Symphony was established in 1988, in Ahmedabad, India. The company is engaged in the manufacturing and trading of residential, commercial, and industrial air coolers in the domestic and international markets. It is the largest air cooler manufacturer in the world. 97% of the revenue comes from the sale of Air coolers.

Q3 FY26 Earnings Results

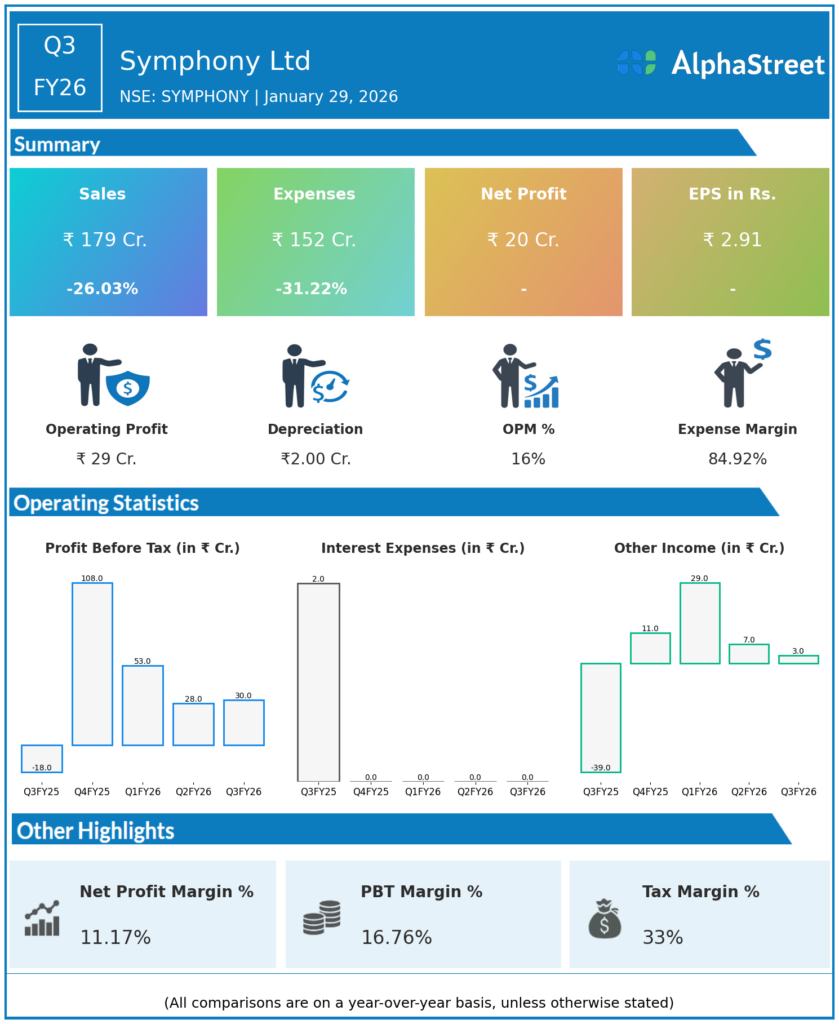

- Revenue from Operations: Consolidated ₹179 cr, −26% YoY vs ₹242 cr, +9.8% QoQ vs ₹163 cr; standalone ₹182 cr (flat YoY), reflecting persistent demand weakness in air coolers amid unseasonal weather, competitive pressures, and market saturation in India (89% of sales).

- EBITDA: Operating profit (excl. OI) ₹29 cr, margin 16.2% (+422 bps YoY, +148 bps QoQ); driven by aggressive cost cuts including employee expenses down to ₹23 cr (−18% YoY) and finished goods purchases −36% YoY.

- PAT: Consolidated ₹20 cr (+5.3% QoQ from ₹19 cr, but −85% YoY vs ₹134 cr), EPS ₹3.00 (−84.6% YoY); standalone ₹34 cr (vs loss of ₹4 cr YoY); 9M revenue ₹593 cr (−32% YoY), PAT ₹81 cr (−40% YoY).

- Other key metrics: 9M tests/patients not applicable; cash equivalents low at ₹20 cr (H1); ROE down to 10.5% from 19%; sales −31% vs 4Q avg, third consecutive double-digit YoY decline.

Management Commentary & Strategic Decisions

- Cost rationalisation delivered margin gains amid revenue contraction from weak seasonal demand; long-term growth anaemic at 3.2% sales CAGR 5Y, but focus on profitability protection.

- Strategic moves: 3rd interim dividend ₹2/share declared; rolled back divestment of Australia/Mexico subsidiaries; Executive Director/Group CEO Amit Kumar resigned; earnings call Jan 29 for details.

Q2 FY26 Earnings Results

- Revenue from Operations: Consolidated ₹163 cr (−44% YoY vs ₹289 cr, −57% QoQ); standalone ₹155 cr (−40% YoY vs ₹259 cr).

- EBITDA: ₹27 cr (−63% YoY), margin 10.4% (−1,178 bps YoY) from revenue deleverage.

- PAT: ₹28 cr (−58% YoY), EPS impacted; H1 trends weak.

- Other key metrics: Lowest quarterly revenue; operating profit −70% YoY.

Management Commentary Q2

- Sharp declines from weak demand beyond seasonality; vulnerability to cycles highlighted.

- Strategic moves: Optimism for recovery; cost focus amid market share concerns.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.