Tata Consultancy Services (TCS) reported its Q3 FY26 earnings, showcasing revenue growth amid a net profit decline driven by exceptional items. The results highlight the company’s focus on AI services and operational stability in a cautious IT spending environment.

Company Overview

TCS, founded in 1968 as part of the Tata Group, stands as India’s largest IT services firm and a global leader in consulting, digital transformation, and software services. It operates across key segments like Banking, Financial Services and Insurance (BFSI), Consumer Business, and Technology, serving over 1,000 clients worldwide with a strong presence in North America, Europe, and India. Presenting below are its Q3 FY26 earnings results.

Q3 FY26 Earnings Highlights

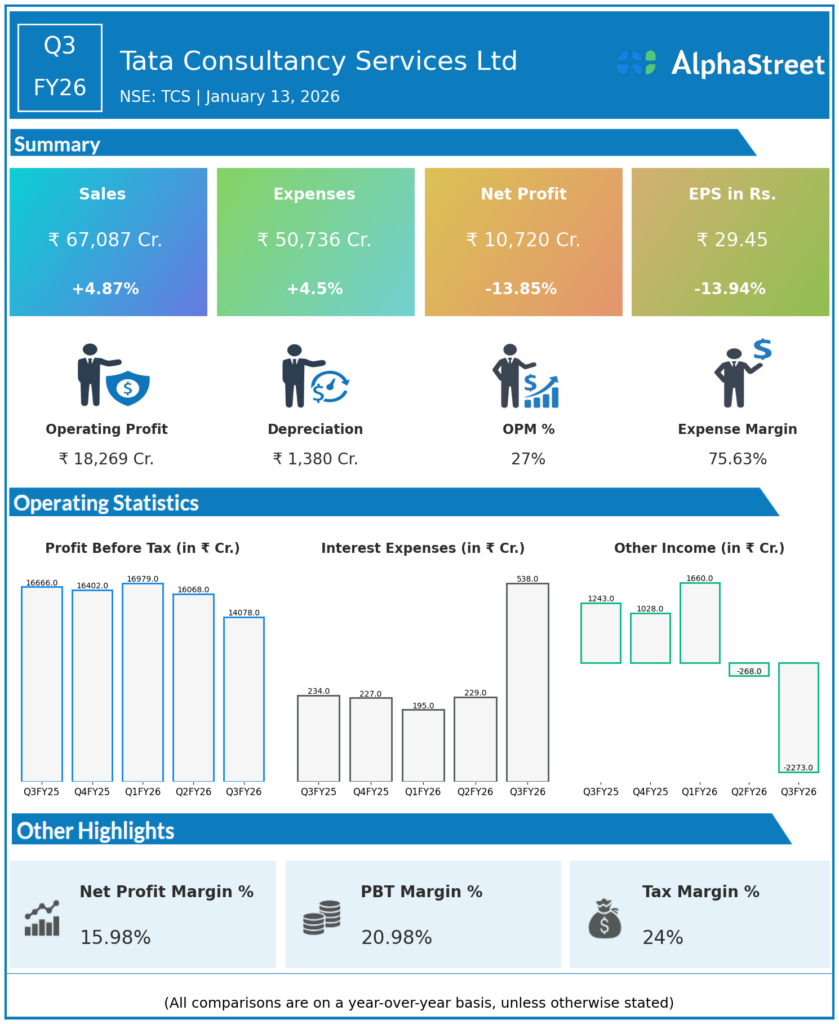

TCS recorded consolidated revenue from operations of ₹67,087 crore in Q3 FY26, marking a 4.87% YoY increase from ₹63,973 crore and a sequential rise from Q2 FY26’s ₹65,799 crore. Net profit (PAT) fell 13.92% YoY to ₹10,657 crore from ₹12,380 crore, primarily due to exceptional charges totaling around ₹4,480 crore related to workforce restructuring (₹1,010 crore US legal provision, ₹2,128 crore labour code impact); excluding these, adjusted PAT rose 8.5% YoY to ₹13,438 crore. EBITDA stood firm with an operating margin of 25.2%, stable QoQ, supported by efficient cost management despite wage pressures.

