Stock Data:

| Ticker | NSE: TATACHEM |

| Exchange | NSE |

| Industry | CHEMICALS |

Price Performance:

| Last 5 Days | +0.88 % |

| YTD | +15.26 % |

| Last 12 Months | -2.52% |

Company Description:

Tata Chemicals is a global leader in the chemicals industry, renowned for its commitment to sustainability, innovation, and excellence. With a diverse portfolio spanning Soda Ash, Salt, Bicarb, Agrochemicals, and more, the company operates across geographies, including India, the UK, the US, and Kenya.

Critical Success Factors:

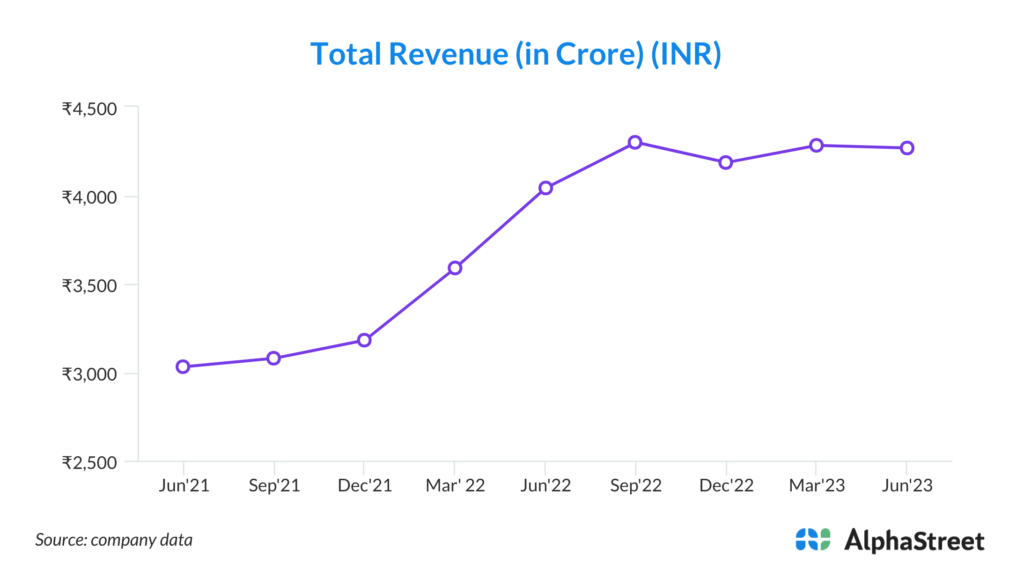

1. Consistent Revenue Growth: Tata Chemicals demonstrated a 6% increase in revenue during the first quarter of FY24 compared to the previous year. This consistent revenue growth showcases the company’s ability to generate income even in challenging market conditions.

