Syngene (established in 1993) as a Biocon subsidiary is India’s first Contract Research Organization (CRO) which expanded later to be an integrated service provider offering end-to-end drug discovery, development, and manufacturing services on a single platform (CRAMS). Total research & manufacturing infrastructure for the company is spread across 1.9 million square feet across locations.

Q3 FY26 Earnings Results (Standalone)

- Revenue from Operations: ₹834.4 crore, down 4.9% YoY from ₹877.1 crore in Q3 FY25; flat QoQ vs Q2 FY26.

- Total Income: ₹848.9 crore, down 5.2% YoY from ₹895.1 crore.

- Total Expenses: ₹753.0 crore, down ~1% YoY.

- Profit Before Tax (PBT): ₹95.9 crore, down 43.5% YoY from ₹169.8 crore.

- Exceptional Charges: ₹65.8 crore related to new Labour Code regulations.

- Profit After Tax (PAT): ₹16.5 crore, down 86.6% YoY from ₹123.1 crore.

- Basic EPS: ₹0.41 vs ₹3.07 in Q3 FY25.

- 9M FY26:

- Revenue from Operations: ₹2,463.8 crore, up 1.6% YoY from ₹2,424.9 crore.

- PAT: ₹156.7 crore, down 46.6% YoY from ₹293.6 crore.

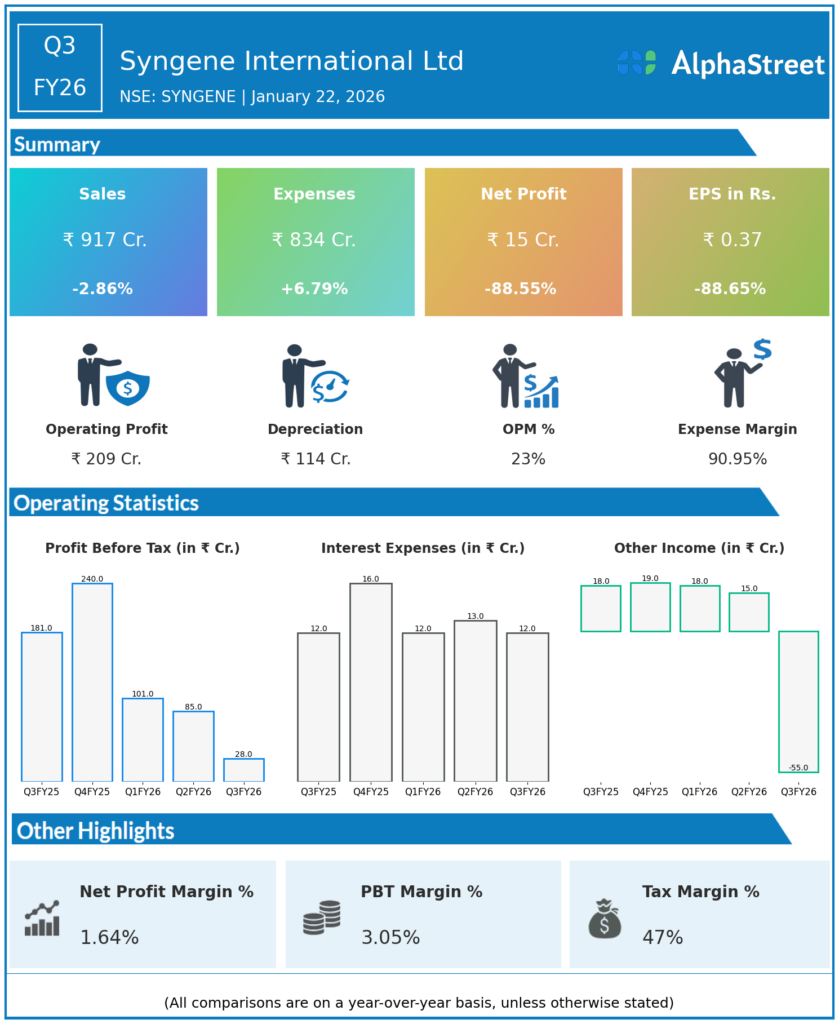

Q3 FY26 Earnings Results (Consolidated)

- Revenue from Operations: ₹917.1 crore, down 2.8% YoY from ₹943.7 crore.

- Reported EBITDA: ₹225 crore, down 26% YoY.

- Reported EBITDA Margin: 24%.

- Reported PAT (before exceptional items): ₹73 crore, down 44% YoY.

- Reported PAT Margin: 8%.

- Reported PAT: ₹15 crore, down 88.5% YoY from ₹131 crore.

- 9M FY26:

- Revenue: ₹2,702 crore, up 3% YoY.

- Reported PAT: ~₹168.8 crore (implied from H1 data), down significantly YoY.

Management Commentary & Strategic Decisions

- Management attributed Q3 profit decline to one‑time Labour Code costs and single‑product impact in biologics manufacturing; underlying business remains resilient with revenue growth from research services offsetting inventory corrections. Extended partnership with Bristol Myers Squibb to 2035, strengthening long‑term revenue visibility in discovery and development services.

- Major investments in biologics capacity and strategic shifts to higher‑margin services continue despite near‑term profitability pressures.

Q2 FY26 Earnings Results (Standalone)

- Revenue from Operations: ₹911 crore, up 2% YoY from ₹908 crore; up 4% QoQ.

- Reported EBITDA: ₹215 crore, down 18% YoY from ₹262 crore; EBITDA margin 23.2% vs 28.8% YoY.

- Reported PAT: ₹67 crore, down 37% YoY from ₹106 crore.

- H1 FY26: Revenue from Operations up 6% YoY.

Management Commentary & Strategic Directions – Q2 FY26

- Q2 performance driven by research services growth offsetting biologics inventory correction; maintaining FY26 revenue guidance with focus on capacity utilisation and margin recovery.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.