Tata Elxsi is amongst the world’s leading providers of design and technology services across industries including Automotive, Media, Communications and Healthcare. Tata Elxsi provides integrated services from research and strategy, to electronics and mechanical design, software development, validation and deployment, and is supported by a network of design studios, global development centers and offices worldwide.

Q3 FY26 Earnings Results

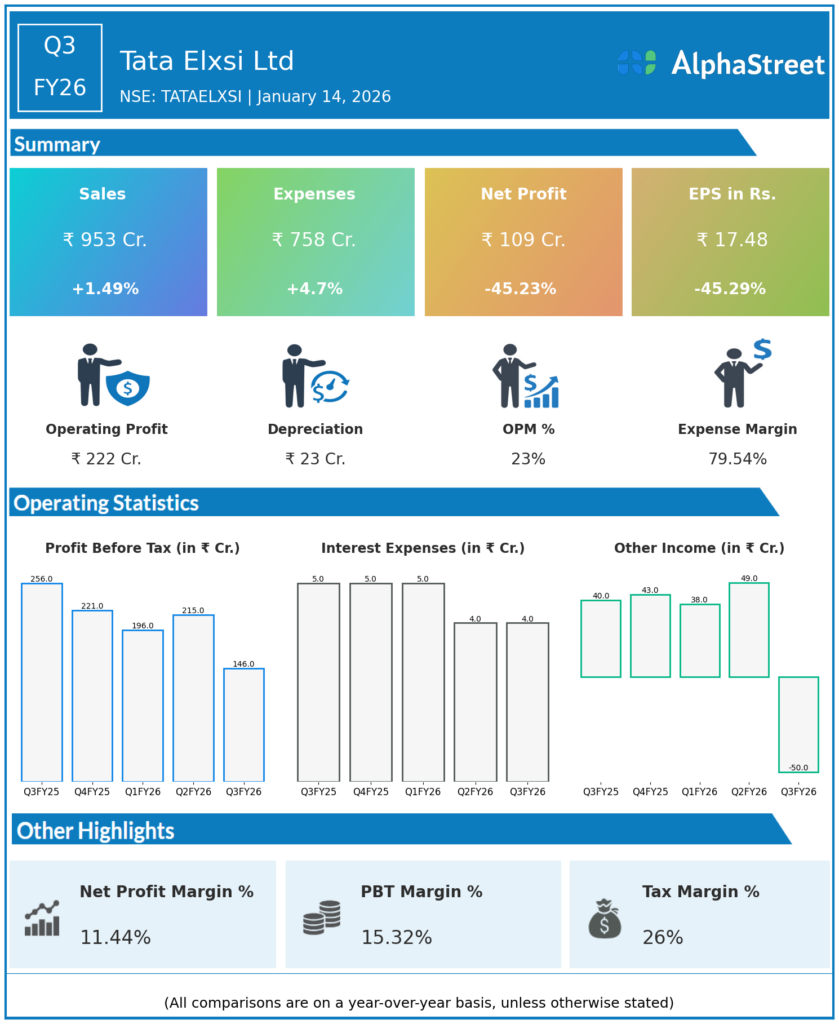

- Revenue from Operations: ₹953.5 crore, up 3.9% QoQ from ₹918 crore in Q2 FY26 and up about 1.4% YoY from ~₹939 crore in Q3 FY25.

- EBITDA: ₹222.2 crore, EBITDA margin 23.3%, up 220 bps QoQ from 21.1% in Q2 FY26.

- Profit Before Tax (PBT): ₹242.0 crore, up 12.7% QoQ from ₹214.7 crore in Q2 FY26.

- Profit After Tax (PAT – reported): ₹108.9 crore, down 29.7% QoQ from ₹154.8 crore in Q2 FY26, due to a one‑time labour‑code related exceptional charge of ₹95.7 crore.

- Profit After Tax (PAT – adjusted / underlying): ₹179.1 crore, up 15.7% QoQ excluding the one‑time exceptional item; implied PAT margin about 18.8%.

