Tata Communications was incorporated on March 19, 1986 as VSNL. In February 2002, the Government of India, as per their disinvestments plan, sold 25% of their holding in the company to the strategic partner. Consequently, the company was taken over under the administrative control of TATA. It is the leading global digital ecosystem enabler. It has a leadership position in emerging markets, and an infrastructure that spans the globe. It delivers managed solutions to multinational companies and service providers. It partners with 300 of the Fortune 500 companies with their state-of the-art solutions, including a wide range of communication, collaboration, cloud, mobility, connected solutions, network and data center services. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

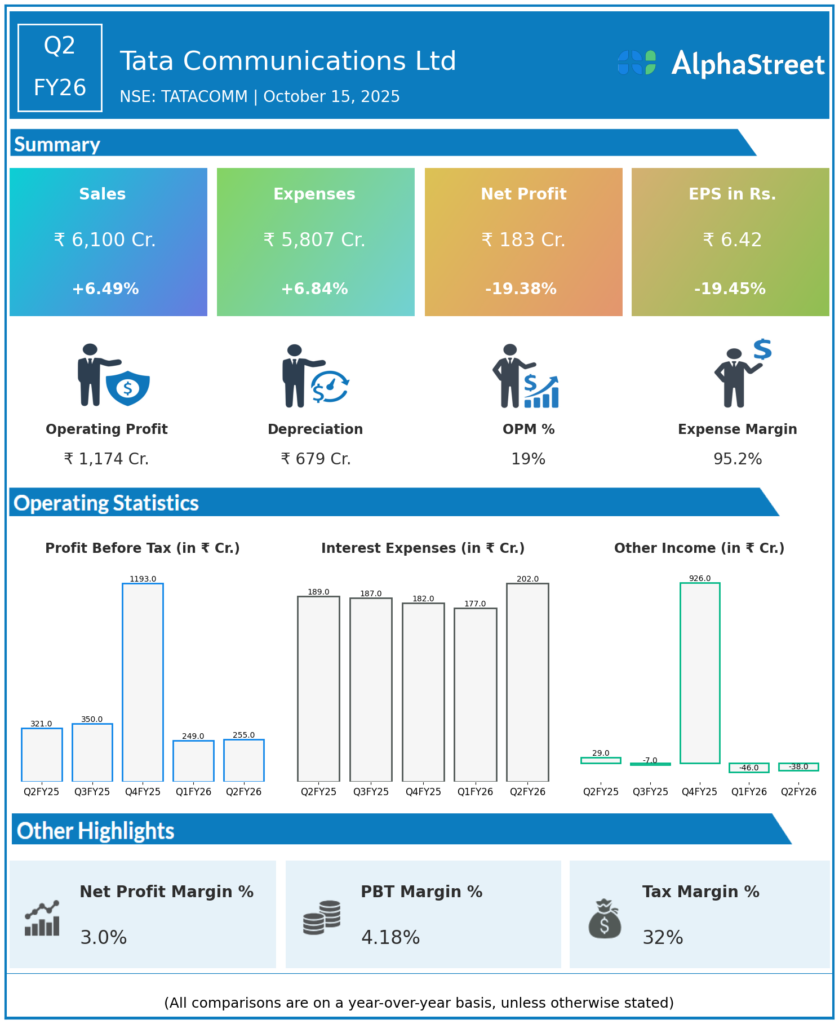

Revenue from operations: ₹6,100 crore, up 6.5% YoY from ₹5,728 crore and up 2.3% QoQ from ₹5,960 crore in Q1 FY26.

-

Net profit (PAT): ₹183 crore, down 19% YoY from ₹227–251 crore in Q2 FY25, and down 3.6% QoQ from ₹190 crore in Q1 FY26.

-

PAT margin: 3%, down 138 bps YoY and 48 bps QoQ; reflects persistent margin pressure.

-

EBITDA: ₹1,174 crore, up 3.9% YoY from ₹1,129 crore.

-

EBITDA margin: 19.2%, narrowed by 48 bps YoY; data EBITDA margin improved sequentially by 140 bps, now 18.6%.

-

Data services revenue: ₹5,179 crore, up 7.3% YoY.

-

Digital portfolio: Grew 14.9% YoY, driven by cloud, network, cybersecurity, and automation segments.

-

Voice Solutions: Declined 4.6% YoY to ₹406 crore, Transformation Services muted, Campaign Registry up 28% YoY to ₹203 crore.

-

Expenses: ₹5,807 crore, up 7% YoY.

-

Shares: Hit a record high post-results; market cap surpassed ₹55,000 crore.

Management Commentary & Strategic Updates

-

CEO A.S. Lakshminarayanan highlighted sustained momentum led by double-digit digital portfolio growth, major government project wins, and launches in strategic areas like Voice AI and Cloud Networking driving strong adoption.

-

CFO Kabir Ahmed Shakir noted improvement in data EBITDA margin, resilient core business, and strong operational discipline; expects strategic bets to bolster profitability and margins in H2 FY26.

-

The company is strengthening its leadership in global communications, digital transformation, and AI-powered products, especially with government and enterprise contracts.

-

Commitment to long-term stakeholder value, capital efficiency, and growth in key verticals remains central to their strategy.

Q1 FY26 Earnings Results

-

Revenue from operations: ₹5,960 crore, up 6.6–7% YoY from ₹5,592–5,727 crore.

-

Data services revenue: ₹5,130 crore, up 9.4% YoY.

-

Net profit (PAT): ₹190 crore, down 42.9% YoY from ₹332–334 crore in Q1 FY25.

-

EBITDA margin: 19.1%.

-

Digital fabric: Order book grew double-digits; segment losses narrowed.

-

Segment highlights: Data services up, voice services down – reflecting strategic mix shift.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.