- Total expenses increased due to key drivers like employee costs and the one-off statutory provisions under new labour codes, affecting gratuity and compensated absences.

- EPS details were not explicitly broken out in filings, but net income aligns with diluted figures around basic levels given the profit base.

- Net debt remained low, with strong cash flows from operations at 130.4% of net income, bolstering a robust balance sheet.

Segment Performance

BFSI Segment

The BFSI segment, TCS’s largest revenue contributor, showed resilience with modest growth amid banking sector caution on tech spends. Revenue trends indicated stability, though specific Q3 figures highlighted softer demand; management noted ongoing deals in core banking modernization. Margins held steady, benefiting from prior optimizations, but faced headwinds from regulatory compliance costs.

Consumer Business and Manufacturing

Consumer business saw mixed results, with retail and manufacturing facing supply chain normalization post-inflation peaks. Operational metrics pointed to volume recovery in digital commerce projects, contributing to overall topline expansion. EBITDA margins improved slightly on cost controls, though raw material-linked services felt commodity volatility indirectly.

Technology and Communication

Technology segment delivered stronger performance, up around 2.8% in prior quarters extending into Q3, driven by cloud migrations. Key metrics included higher deal wins in software-defined infrastructure, with tailwinds from 5G rollouts in communication services. Challenges included talent attrition in niche skills, offset by TCS’s AI upskilling initiatives.

Regional Markets and Others

Regional markets and emerging segments grew 4.6% QoQ in constant currency, fueling overall 0.8% CC growth. This diversification cushioned North America’s flatness (down 0.1% prior), with APAC up 2% on India-centric deals. Metrics like $20M+ clients rose to 310, signaling deepening engagements.

Management Commentary

CEO K Krithivasan emphasized sustained momentum from Q2, with AI services hitting $1.8 billion annualized revenue, up 17.3% QoQ in CC terms. He highlighted a five-pillar AI strategy spanning infrastructure to intelligence, driving client value in cloud and cybersecurity. On costs, management attributed margin stability to workforce efficiency post-restructuring, while noting labour code implementations as one-offs.

Strategic updates included $9.3 billion TCV bookings, with focus on large deals in enterprise AI transformation. Capex remained geared toward AI infrastructure, with no major shifts announced. Demand trends pointed to cautious North America but optimism in Europe and ‘Rest of World’.

Industry Context

The Indian IT sector navigated soft global demand in Q3 FY26, with US election uncertainties and high interest rates curbing enterprise spends. Macro factors like moderating inflation aided supply chains, but regulatory shifts via India’s labour codes added compliance burdens across firms. Globally, AI investments surged, positioning TCS favorably against peers amid digital pivot.

Outlook

Management expressed confidence in AI-led growth continuing into FY27, prioritizing deal conversions and talent readiness. Key focus areas include expanding AI stack capabilities and geographic diversification beyond North America. Risks highlighted encompass geopolitical tensions and slower decision-making by clients, with no numeric guidance provided.

Q2 FY26 Recap

In Q2 FY26, TCS achieved revenue of ₹65,799 crore, up 2.4% YoY and 3.7% QoQ, with constant currency growth at 0.8%. Net profit stood at ₹12,075 crore, a 1.4% YoY rise but 5.4% QoQ dip, alongside 25.2% operating margins (up 70 bps QoQ). Highlights featured $10 billion TCV and BFSI/Technology growth, setting a steady base.

TCS’s Q3 FY26 results underscore operational resilience amid one-offs, with investors eyeing earnings call transcripts for deeper insights into AI traction and demand recovery. Upcoming quarters will test sustained momentum in a dynamic IT landscape.

To view its previous earnings, please visit: Click Here