Incorporated in 2000,Tejas Networks Ltd designs and manufactures wireline and wireless networking products, with a focus on technology, innovation and R&D. TNL carrier-class products are used by telecom service providers, utilities, governments, and defence networks in 75+ countries. Company is currently a part of Panatone Finvest Limited (a subsidiary of Tata Sons Private Limited). Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

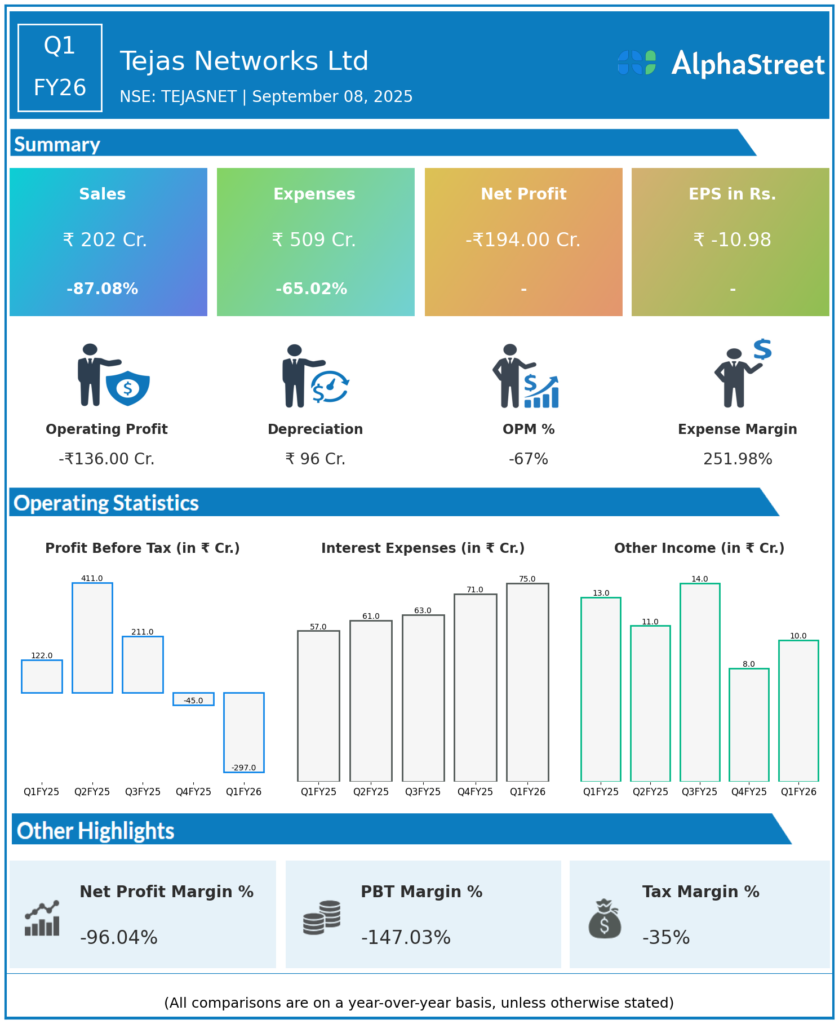

Consolidated Revenue: ₹202 crore, down 87.1% YoY from ₹1,563 crore in Q1 FY25, and down 89% QoQ (Q4 FY25: ₹1,907 crore).

-

EBITDA: Loss of ₹126.6 crore, compared to a positive ₹230 crore in Q1 FY25, with margin contracting from 10.9% to -60%.

-

Profit Before Tax (PBT): Loss of ₹297 crore, down significantly from ₹122 crore profit in Q1 FY25 and loss of ₹45 crore in Q4 FY25.

-

Profit After Tax (PAT): Net loss of ₹194 crore, compared to ₹77 crore profit in Q1 FY25 and loss of ₹72 crore in Q4 FY25.

-

Order Book: ₹1,241 crore with a 22% QoQ growth; the company expects a purchase order worth ₹1,526 crore for BSNL 4G RAN equipment, linked to around 18,685 sites.

-

Gross Margin: Improved to 39.8% in Q1 FY26 from 19% in Q1 FY25; EBITDA margin though deeply negative due to volume drop.

-

Key Business Update: Delay in receipt of key orders, including BSNL 4G expansion, and shipment delays impacted Q1 revenue and profitability.

-

Investments and Partnerships: Signed strategic partnerships with Rakuten Symphony for O-RAN solutions, and with Intel for D2M chipsets; expecting market gains in international and domestic markets.

Key Management Commentary & Strategic Highlights

-

Management emphasized the adverse impact of delayed purchase orders and shipment clearance, but highlighted recent order wins and growing order book as positive signs for coming quarters.

-

CFO Sumit Dhingra noted confidence in future revenue growth supported by BharatNet Phase 3 and private telecom orders, alongside continuous R&D and product development investments.

-

Focus on executing BSNL’s 4G expansion order and scaling up production capacity for GPON, 4G RAN, and packet transport networks.

-

Plans to leverage government PLI schemes and private sector partnerships to strengthen supply chains and market share.

-

Market reacted negatively to Q1 results due to huge revenue contraction and losses; however, management outlook remains cautiously optimistic.

Q4 FY25 Earnings Results

-

Revenue: ₹1,907 crore.

-

PAT: Loss of ₹72 crore.

-

EPS: -₹4.07.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.