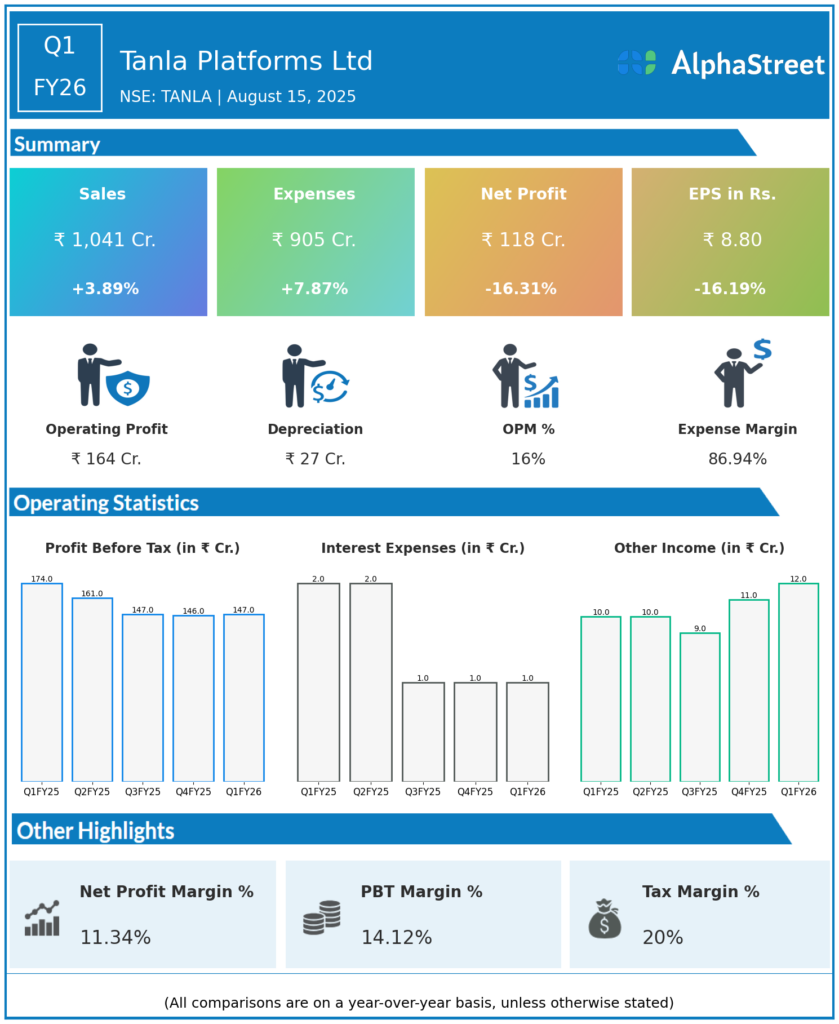

Tanla Platforms Ltd (formerly Tanla Solutions Ltd) is a cloud communications provider enabling businesses to communicate with their customers and intended recipients. It is headquartered in Hyderabad, India. It is a global A2P(application to person) messaging platform provider. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue: ₹1,041 crore, up 3.8% year-over-year (YoY) and 1.6% quarter-on-quarter (QoQ).

-

Gross Profit: ₹261 crore, gross margin at 25.0%.

-

EBITDA: ₹164 crore, EBITDA margin at 15.8% (down from 18.8% YoY).

-

Profit after Tax (PAT): ₹118 crore, down 16% YoY (from ₹141 crore) and 9% QoQ.

-

Earnings per Share (EPS): ₹8.82 (down from ₹10.5 YoY, ₹9.7 QoQ).

-

Cash Balance: ₹910 crore after interim dividend payout.

-

Expenses: Total expenses up 8% YoY to ₹905.2 crore; cost of services ₹780 crore (+6.4% YoY), employee expenses ₹61.5 crore (+30% YoY).

Management Commentary & Strategic Highlights

-

AI-native platform: Tanla’s new AI platform completed first deployment with a major Southeast Asian telco; commercial launch set for Q2 FY26. Management sees early traction and expects scalable new growth streams and improved margin potential going forward.

-

Messaging-as-a-Platform (MaaP): Completed RCS deployment for two Southeast Asian operators, bolstering advanced messaging technology revenue pipelines.

-

Board Actions: Interim dividend of ₹6 per share; announced ₹175 crore buyback at ₹875/share, closing end-August 2025.

-

Leadership: New CFO and independent director appointments supporting governance and strategic expansion.

-

Outlook: CEO notes early feedback for AI platform is positive, confident in long-term shareholder value creation through international expansion and innovation.

-

Capital Allocation: Maintains 30% dividend payout policy, strong cash reserves to support investments and buybacks.

Q4 FY25 Earnings Results

-

Revenue: ₹1,024 crore, up by 2 percent on the YoY basis.

-

Net Profit (PAT): ₹117 crore, down by 10 percent during the same period last year.

-

EBITDA: ₹186 crore, margin at 18.1%.

-

EPS: ₹8.7 vs ₹9.6 during the same period last year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.