Stock Data:

| Ticker | NSE: TATAELXSI |

| Exchange | NSE |

| Industry | Software & Services |

Price Performance:

| Last 5 Days | +0.63% |

| YTD | +23.44% |

| Last 12 Months | +3.80% |

Company Description:

Tata Elxsi Ltd is a global design and technology services company. It operates in India, the US, Europe, and other regions, providing digital design and engineering services, systems integration, and support services. The company specializes in emerging technologies such as IoT, big data analytics, cloud computing, mobility, virtual reality, and artificial intelligence.

Critical Success Factors:

1. Diversified Verticals: Tata Elxsi operates across multiple verticals, including transportation, media and communication, and healthcare. This diversification allows the company to tap into different growth opportunities and mitigate risks associated with concentration in a single sector.

2. Strong Growth Prospects: The company’s key verticals, such as automotive, consumer electronics, and medical devices, offer significant growth potential due to increased research and development (R&D) spending and the reallocation of R&D budgets towards electronics and software. Tata Elxsi’s specialization and expertise in these areas position it well to capture market share and drive revenue growth.

3. Domain Expertise and Market Position: Tata Elxsi is a specialist vendor for top OEMs and tier-I suppliers in the automotive industry. The company’s deep domain expertise, robust platform portfolio, and strong delivery capability have enabled it to strengthen its market position and win wallet share from existing customers.

4. Integrated Engineering Services: Tata Elxsi’s capabilities in digital engineering, hardware and software design, and systems integration make it an attractive partner for complex innovation requirements. The company’s ability to provide cost-effective solutions, leveraging the advantages of offshoring to India, further enhances its value proposition.

5. Strong Financial Position: Tata Elxsi has a debt-free balance sheet and a robust cash balance, which provides the company with the financial strength to pursue inorganic growth opportunities and invest in future expansion.

Key Challenges:

1. Currency Fluctuations: Appreciation of the Indian rupee against other currencies, particularly the US dollar, can adversely impact Tata Elxsi’s financial performance as a significant portion of its revenue is generated in foreign currencies.

2. Macroeconomic Headwinds: The company is exposed to macroeconomic factors such as global economic conditions, geopolitical uncertainties, and changes in technology spending patterns. Adverse macroeconomic conditions can affect customer spending on technology services, leading to reduced demand for Tata Elxsi’s offerings.

3. Banking Crisis and Recession: A banking crisis or a recession in the US, where Tata Elxsi has a significant presence, could have a contagion effect on the technology sector, leading to reduced technology spending by clients and potential project cancellations or delays.

4. Talent Acquisition and Retention: As Tata Elxsi aims to grow its business, attracting and retaining skilled professionals becomes crucial. The company’s ability to recruit and retain top talent in a competitive market is essential for maintaining its technical capabilities and meeting client demands.

5. Regulatory and Compliance Risks: Operating in multiple geographies exposes Tata Elxsi to regulatory changes and compliance requirements. Adhering to evolving regulations, data protection laws, and intellectual property rights can pose challenges and increase operational costs.

Financial Performance:

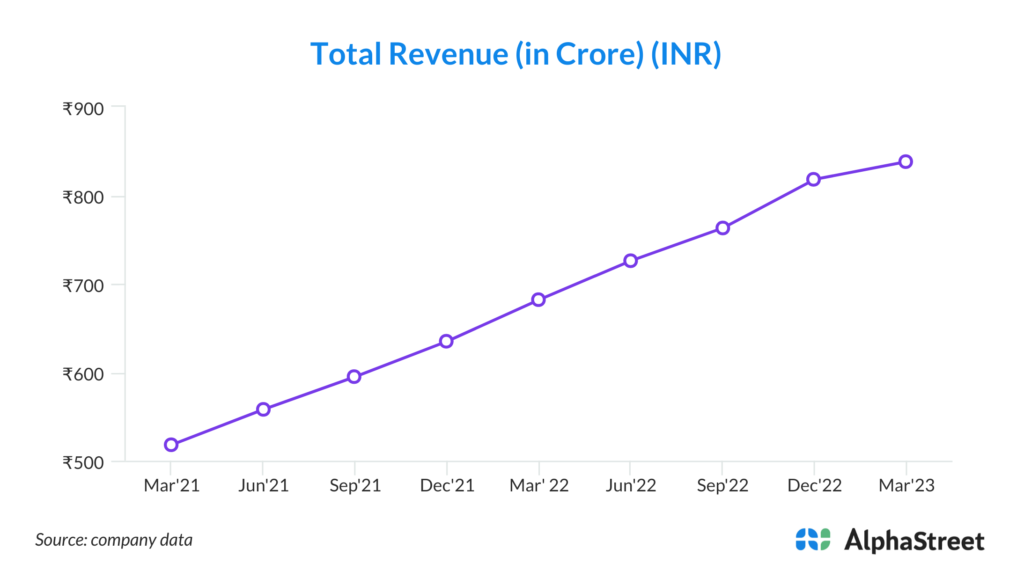

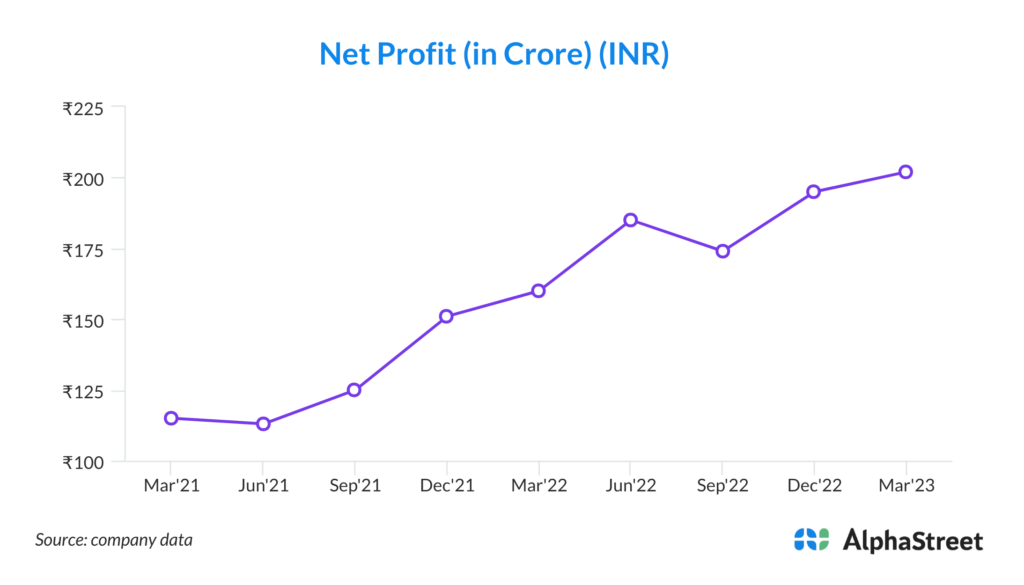

In Q4FY23, Tata Elxsi reported constant currency revenue growth of 1.6% quarter-on-quarter (q-o-q) and 17.9% year-on-year (y-o-y), slightly below market expectations. The company’s revenue growth was primarily driven by the transportation and media & communication verticals, while the healthcare & medical devices vertical also demonstrated positive growth. EBITDA margins declined by approximately 40 basis points q-o-q to 29.8%, mainly due to higher employee expenses. However, net profit increased by 3.5% q-o-q and 25.9% y-o-y, exceeding market estimates, supported by higher other income and lower finance costs.