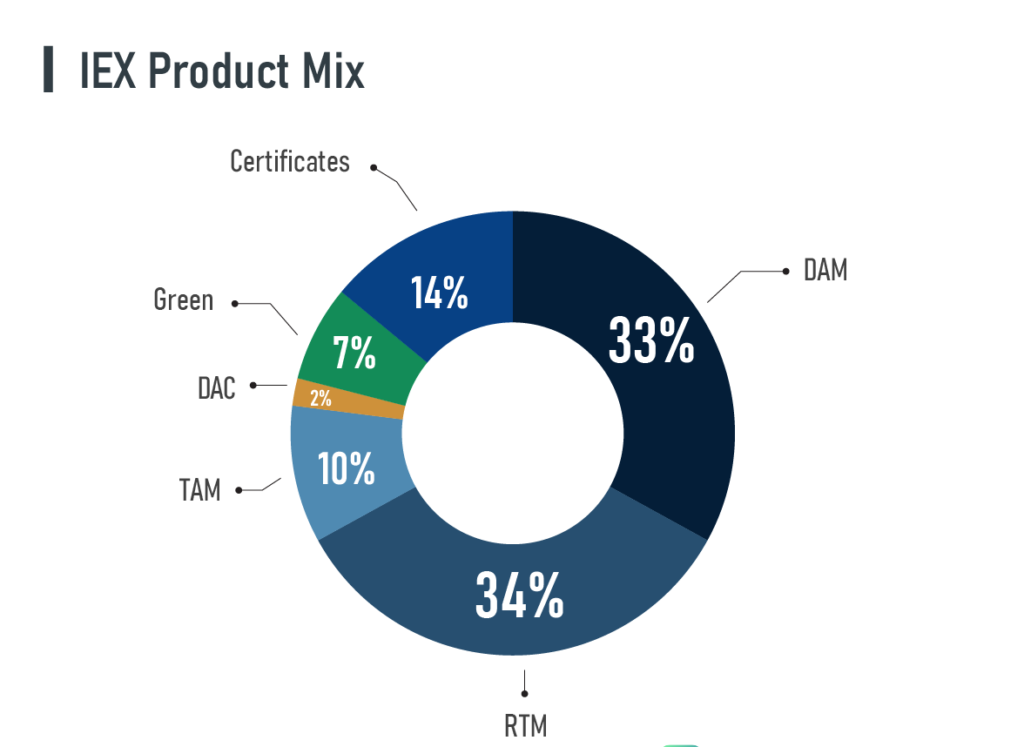

That’s how IEX built its near-monopoly. Today, it still handles around 85% of exchange-based power trading in India. About half its revenue comes from the DAM segment alone.

The Curveball: Market Coupling

But now, IEX’s dominance faces its biggest test.

India’s electricity regulator, CERC (Central Electricity Regulatory Commission), has announced that from January 2026, the DAM segment will shift to a system called market coupling.

What’s that?

