Tata Elxsi is amongst the world’s leading providers of design and technology services across industries including Automotive, Media, Communications and Healthcare. Tata Elxsi provides integrated services from research and strategy, to electronics and mechanical design, software development, validation and deployment, and is supported by a network of design studios, global development centers and offices worldwide. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

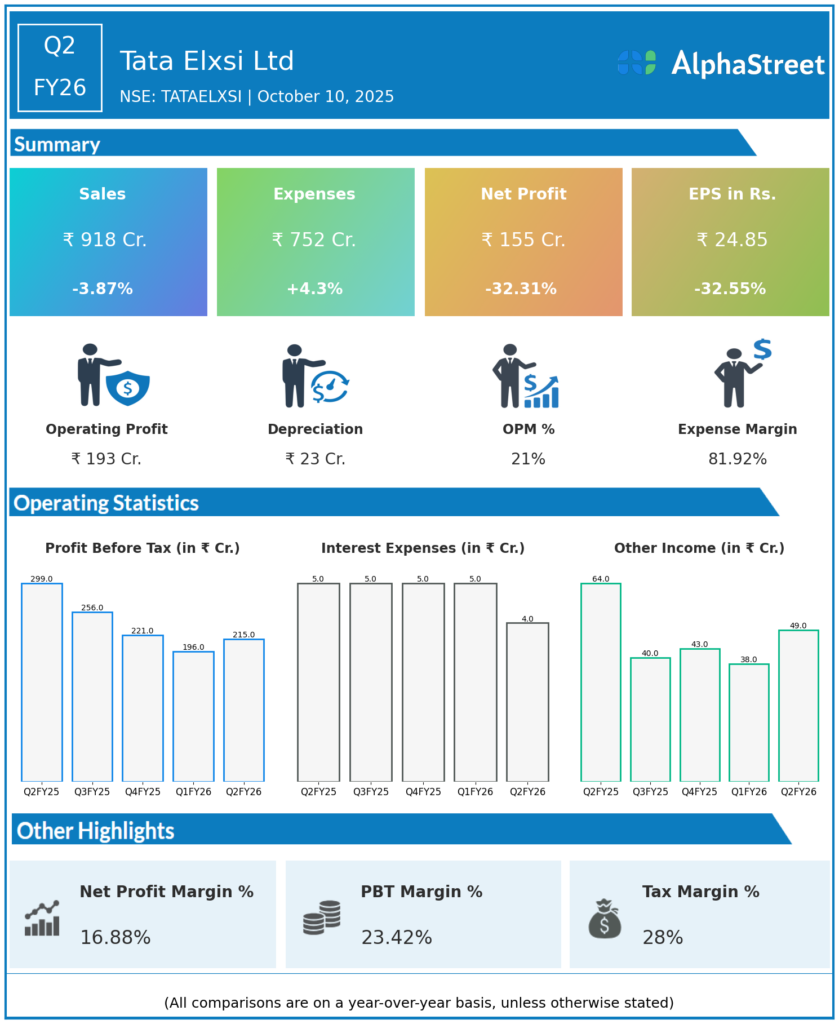

Revenue from Operations: ₹918.1 crore, up 2.9% QoQ, down 3.8% YoY from ₹955 crore in Q2 FY25.

-

EBITDA: ₹193.3 crore, EBITDA margin 21.1%.

-

Profit Before Tax (PBT): ₹214.7 crore, up 9.4% QoQ.

-

Profit After Tax (PAT): ₹154.8 crore, up 7.2% QoQ, but down 32.5% YoY from ₹229.4 crore in Q2 FY25.

-

PAT margin: 16% (50 bps expansion QoQ).

-

Media & Communication segment: Accounts for over 31% of revenue, grew 6.8% QoQ.

-

Transportation segment: Accounts for over 53% of revenue, grew 0.7% QoQ.

-

US Region: Revenue grew 7.9% QoQ.

-

Employee count: 11,951 as of Q2 FY26.

-

EBIT: ₹170 crore, up 4.6% QoQ with margins at 18.5%.

Management Commentary & Strategic Decisions

-

CEO Manoj Raghavan highlighted robust growth in the US region and continued expansion in core verticals and adjacent markets.

-

Operational excellence led to margin expansion despite challenging market and geopolitical conditions.

-

Large deal ramp-ups in Media & Communication and steady transportation growth contributed to resilience.

-

Tata Elxsi established an exclusive Cloud HIL centre for Suzuki Motors in Thiruvananthapuram, strengthening its strategic partnership and global OEM SDV programs.

-

The company is focusing on differentiated technology capabilities, offshore execution excellence, and adjacent market expansion for sustained momentum.

-

Continued investment in deals for both transportation and media is expected to drive growth going forward.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹892.1 crore, down 3.7% YoY from ₹926 crore; down 1.8% QoQ from ₹908 crore in Q4 FY25.

-

EBITDA: ₹186.7 crore, EBITDA margin 20.9%.

-

Profit Before Tax (PBT): ₹196.3 crore, PBT Margin 21.1%.

-

Profit After Tax (PAT): ₹144.4 crore, down 22% YoY from ₹184 crore in Q1 FY25, down 16% QoQ.

-

PAT margin: 15.5%.

-

Transportation segment: Reported 3.7% sequential growth despite overall topline decline; attributed to deal ramp-ups.

-

Media & Communication segment: Declined 5.5% sequentially, healthcare fell 6.7% QoQ, impacted by client decisions and transition costs.

-

CEO Manoj Raghavan attributed the softness to macroeconomic headwinds and client-specific issues, with expectations for recovery in subsequent quarters.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.