Incorporated in 2000,Tejas Networks Ltd designs and manufactures wireline and wireless networking products, with a focus on technology, innovation and R&D. TNL carrier-class products are used by telecom service providers, utilities, governments, and defence networks in 75+ countries. Company is currently a part of Panatone Finvest Limited (a subsidiary of Tata Sons Private Limited). Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

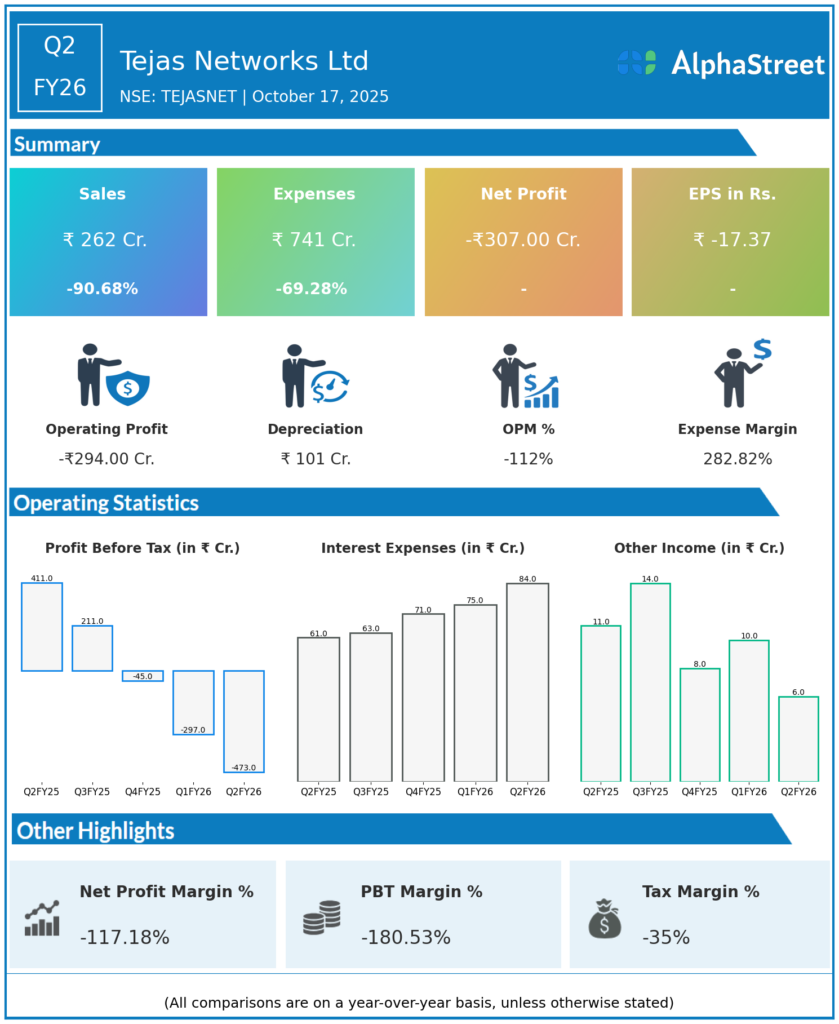

Revenue from Operations: ₹262 crore, up 30% QoQ from ₹202 crore in Q1 FY26, but down sharply YoY from ₹2,811 crore in Q2 FY25.

EBIT: ₹–394 crore, compared to ₹–232 crore in Q1 FY26.

Profit Before Tax (PBT): ₹–473 crore versus ₹–297 crore in Q1 FY26.

Profit After Tax (PAT): ₹–307 crore, widening from ₹–194 crore in Q1 FY26.

EBITDA Margin: Deeply negative due to sizable provisions and manufacturing adjustments.

Inventory: ₹2,383 crore versus ₹2,537 crore in Q1 FY26.

Trade Receivables: ₹4,026 crore, indicating healthy collections of ₹700 crore during the quarter.

Borrowings: ₹4,156 crore as of Q2 FY26, mainly for working capital and capex.

Cash & Equivalents: ₹417 crore.

Order Book: ₹1,204 crore, with India accounting for 93% and international markets 7%.

Adjusting for exceptional items (₹190 crore provisions for inventory obsolescence and warranty), PBT would have been around ₹–284 crore.

Management Commentary & Strategic Updates

-

Wireless Business:

-

Official commencement of BSNL’s nationwide 4G services with 97,500 cell towers running Tejas RAN units.

-

64T64R Massive MIMO radio launched at IMC 2025 by the Minister of Communications.

-

Successfully executed India’s first private 5G RAN deployment under BSNL CNPN in Madhya Pradesh.

-

Conducted a 4G/5G POC in South Asia, and ongoing deals with NEC and Rakuten for international 5G supply agreements.

-

-

Wireline Business:

-

Won BharatNet Phase III orders for IP/MPLS routers; Tejas now supplies the largest number of packages.

-

Rolled out 1.2 Tbps DWDM transmission solution and 400G deployments across India, Europe, and Africa.

-

Completed 10G-CPON deployment in Europe and secured multiple expansion orders from domestic telecoms.

-

-

Other Developments:

-

Appointed Dr. Randhir Thakur (CEO of Tata Electronics, ex-Intel executive) as Non-Executive Director.

-

Filed 39 new patents, bringing the total to 587.

-

Nominated as a finalist in Network X Awards (Paris) for “Most Innovative Optical Transport Use Case.”

-

The company reiterated optimism on long-term trends: AI-led data growth, 5G/6G standardization, and 800G optical advancements are expected to drive sustained international expansion.

Q1 FY26 Earnings Results

Revenue from Operations: ₹202 crore, down 87% YoY from ₹1,563 crore in Q1 FY25, due to delays in major government purchase orders including BSNL 4G expansion.

EBITDA: Loss of ₹126.6 crore compared to positive ₹230 crore in Q1 FY25.

Profit Before Tax (PBT): Loss of ₹297 crore versus profit of ₹122 crore in Q1 FY25.

Profit After Tax (PAT): ₹–194 crore versus ₹77 crore profit YoY.

Gross Margin: 39.8%, up YoY due to higher value mix despite lower volumes.

Order Book: ₹1,241 crore, up 22% QoQ, supporting recovery visibility.

Inventory: ₹2,537 crore; Trade Receivables: ₹4,453 crore; Borrowings: ₹3,990 crore.

Management Commentary (Q1 FY26):

COO Arnob Roy and CFO Sumit Dhingra attributed losses to delayed BSNL orders and shipment bottlenecks but confirmed new contracts for BharatNet Phase III and private 5G deployments. They emphasized the partnership with Rakuten Symphony and Intel for O-RAN and D2M chipset integration as key enablers for export market entry.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.