Incorporated in 1994, Tata Technologies Limited is a global engineering services company offering Product Development and Digital Solutions. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

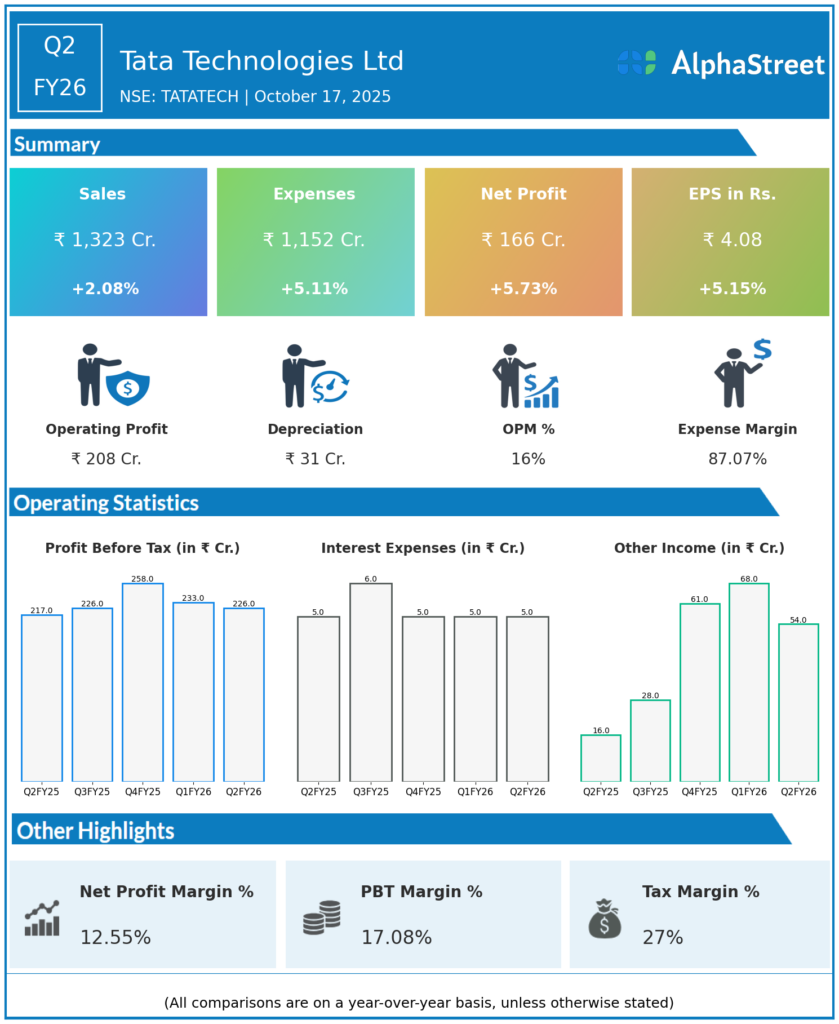

Revenue from Operations: ₹1,323.33 crore, up 2.1% YoY from ₹1,296.45 crore in Q2 FY25.

EBITDA: ₹207.8 crore, down 11.7% YoY from ₹235.4 crore.

EBITDA Margin: 15.7%, compared to 18.1% in Q2 FY25.

Profit Before Tax (PBT): ₹224.3 crore, up 4.5% YoY from ₹214.5 crore.

Profit After Tax (PAT): ₹165.5 crore, up 5.1% YoY from ₹157.4 crore, though down 2.8% QoQ from ₹170.3 crore in Q1 FY26.

PAT Margin: 12.5%, compared to 12.1% YoY.

Expenses: ₹1,150.97 crore, up 5% YoY.

Services Segment: Contributed ₹1,012.8 crore (77% of total revenue).

Technology Solutions Segment: Contributed ₹310.5 crore (23% of total revenue), up 6.6% YoY.

Attrition (LTM): 15.1%.

Employee Strength: 12,402 as of September 30, 2025.

Management Commentary & Strategic Decisions

CEO Warren Harris stated:

“Q2 FY26 was a quarter of steady progress and resilience. We achieved a return to growth, maintained margin discipline, and strengthened our strategic position in Europe. As we move into H2 FY26, we do so with a resilient foundation, robust pipeline, and focus on accelerating sustainable, technology-led growth.”

Key strategic highlights:

-

Continued growth from non-automotive verticals (aerospace and industrial machinery), offsetting automotive softness.

-

Strengthened client relationships with Jaguar Land Rover and Tata Motors; management confirmed both have reaffirmed product innovation commitments.

-

Entered advanced discussions to acquire Es-Tee GmbH (Germany) for €75 million to enhance automotive engineering capabilities and expand its European base.

-

Continued investments in digital engineering, simulation-led design, and manufacturing digitalization platforms.

-

Emphasized operational discipline and workforce engagement to navigate macro headwinds.

CFO Savitha Balachandran added:

“Margins remained stable despite macroeconomic volatility. We continue to invest in innovation and maintain financial strength. While near-term demand may remain soft, a rebound is expected in Q4 FY26 as key programs scale up.”.

Q1 FY26 Earnings Results

Revenue from Operations: ₹1,244.3 crore, down 1.9% YoY from ₹1,269 crore and down 3.2% QoQ.

EBITDA: ₹200.1 crore, with an EBITDA margin of 16.1%.

Profit After Tax (PAT): ₹170.28 crore, up 5.1% YoY from ₹162.03 crore, but down 9.9% QoQ from ₹188.9 crore in Q4 FY25.

Net Income Margin: 13.7%, compared to 12.8% YoY.

Service Revenue: ₹963.7 crore, down 3.2% QoQ.

Attrition Rate: 13.8% versus 13.2% in Q4 FY25.

Employee Strength: 12,407.

CEO Warren Harris commented that Q1 began cautiously due to client hesitation following tariff announcements but recovered through the quarter, backed by six strategic deal wins across auto and aerospace sectors.

CFO Savitha Balachandran highlighted strong cash flows and disciplined working capital management, with continued investments in digital solutions for EVs and sustainability platforms.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.