Tanla Platforms Ltd (formerly Tanla Solutions Ltd) is a cloud communications provider enabling businesses to communicate with their customers and intended recipients. It is headquartered in Hyderabad, India. It is a global A2P(application to person) messaging platform provider. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

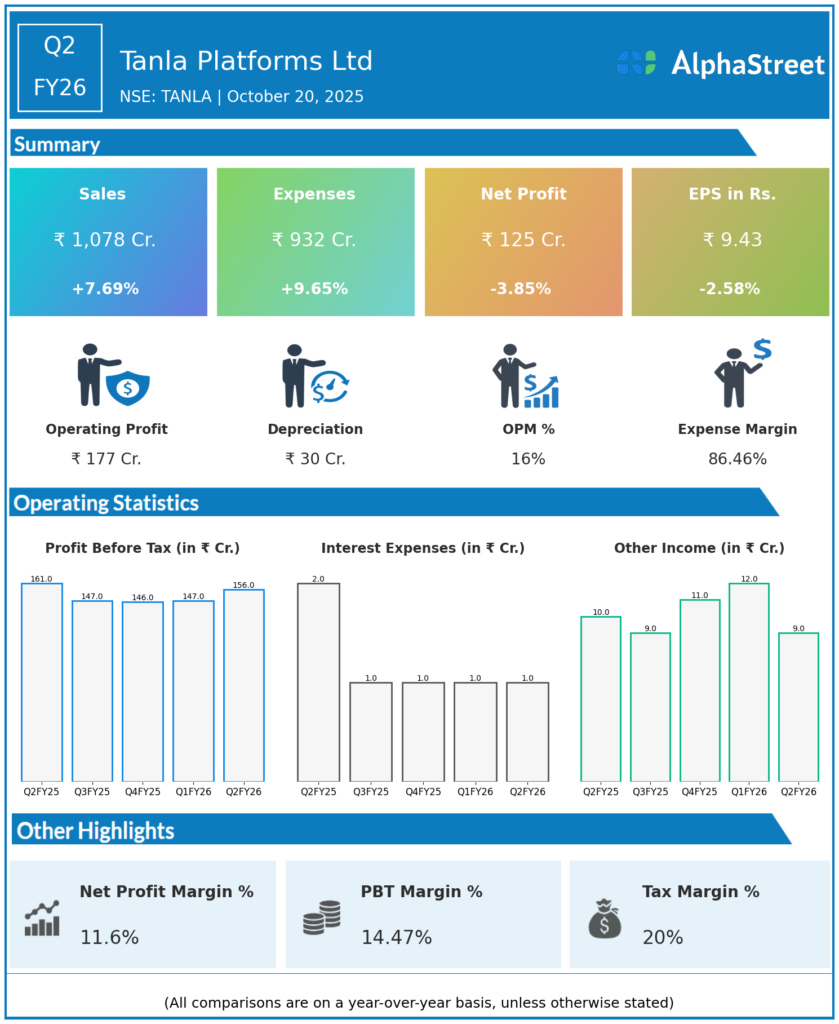

Revenue: ₹1,078 crore, increased by 3.6% QoQ and 7.8% YoY, reflecting continued growth in cloud communication services.

-

Gross Profit: ₹287 crore, grew 10% QoQ and 9.5% YoY, with gross margin at 26.6%, capitalizing on higher automation-driven revenue streams.

-

EBITDA: ₹177 crore, increased by 8.2% QoQ and slight 1.2% YoY, with EBITDA margin at 16.5%, signaling operational leverage.

-

Net Profit After Tax: ₹125 crore, up 5.6% QoQ but down 4% YoY, impacted partly by strategic investments and expenses on R&D.

-

Earnings Per Share (EPS): ₹9.43.

-

Free Cash Flow: ₹165 crore, representing 132% of PAT, underpinning strong cash conversion.

-

Cash & Equivalents: ₹881 crore after buybacks and dividend payouts.

-

Operational Highlights:

-

Wisely.ai platform launched in August, with key wins including Indosat Ooredoo Hutchison (IOH) in Indonesia.

-

Added 84 new customers, including Tier-1 telecoms and enterprise clients globally.

-

Focused on growth in enterprise cloud communications, AIOps, and CPaaS markets.

-

Strategic Outlook and Commentary

-

Uday Reddy, Founder & CEO:

“Q2 was a landmark quarter where we achieved our highest gross profit in eight quarters. Our Wisely.ai platform is gaining rapid traction across Asia and Africa, and we are now expanding our global footprint through strategic alliances in Tier-1 telcos and enterprise segments”. -

The company aims for double-digit revenue growth in FY26 driven by AI-enabled solutions, increased customer adoption, and expansion into new regions.

-

Investing heavily in product innovation, cybersecurity, and regulatory compliance to sustain long-term leadership.

Q1 FY26 Earnings Results

-

Revenue: ₹1,043 crore, a healthy YoY growth.

-

Net Profit: ₹118 crore, reflecting the start of margin recovery efforts.

-

Operational Focus: Market share expansion in telecom and BFSI sectors, deepening AI platform deployment.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.