Incorporated in 1994, Tata Technologies Limited is a global engineering services company offering Product Development and Digital Solutions.

Q3 FY26 Earnings Results

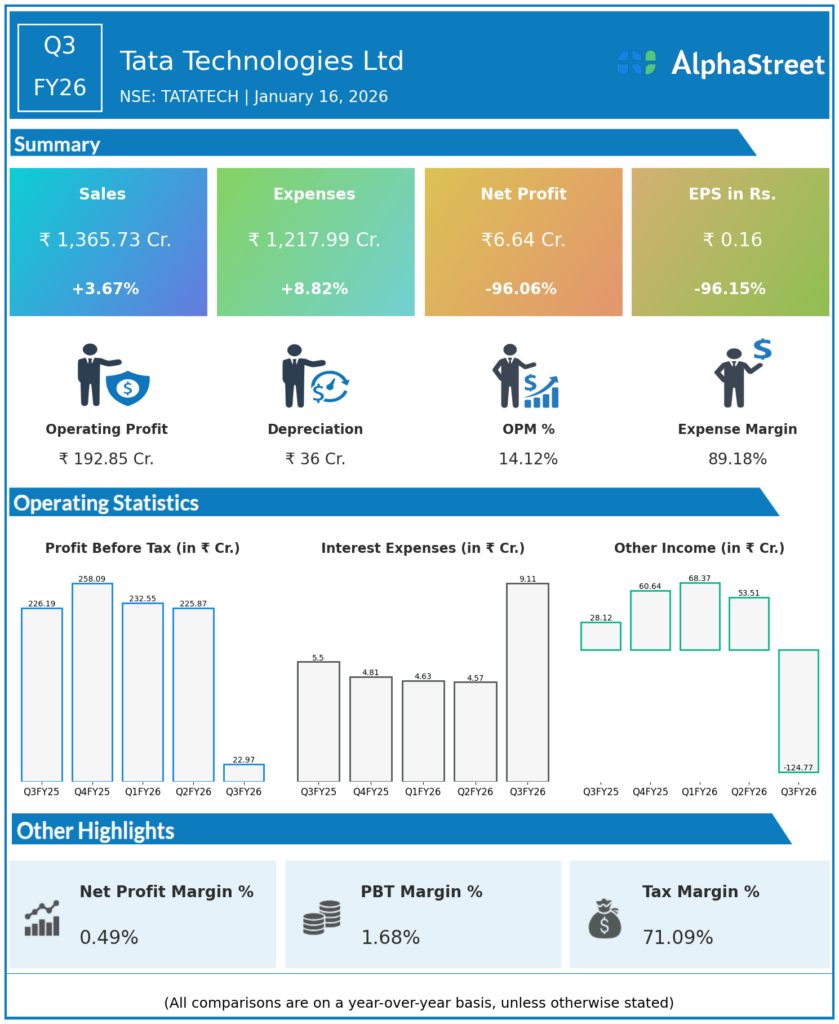

- Revenue from Operations: ₹13,657 million, up 3.2% QoQ from ₹13,233 million in Q2 FY26 and up 3.7% YoY from ₹13,174 million in Q3 FY25.

- Services Segment Revenue: ₹10,602 million, up 4.7% QoQ; now 78% of total operating revenue.

- Operating EBITDA: ₹1,929 million (reported range in sources); core figure widely cited at ₹1,929 million, with EBITDA margin 14.1%, down from 15.7% in Q2 FY26 and 17.8% in Q3 FY25.

- EBIT: ₹1,724 million; EBIT margin 12.6%, vs 14.4% in Q2 FY26 and 16.1% in Q3 FY25, indicating continued margin compression.

- Net Income (underlying, ex‑exceptional): ₹1,350 million, net income margin 9.9% vs 12.5% in Q2 FY26 and 12.8% in Q3 FY25.

- Reported Profit After Tax (PAT): ₹6.64 crore (₹66.4 million), down ~96% YoY from ₹168.6 crore and ~96% QoQ from ₹165.5 crore due to a one‑time labour‑code exceptional charge of about ₹140 crore (₹1.4 billion).

- 9M FY26 snapshot:

- Sales: ₹39,333.5 million vs ₹38,828 million in 9M FY25.

- Revenue: ₹40,769.4 million vs ₹39,498.5 million.

- Net income: ₹3,424.2 million vs ₹4,880.8 million; EPS ₹8.43 vs ₹12.03, reflecting the impact of Q3 exceptional charges.

Management Commentary & Strategic Decisions

- Management characterised Q3 as a mixed quarter: revenue grew QoQ and YoY, led by the services segment, but margins contracted and reported profit collapsed due to the statutory impact of India’s new labour codes and related one‑time provisions.

- The CEO flagged that, excluding the labour‑code exceptional item, profit before tax was ~₹137 crore and net income margin was around 9.9%, indicating that underlying business profitability remains intact though under margin pressure.

- Strategic updates:

- Acquisition: Completed 100% acquisition of Germany’s Es‑Tee Group via the Singapore subsidiary, strengthening high‑end automotive engineering, especially ADAS, connected driving and digital engineering; fixed consideration €51.4 million (₹532.3 crore) plus up to €14.6 million (₹151.8 crore) earn‑out.

- Vertical & deal traction: Six strategic deal wins in Q3 across automotive, aerospace and industrials, supporting a strong pipeline and management guidance of >10% sequential revenue growth in Q4 FY26.

- Margin outlook: CFO indicated Q3 margin headwinds from labour‑code impact and acquisition‑related costs are largely behind the company, with an expectation to return to and exceed the Q2 adjusted margin run‑rate in coming quarters.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹13,233.3 million, up ~2.0% YoY from ₹12,964.5 million in Q2 FY25 and up ~6.4% QoQ from ~₹12,436–12,440 million in Q1 FY26.

- Operating EBITDA: ₹2,078 million, down 11.8% YoY from ₹2,355 million; EBITDA margin 15.7% vs 18.2% in Q2 FY25, reflecting pricing/mix and cost pressures.

- EBIT (Operating Profit): ₹1,890 million, up 4.6% sequentially with normalised EBIT margin around 14.4%; adjusted EBITDA margin around 16.4% after excluding a one‑time consulting expense >₹10 crore.

- Profit After Tax (PAT): ₹165.5 crore, up just over 5% YoY from ₹157.4 crore, but down ~3% QoQ from ₹170.3 crore in Q1 FY26.

- Expenses: ₹1,150.97 crore, up 5% YoY, outpacing revenue growth and weighing on margins.

- People metrics: LTM attrition 15.1%; workforce 12,402 employees at quarter end.

Management Commentary & Strategic Directions

- Management described Q2 FY26 as a quarter of resilience and positive momentum, with a return to growth, stable margins on an adjusted basis, and progress on innovation and geographic diversification (notably Europe).

- The CEO noted strong progress on strategic priorities: advancing the innovation agenda, strengthening partnerships and talent, and building a robust pipeline to support a solid rebound in Q4 despite expected “short‑term tactical challenges” in Q3.

- CFO commentary stressed financial resilience and operational discipline: stable adjusted margins despite macro headwinds, a healthy balance sheet enabling continued investments, and a cautious but confident stance on navigating near‑term demand softness while targeting sustainable value creation in H2 FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.