Tata Chemicals Ltd (BSE: 500770; NSE TATACHEM) reported a consolidated loss for the third quarter on Monday, as a global glut in soda ash markets and softening prices overshadowed higher domestic volumes.

The Mumbai-based company, a major supplier to the glass and detergent industries, posted a consolidated revenue from operations of ₹3,550 crore for the quarter ended Dec. 31, 2025, representing a 1% decline from the same period last year. Earnings before interest, taxes, depreciation, and amortization (EBITDA) dropped to ₹345 crore, down from ₹434 crore a year earlier, primarily due to subdued pricing across all geographies.

Market Headwinds

The company’s performance was sharply impacted by “unsustainable low prices” in export markets, particularly in Southeast Asia. Global soda ash markets remain oversupplied with high inventory levels, leading to prices nearing record lows in certain instances. While demand remains robust in India, it has seen slight declines in China and the U.S. due to reduced demand for flat and container glass.

Soda ash markets continue to remain oversupplied, with high inventory levels across most regions. The near-term outlook remains “subdued and uncertain” with limited visibility on immediate improvement.

Financial Highlights

• Q3 PAT: The company reported a Profit After Tax (before exceptional items and non-controlling interest) of ₹(15) crore, compared to a profit of ₹49 crore in Q3FY25.

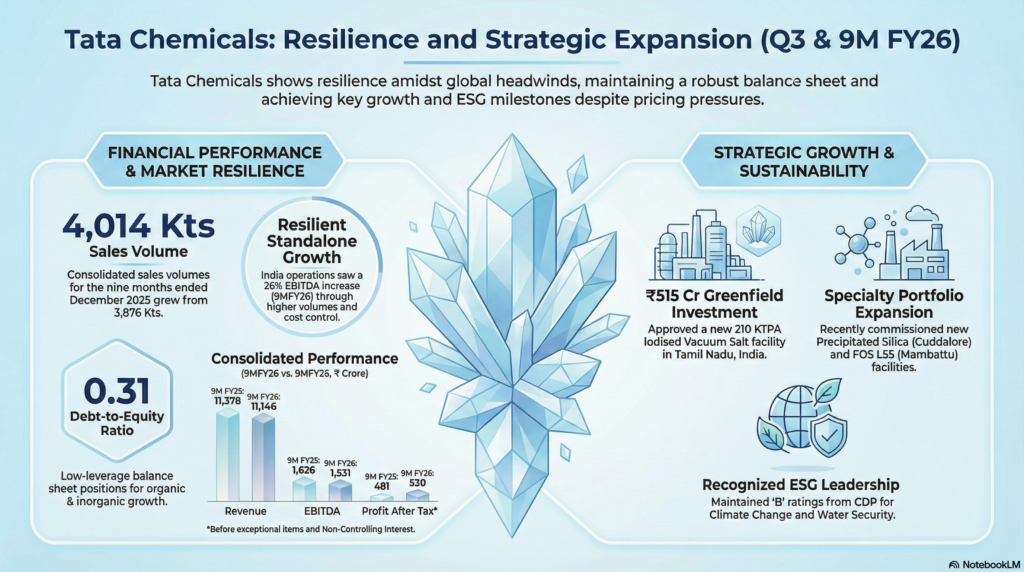

• 9-Month Performance: For the nine months ended Dec. 31, consolidated revenue stood at ₹11,146 crore, down 2% year-on-year. However, nine-month PAT (before exceptional items) rose to ₹520 crore from ₹491 crore in the prior year.

• Exceptional Charge: The company took an exceptional charge of ₹54 crore in Q3 related to the new labour code.

• Debt: Net debt as of Dec. 31, 2025, stood at ₹5,596 crore, up from ₹4,884 crore in March 2025, impacted by lower cash generation and rupee depreciation.

Strategic Investments and Expansion

Despite the market volatility, Tata Chemicals continues to pivot toward specialty chemicals and core consumer products. The board approved a ₹515 crore greenfield investment to set up an Iodised Vacuum Salt Dried (IVSD) facility in Tamil Nadu, India, with a capacity of 210 kilo tonnes per annum.

The company also recently announced the acquisition of Novabay Pte. Limited, a premium pharma-grade bi-carb plant in Singapore, a move intended to deepen its presence in high-margin specialty segments. Additionally, several new capacities were commissioned during the quarter, including a specialty silica facility in Cuddalore and a dietary fiber (FOS) plant in Mambattu.

Tata Chemicals’ standalone operations showed more resilience, with Q3 revenue rising 3% to ₹1,204 crore and EBITDA increasing 9% to ₹228 crore, supported by higher volumes and disciplined cost management.