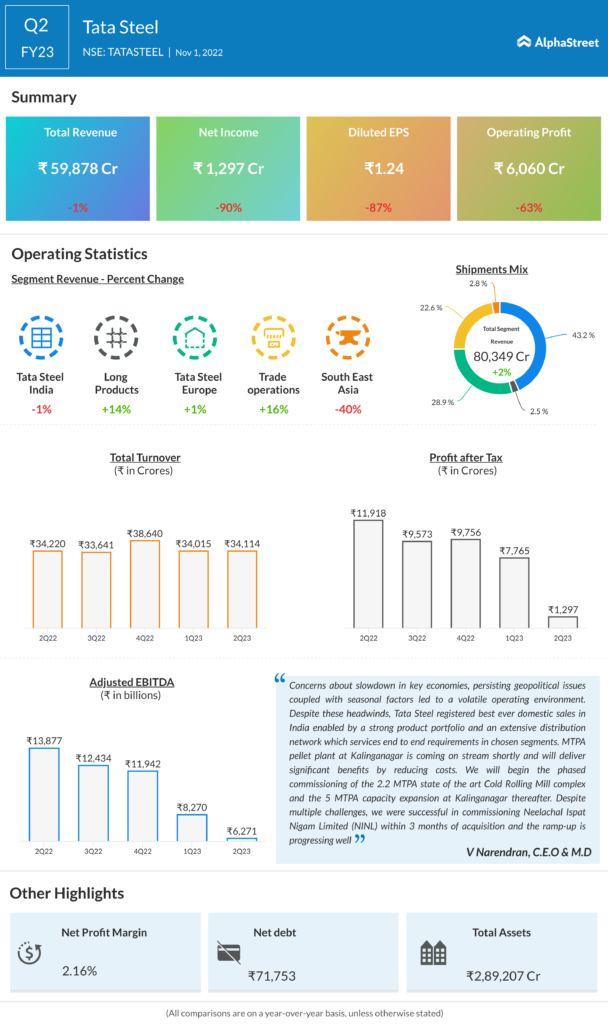

Tata Steel reported a consolidated net profit at INR 1,297 crore in July to September quarter (Q2FY23), down by 90 per cent, on the back of declining margins. In the year-ago period, net profit was at INR 12,548 crore. Revenues from operations at INR 59,877.52 crore was marginally down by a percent from INR 60,387.13 crore in the year-ago period. Sequentially, revenues were down 5.6 per cent and net profit by 80.49 per cent.

Deliveries from Europe operations were lower on QoQ basis, in part due to seasonal factors and subdued demand in Europe. Turnover was £2,307 million and EBITDA was £199 million, which translates to an EBITDA of £106 per tonne.

Gross debt in the September quarter stood at INR 87,516 crore compared with INR 82,597 crore in the June quarter.

Koushik Chatterjee, executive director and chief financial officer, Tata Steel, said the quarter saw bunching of several large cash payouts, including the highest-ever dividend payout relating to financial year 2021-2022, the acquisition of NINL, an accelerated capex driven by the need to complete the Tata Steel Kalinganagar Phase II”. However, while gross debt increased, Chatterjee said the financial metrics continued to be well within the investment grade level. He said the company would work towards reducing it by the year-end. The Tata Steel management is expecting gradual improvement in the second half.