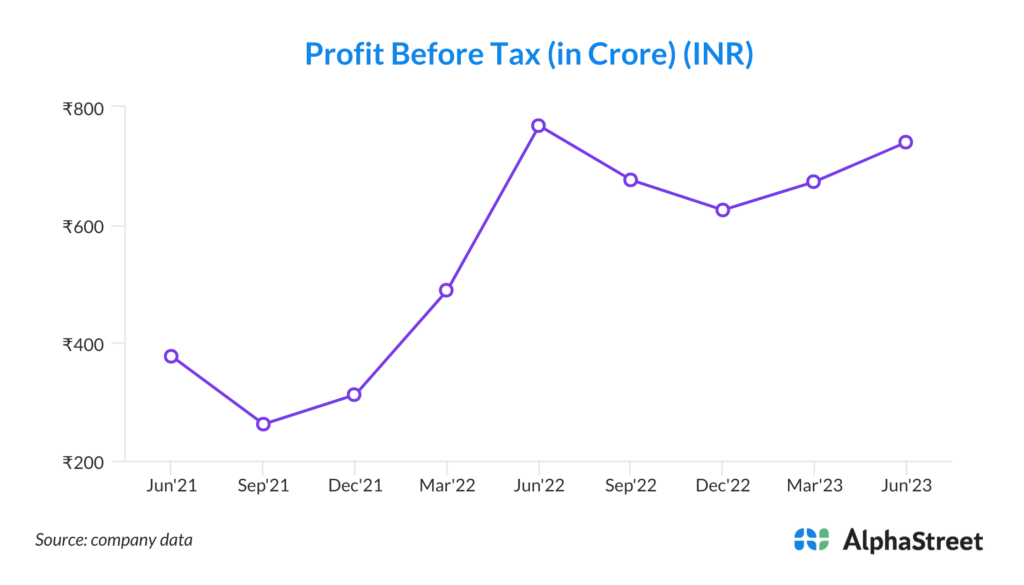

2. Record-High EBITDA: The company achieved its all-time high EBITDA of Rs. 1,043 crore during the quarter, demonstrating strong operational efficiency and profitability. This is a significant strength as it reflects effective cost management and business performance.

3. Diverse Business Portfolio: Tata Chemicals operates in various geographies, including India, the UK, the US, and Kenya, with different business segments such as Soda Ash, Salt, Bicarb, and Agrochemicals. This diversity minimizes risks associated with market fluctuations in a specific sector or region.

4. Global Expansion Plans: The company’s commitment to expansion with approved plans for increasing capacities in India, Kenya, and the US signifies a long-term growth strategy. This expansion will help Tata Chemicals tap into new markets and strengthen its global presence.

5. Steady Margins and Cost Focus: Tata Chemicals’ focus on maintaining steady margins through engagement with customers and cost management is a notable strength. This approach ensures profitability and financial stability.

6. Debt Repayment and Strong Cash Flow: The company’s commitment to debt repayment, including a significant amount repaid during the quarter, and a strong cash balance of Rs. 1,544 crore, indicates a healthy financial position. This helps reduce financial risks and supports future investments.

7. Resilience in Challenging Markets: Despite challenges in the agrochemical industry, Tata Chemicals subsidiary Rallis maintained margins through better product mix and pricing. This resilience in the face of adverse market conditions showcases the company’s ability to adapt and thrive.

Key Challenges:

1. Market Demand Volatility: One of the key risks for Tata Chemicals is the volatility in market demand, particularly in the Soda Ash business. The company highlighted that the China net supply increase in the market, coupled with lower-than-expected demand, created a surplus. This overcapacity could lead to price pressures and affect Tata Chemicals’ revenue and profitability.

2. Supply Chain Disruptions: Tata Chemicals mentioned that supply chain constraints in the past had impacted inventory levels. While these constraints have eased, any future disruptions or delays in the supply chain could affect the company’s ability to meet customer demands and maintain its market position.

3. Import Competition: The surge in imports in India, which almost doubled, impacted Tata Chemicals’ domestic supplies. The company had to take steps to ensure competitive pricing. Continual increases in imports could pose a threat to the company’s market share and pricing power.

4. Taxation Changes: Tata Chemicals mentioned higher tax outflows due to changes in tax rates, especially in Magadi and the U.S. Changes in tax policies or regulations in any of the regions where Tata Chemicals operates can significantly impact its financial performance.

5. Weather-Related Risks: Natural disasters, such as the Biparjoy Cyclone mentioned in the report, can disrupt operations, impact production, and lead to supply chain interruptions. Climate change and extreme weather events pose a continuing risk to Tata Chemicals’ operations.

6. Commodity Price Fluctuations: Tata Chemicals’ performance is influenced by commodity prices, especially in the Soda Ash and Salt businesses. Fluctuations in prices of raw materials or finished products can affect profitability and margins.

7. Competitive Landscape: The company operates in competitive markets globally. Changes in the competitive landscape, including the entry of new competitors or aggressive pricing strategies by existing competitors, can impact market share and margins.