Tata Steel Ltd is Asia’s first integrated private steel company setup in 1907. The company has presence across the entire value chain of steel manufacturing from mining and processing iron ore and coal to producing and distributing finished products. The company has a target to increase domestic steelmaking capacity to 30 MnTPA by 2025.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

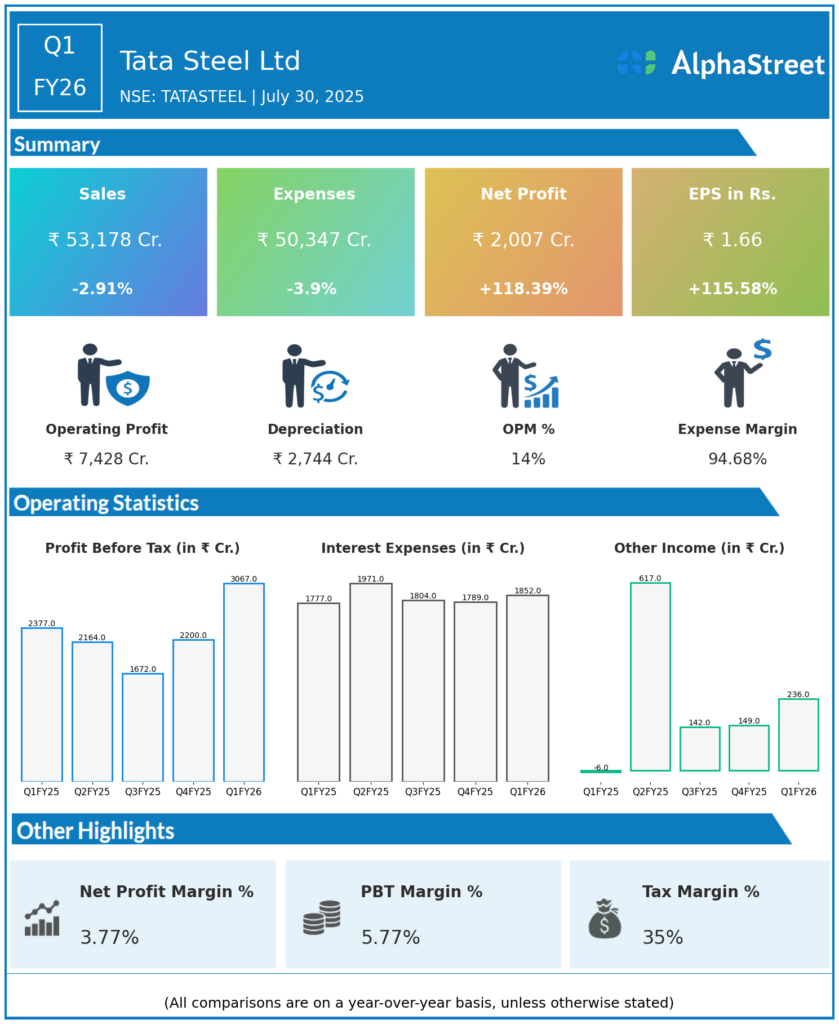

Consolidated Net Profit (PAT): ₹2,007 crore, a sharp increase of 118% year-over-year (YoY) from ₹960 crore in Q1 FY25.

-

Revenue from Operations: ₹53,178 crore, down 3% YoY from ₹54,771 crore in the year-ago period (nearly flat).

-

EBITDA: Tata Steel India business delivered an EBITDA of ₹7,486 crore with an EBITDA margin of 24%.

-

EBITDA per Ton: Improved to ₹15,760 per ton, up by ₹2,510 from the previous quarter.

-

Steel Production in India: 5.24 million tons.

-

Steel Deliveries in India: 4.75 million tons (down from 4.94 million tons in Q1 FY25).

-

Operational Impact: Production and deliveries were temporarily impacted due to maintenance shutdowns at Jamshedpur and Neelachal Ispat Nigam Limited (NINL) plants, but normal operations are expected to resume in coming quarters.

-

Acquisitions: Tata Steel acquired 100% equity stake in Neelachal Ispat Nigam on July 24, 2025 — NINL generated an EBITDA of ₹224 crore in Q1.

-

Investment: Approved acquisition of 26% equity stake in TP Adarsh Ltd (a solar power venture by Tata Power Renewable Energy) aiming to reduce power costs and carbon footprint, with up to ₹6 crore investment planned.

-

Net Debt: ₹84,835 crore as of June 30, 2025.

-

Liquidity: Strong liquidity position with ₹43,578 crore including ₹14,118 crore in cash and cash equivalents.

Key Management Commentary & Strategic Highlights

-

Tata Steel’s India operations drove strong profitability despite challenges in European operations.

-

Focus on operational efficiency and cost control led to better EBITDA per ton.

-

Integration of NINL will strengthen raw material security and improve operational scale.

-

Investment in renewable energy (TP Adarsh) is part of Tata Steel’s sustainability and carbon reduction strategy.

-

Management expects normalized production and deliveries post maintenance shutdowns in upcoming quarters.

-

The company maintains a strong liquidity position and continues to manage net debt prudently.

-

Overall outlook remains positive on India business growth and cost discipline despite muted revenue.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

The Q4 FY25 revenue was approximately ₹56,218 crore, down by 4% on YOY basis

-

Profit for Q4 FY25 was ₹1,201 crores, up by 116% on the YOY basis.

-

The quarter supported Tata Steel’s strong annual results with solid production and delivery numbers before asset shutdowns.

- The board of directors also recommended a dividend of ₹3.60 per for the financial year 2024-25.