Current Status Overview

Syngene International Ltd is an India-based contract research, development, and manufacturing services company serving pharmaceutical and biotechnology clients. The company reported muted revenue growth and significant profit contraction in its most recent quarterly results.

Share Price Performance

The company’s shares were trading around INR 545–558 on the NSE as of the latest session. The stock has declined in recent months and remains below its 52-week high.

Revenue Performance

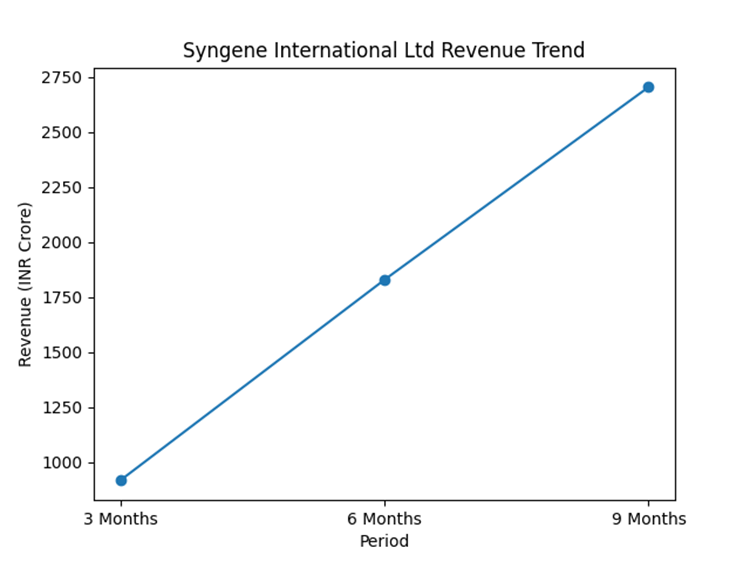

Revenue for the last three months was approximately INR 917 crore. Revenue for the last six months totaled about INR 1,828 crore. Revenue for the last nine months stood at roughly INR 2,703 crore.

Market Analysis

Syngene operates in the global CRDMO segment alongside multinational and regional peers. Industry demand remains stable, though margin pressure persists across the sector.

Analyst Commentary

Public analyst commentary remains mixed following the latest earnings release. No clear consensus shift has been reported.

Mergers & Acquisitions

Syngene completed the acquisition of a US-based biologics manufacturing facility in 2025. No additional M&A activity has been reported recently.

Outlook

The company’s outlook remains cautious amid profitability challenges. Future performance will depend on contract execution and cost management.

Revenue Chart