- Segment performance:

- Transportation: Strongest growth driver with healthy double‑digit QoQ growth led by accelerated ramp‑up of software‑defined vehicle (SDV) deals and recovery with a key global OEM.

- Media & Communication: Muted/flat QoQ performance, impacted by seasonal furloughs and some deal‑closure delays.

- Healthcare & Life Sciences: Soft in the quarter due to seasonality and timing of regulatory‑driven spends, with recovery expected from Q4.

- Geography:

- US and Europe delivered the strongest growth, benefiting from ramp‑ups in large accounts and new design‑led engineering wins.

- India and rest‑of‑world were comparatively softer but stable.

Management Commentary & Strategic Decisions

- CEO Manoj Raghavan highlighted that the quarter saw healthy growth in revenues and a strong improvement in operating margins, driven by better utilisation, disciplined cost management, and continued traction in transportation, especially SDV programmes with global OEMs.

- Management emphasized that the one‑time labour‑code related provision is a non‑recurring exceptional item; underlying business profitability remains intact with adjusted PBT and PAT growing double‑digit QoQ.

- Key strategic directions reaffirmed in Q3 FY26:

- Deepening focus on SDV and next‑gen mobility: Scaling embedded software, AI/ML and cloud‑native platforms for automotive and off‑highway OEMs, including a new US off‑highway OEM deal for an advanced operator information and control system.

- Investing in Gen AI and AI‑enabled engineering: Building horizontal platforms and accelerators to drive productivity and differentiated solutions across transportation, media and healthcare.

- Expanding large deals and partnerships: Multi‑million‑dollar wins in healthcare (regulatory workflows, digital engineering) and strategic telecom partnerships for network virtualisation and cloud‑based platforms.

- Continued focus on offshore leverage and delivery excellence to sustain and further expand margins, while selectively investing in talent and labs in priority geographies.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹918.1 crore, up 2.9% QoQ from ₹892.1 crore in Q1 FY26; down 3.9% YoY from ₹955.1 crore in Q2 FY25.

- EBITDA: ₹193.3 crore, EBITDA margin 21.1%.

- Profit Before Tax (PBT): ₹214.7 crore, up 9.4% QoQ; PBT margin about 23.4%, improving 110 bps QoQ.

- Profit After Tax (PAT): ₹154.8 crore, up 7.2% QoQ from ₹144.4 crore in Q1 FY26, but down 32.5% YoY from ₹229.4 crore in Q2 FY25.

- PAT margin: 16.0%, with ~50 bps expansion QoQ.

- Segment and regional highlights:

- Media & Communication: Accounted for just over 31% of revenue and grew 6.8% QoQ, aided by large deal ramp‑ups.

- Transportation: Accounted for over 53% of revenue, growing 0.7% QoQ, with continued strength in core automotive even as some programmes normalised.

- US region revenue grew 7.9% QoQ, emerging as the fastest‑growing geography in the quarter.

- Operational metrics:

- EBIT: ₹170 crore, up 4.6% QoQ, with EBIT margin at 18.5%.

- Employee count: 11,951 as of Q2 FY26, reflecting selective hiring aligned with large deal ramp‑ups.

Management Commentary & Strategic Decisions in Q2 FY26

- CEO Manoj Raghavan highlighted robust growth in the US region and continued expansion in core transportation and media verticals, despite an overall challenging macro environment.

- Management pointed out that margin expansion was driven by operational excellence, higher offshore mix and improved utilisation, even as the company continued to invest in capability building and innovation.

- Strategic initiatives reinforced in Q2 FY26:

- Establishment of an exclusive Cloud HIL centre for Suzuki Motors in Thiruvananthapuram to support global SDV programmes, deepening OEM partnerships.

- Focus on differentiated technology capabilities (SDV, autonomous, ADAS, digital broadcast, OTT platforms, MedTech engineering), offshore execution and adjacent market expansion.

- Continued investment in deal origination and mining across transportation and media, with expectations that these will drive growth in subsequent quarters.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.