Texmaco Rail & Engineering Ltd is an engineering infrastructure company & part of the Adventz Group, The company is involved in the business of manufacturing Rolling stock, hydro-mechanical equipment, steel castings & construction of Rail EPC, bridges, and other steel structures. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

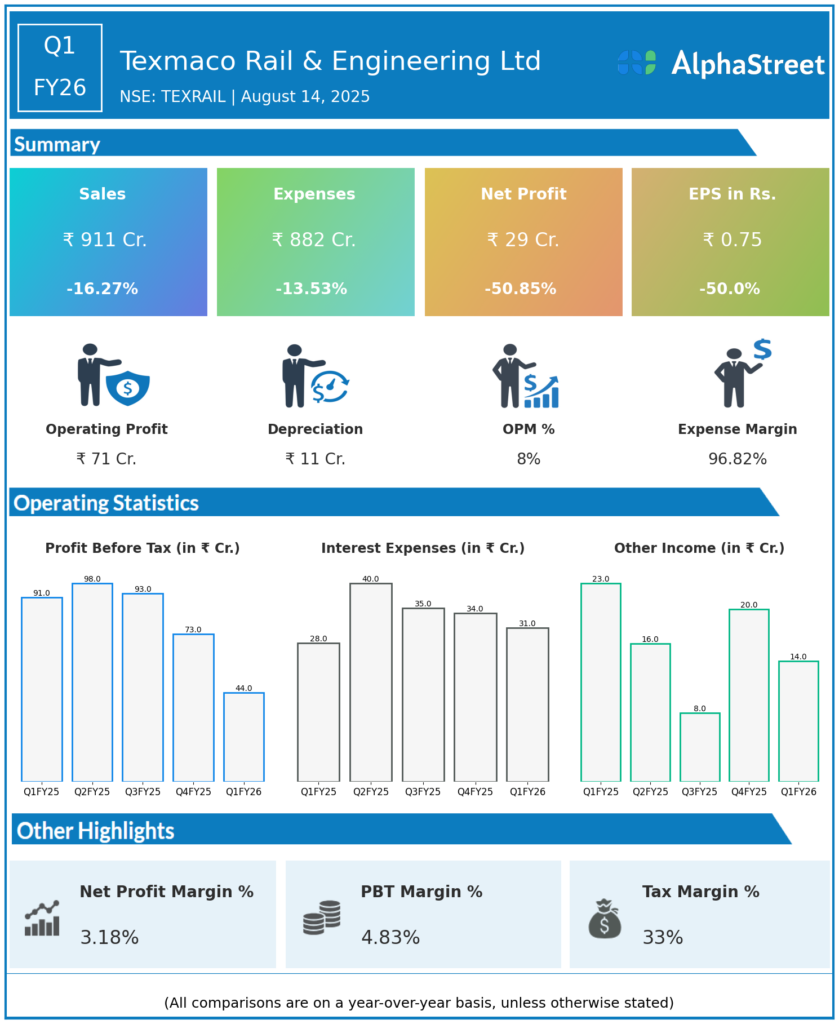

Revenue from Operations: ₹911 crore, down 16% year-over-year (YoY) from ₹1,088 crore in Q1 FY25.

-

EBITDA: ₹79 crore, down 33.7% YoY; margin at 8.7% (previous year: 9.8%).

-

Net Profit (PAT): ₹29 crore, down nearly 51% YoY from ₹59.8 crore; margin at 3.2%.

-

Order Book: ₹7,053 crore as on June 30, 2025, ensuring strong revenue visibility for coming quarters.

-

Freight Cars Delivered: 1,815 units in Q1 FY26.

-

Foundry Division Volumes: 8,667 metric tonnes.

-

Share Performance: Opened ₹137.00, closed ₹137.57 on August 14, 2025, market cap ₹5,520 crore.

Management Commentary & Strategic Highlights

-

Management attributed revenue and profit declines mainly to temporary short supply of wagon wheelsets from Indian Railways, which disrupted production but has since been resolved.

-

Despite this, significant new order inflows from both Indian and international markets strengthened the execution pipeline and reinforced Texmaco’s leadership in the freight rolling stock industry.

-

The company secured large orders for traction transformers, wagon manufacturing, and maintenance contracts, deepening ties with Indian Railways and expanding international presence.

-

Texmaco continues to invest in process improvements and production line upgrades to bolster capacity and meet predicted demand recovery in H2 FY26.

-

The strong closing order book of ₹7,053 crore gives management confidence in achieving targets for the year.

“While Q1 FY26 saw a decline in revenue, primarily due to short supply of wagon wheelsets from Indian Railways, these issues have since been resolved.”

— Indrajit Mookerjee, Executive Director & Vice Chairman

Q4 FY25 Earnings Results

-

Revenue: ₹1,346 Crores, up by 18% over the past year from ₹1,145 Crores during the same period.

-

Net Profit: ₹39, down by 13% on the YoY basis from ₹45 Crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.