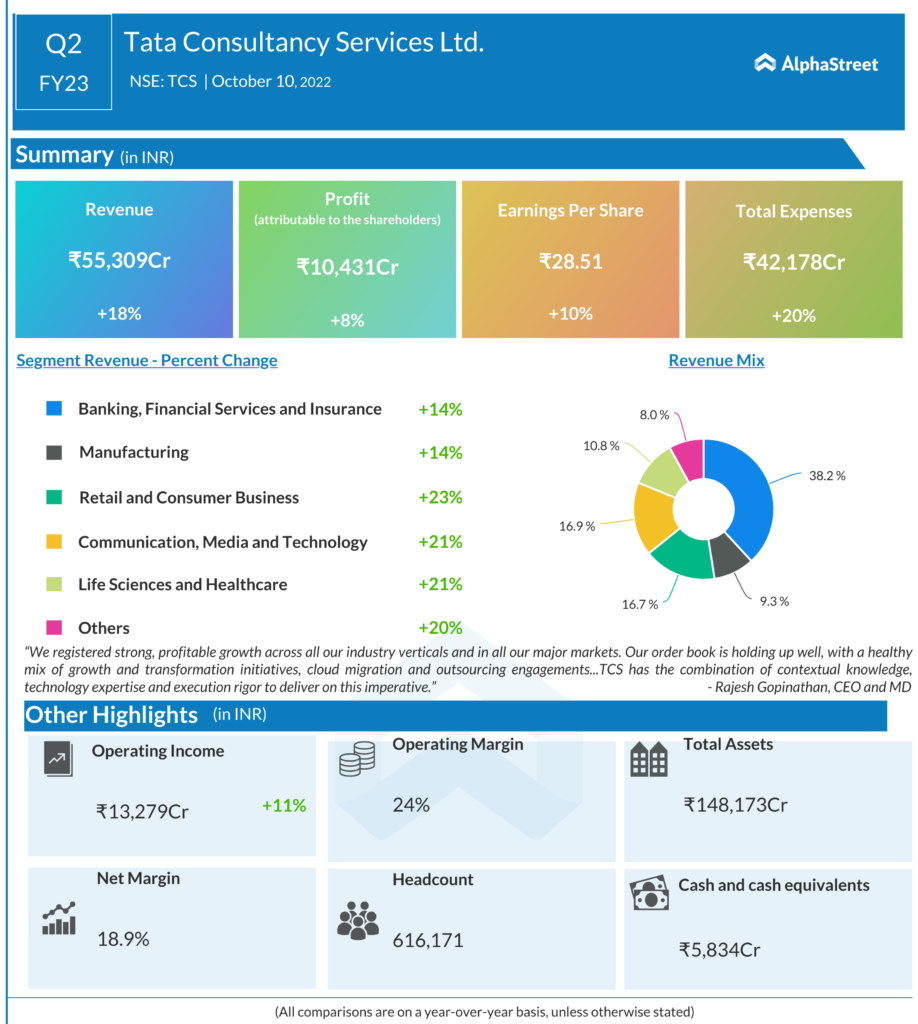

Key highlights from Tata Consultancy Services Ltd (TCS) Q2 FY23 Earnings Concall

Management Update:

- [00:03:44] TCS said the company expects supply side issues to start easing in 2H23.

- [00:05:21] The company recruited 35,000 freshers in 1H23, with 20,000 onboarded in 2Q23.

- [00:13:25]TCS added 5 more clients in the $100 million plus band, taking the total to 59 clients.

Q&A Highlights:

- [00:28:38] Kumar Rakesh of BNP Paribas asked about the drivers of strong growth in Europe and UK geographies. Rajesh Gopinathan MD replied that the company’s participation in technology solutions, which is at the core of both growth, consolidation and optimization, helped it to driver significant growth in those geographies.

- [00:30:44] Kumar Rakesh of BNP Paribas also enquired about the seasonality trends going forward. Rajesh Gopinathan MD said that apart from the volatility in European, the conversations with clients indicate regular seasonality. Overall, there is no change in seasonality pattern.

- [00:32:43] Sandeep Agrawal with Edelweiss enquired about any indications of caution from US clients. Rajesh Gopinathan MD clarified that TCS has not seen any threats in terms of caution than normally expected and is seeing a fairly strong environment in US.

- [00:34:20] Sandeep Shah from Equirus Securities asked if the trend of strong multi-power outsourcing deals is going to continue. Rajesh Gopinathan MD answered that operating model transformation is a strong trend and TCS is seeing multiple opportunities across all markets and it’s also driving strong demand. TCS expects it to continue to remain strong in the foreseeable future.

- [00:37:19] Sandeep Shah from Equirus Securities enquired if for 2Q23 100% variable pay will be paid or something will be adjusted. Milind Lakkad Chief HR Officer said the company is going to pay 100% of variable pay for 70% of its employees and the rest will get paid based on their performance.

- [00:40:08] Ravi Menon of Macquarie asked about the net hiring being little lower than the revenue growth. Rajesh Gopinathan MD clarified that TCS is investing significantly in headcount additions through last year. TCS will try to balance its overall headcount to overall revenue from a longer term perspective and added that it’s in line with the plan.

- [00:41:37] Gaurav Rateria with Morgan Stanley asked if revenue productivity that got impacted due to capacity addition is still continuing. Rajesh Gopinathan MD replied that the company‘s overall hiring model is predicated on much longer cycle rather than short-term QonQ adjustments.

- [00:46:12] Apurva Prasad from HDFC Securities asked about the booking trajectory for 2H23. Rajesh Gopinathan MD said that it’s difficult to say as the company is running at 1.2 time book to bill. Additionally, TCS said that booking trajectory won’t have a significant impact on the company’s business model.

- [00:54:31] Rahul Jain from Dolat Capital asked about subcon cost trend. Rajesh Gopinathan MD replied that subcon costs have started trending downwards. TCS expects that with borders opening up and visa availability in most countries, subcon cost will start trending down.