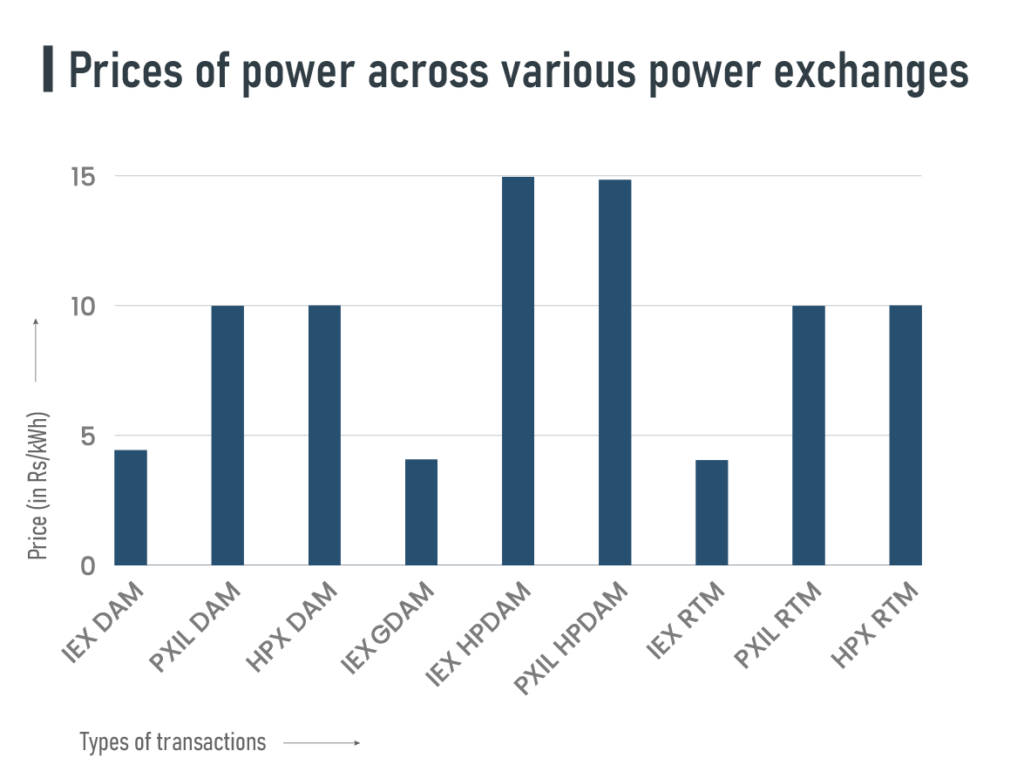

It means a central authority will match all buy and sell orders across every exchange IEX, PXIL, and even the newer Hindustan Power Exchange (HPX). So, if a buyer places an order on IEX, it could get matched with a seller on PXIL. The price would be uniform across exchanges.

In short: IEX loses control over pricing and price discovery, its biggest advantage so far.

Why Investors Are Spooked

You can see why investors panicked.

- Revenue hit: The Day Ahead Market makes up nearly one-third of IEX’s total volumes. If customers start placing orders on rival platforms, those volumes and the transaction fees that come with them could shrink.

- Loss of monopoly: Once prices are the same across exchanges, platforms will compete on fees and features. IEX’s near-monopoly could weaken.

- Pricing power gone: IEX currently charges around 4 paise per unit traded. Even a small cut by PXIL or HPX could hurt its revenue.

With over 121 billion units (BU) traded in FY25, IEX earned about ₹657 crore in revenue, 75% of which came from transaction fees. The model is lean and lucrative, profit margins above 65%, ROE near 40%, and almost zero debt. But with coupling, that edge could erode fast.

Could It Still Be a Win?

Not everyone’s writing IEX off just yet.

Despite the fear, mutual funds and long term investors still hold substantial stakes in IEX. Why? Because the underlying opportunity remains massive.

Only about 7% of India’s total electricity is traded on exchanges today. The government wants to raise that to 25% in five years.

So even if IEX’s share drops, the overall market size could explode, leaving plenty of room for growth.

Also, market coupling doesn’t impact all of IEX’s business segments. Its Real-Time Market (RTM), Term-Ahead Market (TAM), and Green Energy Market are growing fast and aren’t being coupled yet.

In fact, IEX’s Q1 FY26 results showed strong traction, steady profits and 40–50% YoY growth in RTM and green segments.

The Habit Factor

Even if prices are uniform across platforms, switching isn’t always easy.

Think about it like this: You might prefer ordering from Swiggy even if Zomato shows the same price. It’s habit. You know the app, the interface, and the reliability. Similarly, traders who’ve used IEX for years might stick around, unless rivals offer something drastically better.

So yes, the monopoly moat may shrink, but customer stickiness could still hold strong.

The Wildcard: Regulation and Trust

There’s another layer to this story: regulation and perception.

Just before the CERC order, options data showed a sudden spike in put buying on IEX, meaning some traders bet big on a stock fall. And they were right.

Whether that was foresight or insider knowledge, we’ll never know. But it’s a reminder that in regulated sectors, one government circular can change everything overnight. That’s why many investors avoid regulation heavy businesses, too many moving parts outside management’s control.

The Bigger Picture

Despite the noise, IEX isn’t a broken story. It’s a great business facing a maturing industry.

Yes, it might no longer be a monopoly. But as India’s electricity market expands, especially with the push for green power and flexible supply, short term trading will become more important. And IEX, with its first mover advantage, deep liquidity, and trusted platform, will still play a central role.

Market coupling is months away. Implementation may take time even in Europe, the process took nearly a decade. That gives IEX time to adapt, lower fees, improve products, and retain users.

The Bottom Line

IEX has always been a story of network effects, efficiency, and trust. Now, it’s entering a phase of competition, innovation, and change. If you’re an investor, it’s no longer a monopoly play but it’s a bet on execution in a growing but regulated market.

So while the moat may be narrowing, the road ahead is far from closed.

The question is simple? Will IEX reinvent itself for a coupled market or get outpaced by the very competition it once dismissed?

Only time (and a few electricity bills) will tell.