Tech Mahindra Ltd provides comprehensive range of IT services, including IT enabled service, application development and maintenance, consulting and enterprise business solutions, etc. to a diversified base of corporate customers in a wide range of industries.

Q3 FY26 Earnings Results

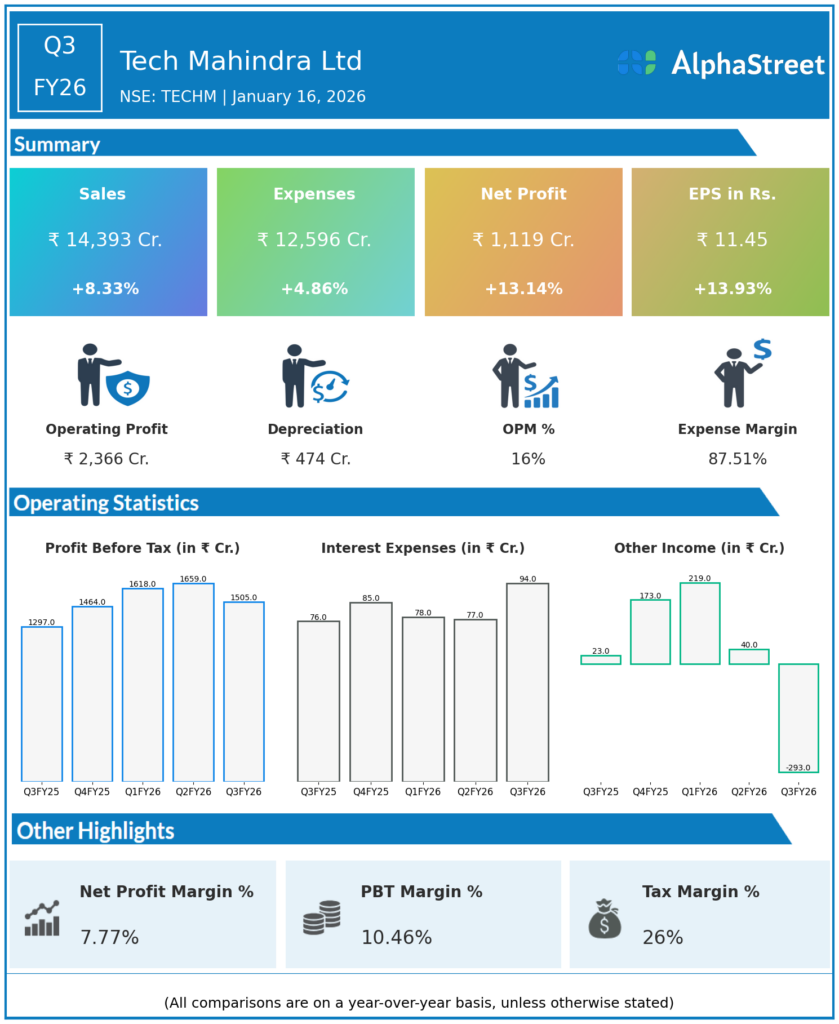

- Revenue from Operations: ₹14,393 crore, up 2.8% QoQ from ₹13,995 crore in Q2 FY26 and up 8.3% YoY from ₹13,286 crore in Q3 FY25.

- EBIT: ₹1,892 crore, up 11.3% QoQ from ₹1,699 crore and up 40.1% YoY from ₹1,351 crore; EBIT margin 13.1%, up ~100 bps QoQ and ~290 bps YoY.

- EBITDA: ₹2,365.6 crore vs ₹2,168.0 crore in Q2 FY26 and ₹1,809.0 crore in Q3 FY25.

- Profit After Tax (PAT): ₹1,122 crore, up 14.1% YoY from ₹983.2 crore; operational PAT (ex‑exceptional items) up ~34% YoY.

- PAT margin: 7.8% (USD basis PAT USD 125 million, margin 7.8%), up ~40 bps YoY; operational PAT margin up ~180 bps YoY.

- EPS (diluted): ₹12.64 per share vs ₹11.1 in Q3 FY25 and ₹13.5 in Q2 FY26.

- New deal wins: USD 1,096 million TCV, up 47% YoY and 34% QoQ; fifth straight quarter with strong net new TCV.

- Cash & other metrics:

- Cash & cash equivalents: ₹7,666 crore at quarter end.

- LTM IT attrition: 12.3%.

- Headcount: 149,616, down 872 YoY.

Management Commentary & Strategic Decisions

- Management termed Q3 FY26 a strong execution quarter with broad‑based revenue growth and sharp profitability improvement, as Project 40s and other transformation initiatives continued to drive operating leverage and margin expansion.

- The company highlighted robust deal momentum with USD 1.096 billion TCV, led by large wins in telecom, enterprise, and engineering services, underlining improving demand and the success of its new go‑to‑market structure.

- Strategic focus areas:

- Scaling AI‑led and cloud‑centric offerings, including its AI platform and AWS Generative AI competency, to deepen enterprise transformation engagements.

- Continuing margin‑improvement journey via pyramid optimisation, SG&A discipline, utilisation gains, and mix shift towards higher‑value services.

- Strengthening balance sheet and maintaining healthy cash generation while selectively investing in growth, talent and capabilities aligned with the three‑year transformation plan into FY27.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹13,995 crore, up 4.8% QoQ from ~₹13,354 crore in Q1 FY26 and up 5.1% YoY from ₹13,316 crore in Q2 FY25.

- Revenue (USD): USD 1,586 million, up 1.4% QoQ; down 0.2% YoY in reported terms; in constant currency, up 1.6% QoQ and down 0.3% YoY.

- EBIT: ₹1,699 crore, up 15.0% QoQ and 32.7% YoY; EBIT margin 12.1%, up 108 bps QoQ and 254 bps YoY.

- Profit After Tax (PAT): ₹1,194 crore, up 4.7–4.8% QoQ and strongly up YoY; PAT margin 8.5%, flat QoQ and higher YoY.

- Free cash flow: USD 237 million for the quarter.

- New deal wins: USD 816 million TCV, up 35–57% YoY, with broad‑based wins across telecom, logistics, European telcos, semicon equipment and APAC insurance.

Management Commentary & Strategic Directions

- Management described Q2 FY26 as the best revenue growth quarter in the last 10 quarters, reflecting visible benefits from the ongoing three‑year transformation, productivity gains and improved execution.

- Margin expansion was driven by operating leverage, cost optimisation and mix, even as the company continued to invest in AI platforms, key accounts and talent.

- Strategic themes:

- Advancing the “Project 40s” margin‑recovery program while pushing AI leadership and strengthening key accounts to drive larger, more profitable deals.

- Focusing on multi‑year, high‑value deals in telecom, engineering, and enterprise digital transformation, supported by the new organisational structure.

- Staying on track with the FY27 transformation target, balancing near‑term profitability improvement with long‑term capability building.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.