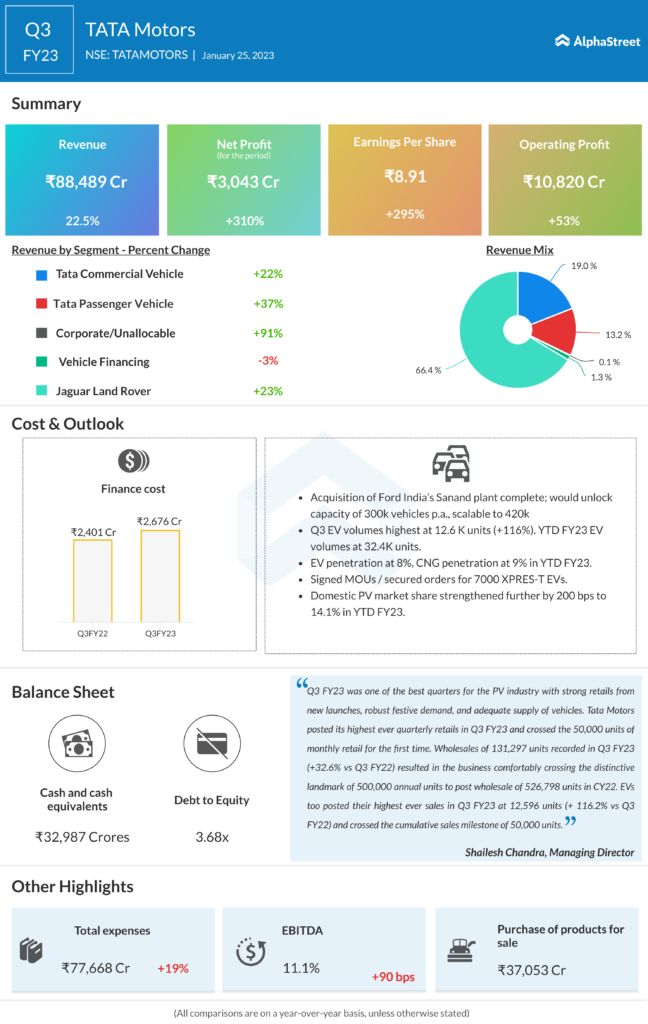

Tata Motors on January 25 reported a consolidated net profit of INR 2,957.71 crore for the quarter ended December 2022, against a loss of INR 1,516.14 crore in the same quarter last year. Revenue from operations came in at INR 88,488.59 crore, up 22.51 percent from INR 72,229.29 crore in the same quarter last year, Tata Motors said in an exchange filing.

Free cash flow (automotive) in the quarter, was positive at INR 5,300 crore (as compared to INR 4,000 crore in Q3FY22) owing to improvement in cash profits and working capital.

JLR

Revenue for Jaguar Land Rover (JLR), which is the biggest unit of Tata Motors, were at £6 billion, up 28 percent year on year (YoY) and up 15 percent sequentially reflecting better supplies, strong model mix and pricing. Profit before tax in the quarter was £265 million, up from a loss of £9 million a year ago with a positive EBIT margin of 3.7 percent, up from 1.4 percent in Q3FY22.

The higher profitability reflects increased wholesale volumes with favourable mix, pricing and foreign exchange offset partially by higher inflation and supplier claims largely related to constrained volumes, the company said. Wholesale volumes were at 80,000, the highest level since Q1FY22 when the semiconductor shortages began and up 15 percent YoY. Liquidity remained strong at the end of the quarter with £3.9 billion of cash, it said.

Commercial Vehicles

Tata CV revenues were up 22.5 percent at around INR 16,900 crore. EBITDA margins were 8.4 percent (up 580 bps YoY) and EBIT margins were at 5.9 percent (up 650 bps YoY) led by better mix, higher realisations, cost savings and softened commodity prices.

Tata CV global wholesales stood at 97,100 units (down 6 percent YoY) during the quarter, primarily because of weaker international business volumes. CV domestic wholesales were at 90,800 units (flat YoY), domestic retails at 97,700 units (up 5 percent).

Passenger Vehicles

Tata PV revenues were up 37 percent YoY at around INR 11,700 crore reflecting higher volumes and realizations. EBITDA margins were 6.9 percent (up 370 bps YoY) and EBIT margins were at 1.5 percent (up 510 bps) YoY driven by improved volumes and mix, higher realizations, softening commodities and certain one offs.

PV domestic wholesales were at 1,31,300 units (up 33 percent), domestic retails at 1,38,900 units (up 27 percent), which was the highest. Q3 electric vehicle (EV) volumes were also highest at 12,600 units (up 116 percent).

Outlook

Tata Motors said it remains cautiously optimistic on the demand situation despite global uncertainties.

“We will remain vigilant on demand and our continued focus on profitable growth, improving semiconductor supplies and stable commodity prices will aid revenue growth, margin improvement and positive cash delivery in Q4FY23,” it said.