Tata Power Company Ltd is primarily involved in the business of the generation, transmission and distribution of electricity. It aims to produce electricity completely through renewable sources. It also manufactures solar roofs and plans to build 1 lakh ev charging stations by 2025 The company is India’s largest vertically-integrated power company. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Summary:

-

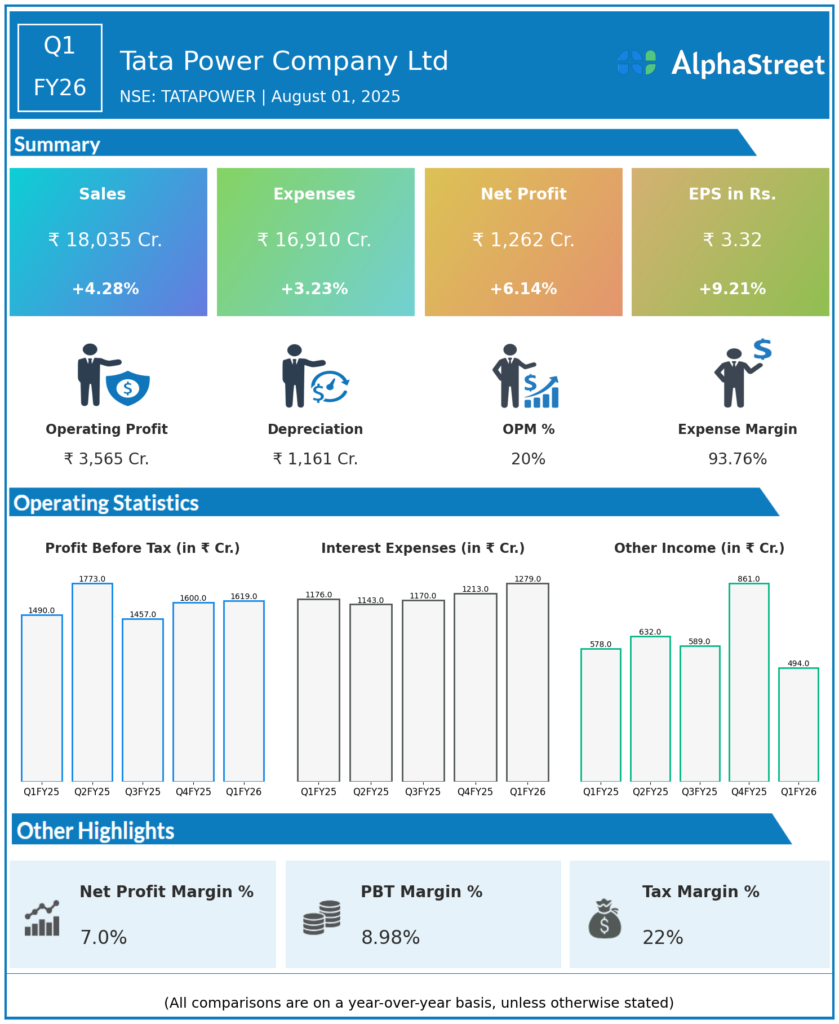

Consolidated Net Profit (PAT): ₹1,262.3 crore, up 6.2% year-over-year (YoY) from ₹1,188.6 crore in Q1 FY25.

-

Revenue from Operations: ₹17,464 crore, up about 4% YoY.

-

EBITDA: Around ₹4,139 crore, up 15% YoY.

-

Segments: Growth driven by renewables and manufacturing businesses; distribution companies (discoms) providing reliable electricity to 13 million consumers.

-

Margins: EBITDA margin improved due to operational efficiencies.

-

Other Highlights: Net debt reduction initiatives continuing; business diversification supported by renewable energy and infrastructure projects.

Key Management Commentary & Strategic Highlights

-

Management expressed confidence in sustaining growth through renewable energy expansion and stable distribution operations.

-

Focus on operational efficiencies, cost discipline, and capitalizing on the increasing power demand.

-

Ongoing projects in generation, transmission, and distribution expected to contribute to capacity build and revenue growth.

-

Commitment to sustainability and increasing renewable capacity as part of the company’s long-term strategy.

-

Management highlighted resilience despite challenges in the power sector and reinforced optimism for FY26.

Q4 FY25 Earnings Summary:

- Tata Power Company Ltd reported Revenues for Q4FY25 of ₹17,096.00 Crores up from ₹15,847.00 Crore year on year, a rise of 7.88%.

- Total Expenses for Q4FY25 of ₹16,357.00 Crores up from ₹15,717.00 Crores year on year, a rise of 4.07%.

- Consolidated Net Profit of ₹1,306.00 Crores up 24.86% from ₹1,046.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹3.26, up 16.43% from ₹2.80 in the same quarter of the previous year.

- Operational Progress: Strong execution in renewable projects and distribution business.

-

Margins: Stable EBITDA margins reflecting ongoing efficiency improvements.

To view the company’s previous earnings, please click here