Tata Consumer Products Ltd. is one of the leading companies of the Tata Group, with presence in the food and beverages business in India and internationally. It is the second largest tea company globally and has significant market presence and leadership in many markets. In addition to South Asia (mainly India), it has presence in various other geographies including Canada, UK, North America, Australia, Europe, Middle East and Africa.

Q3 FY26 Earnings Results

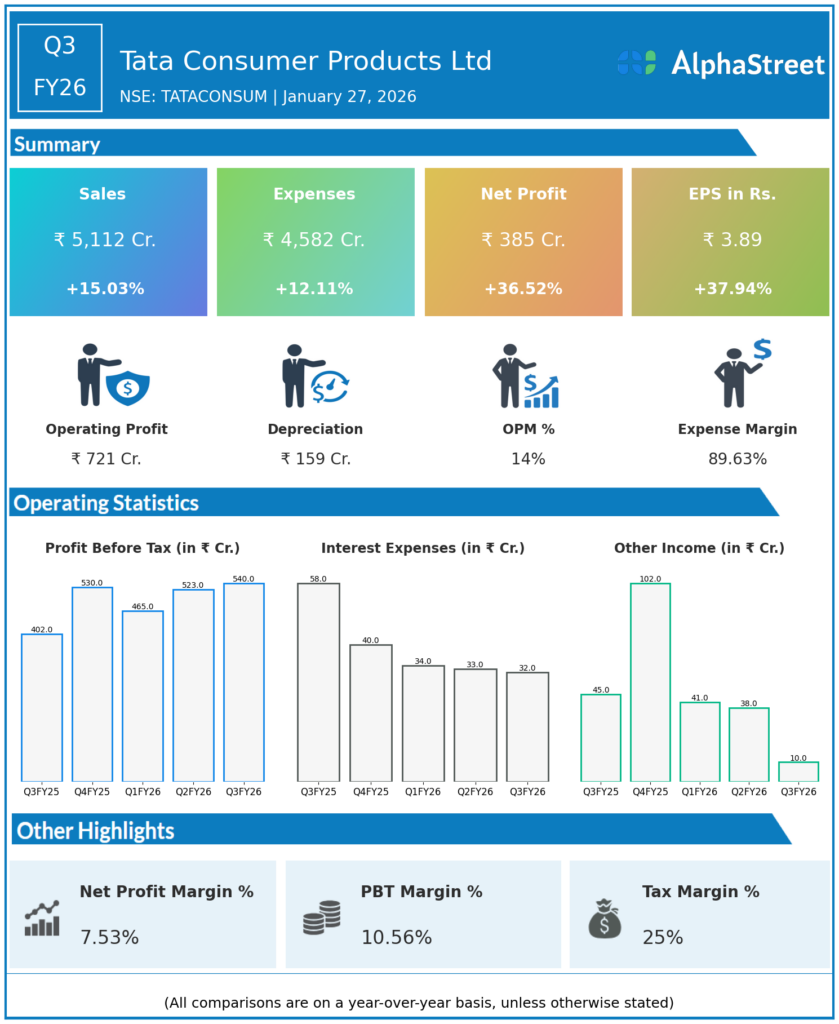

Revenue from Operations / Net Sales: ₹5,112 cr, up 15.04% YoY from ₹4,444 cr in Q3 FY25, +2.94% QoQ from ₹4,966 cr in Q2 FY26, led by 13% underlying growth in India business, 11% in international, and 20% in non-branded; branded business revenue ₹4,603 cr (+14.32% YoY).

EBITDA / Operating Profit: ₹721 cr (before other income), up 28% YoY, +6.4% QoQ, with margin expanding 140 bps YoY and 57 bps QoQ to 14.1% (highest recent); total expenses ₹4,582 cr (+12.11% YoY).

Profit Before Tax (PBT): ₹540 cr, +34.33% YoY.

Profit After Tax (PAT) / PAT Margin: ₹385 cr (₹384.61 cr precise), +37.91% YoY from ₹282 cr in Q3 FY25, -4.91% QoQ from ₹404 cr in Q2 FY26; PAT margin 7.88% (-12 bps QoQ, +YoY implied); 9M PAT ₹1,123 cr (+YoY).

9M YTD Performance: Revenue ₹14,857 cr (+YoY), PAT ₹1,123 cr (+YoY).

Management Commentary & Strategic Decisions

- Strongest quarterly revenue on record driven by volume-led growth in beverages/foods (India core), premiumisation, and distribution expansion; margin gains from lower tea costs offset by coffee inflation/investments, with branded India up double-digits.

- Strategic focus: Innovation-led portfolio (e.g., Tata Sampann), RTD acceleration, Capital Foods/Organic India integration post-GST; 9M traction positions for FY26 outperformance amid valuation scrutiny and working capital pressures (debtors turnover 16.17x).

Q2 FY26 Earnings Results

- Revenue from Operations: ₹4,966 cr, +18% YoY, +3.8% QoQ; total income ₹5,004 cr (+17.5% YoY).

- EBITDA: Implied strong, margin steady at 13.5%.

- PAT: ₹407 cr, +11% YoY, +22.5% QoQ; PBT ₹523 cr (+31.8% YoY).

- Total Expenses: ₹4,481 cr (+16.8% YoY).

Management Commentary Q2

- Double-digit India core growth (tea/salt), Tata Sampann momentum, RTD resilience despite weather; steady profit on efficiencies, innovation/distribution driving market share.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.